Age To Draw From Ira Without Penalty

Age To Draw From Ira Without Penalty - Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Web are you over age 59 ½ and want to withdraw? Web in the case of both a traditional and roth ira, you can start withdrawing funds (or in official terms, take distributions) after you reach age 59½. Web if you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important to know what to expect in potential taxes and penalties, along. July 21, 2023, at 9:21 a.m. 45+ years experienceserving all 50 stateseasy setuppersonalized service Web your first rmd must be taken by 4/1 of the year after you turn 73. Web you have the option, but not the obligation, to take from your ira without penalty once you've turned 59 1/2, assuming you don't qualify for any listed exceptions. Web required minimum distributions (rmds) are minimum amounts that ira and retirement plan account owners generally must withdraw annually starting with the year they reach. Web age 59 ½ and under. Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. A quick reminder of how a roth works: Web if you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important to know what to expect in potential taxes and penalties, along. The rmd for each year is calculated by. While. Web your first rmd must be taken by 4/1 of the year after you turn 73. If you’ve inherited an individual retirement account since 2020, you could have a shorter timeline to withdraw the money, which can trigger tax consequences. Web if you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important. 45+ years experienceserving all 50 stateseasy setuppersonalized service When you reach that age you can take distributions from a. A quick reminder of how a roth works: At age 73 and over, you must begin. Your spouse can also withdraw $10,000 from their own ira without paying an early. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a roth—whether you need it. The rmd for each year is calculated by. The rmd rules require individuals to take withdrawals from their iras (including simple iras and sep. Web required minimum distributions (rmds) are minimum amounts that ira and retirement plan account owners generally must withdraw annually starting with the year they reach. Find, research & decidediscover all your optionsplan for your retirement At age 73 and over, you must begin. Web generally, withdrawals before age 59 1/2 incur a 10% penalty on top of income taxes. Government. Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Web are you over age 59 ½ and want to withdraw? An individual can contribute funds to a roth ira, up to. Your spouse can also withdraw $10,000 from their own ira without paying an early. Web you have the option, but not the obligation, to take from. Web in the case of both a traditional and roth ira, you can start withdrawing funds (or in official terms, take distributions) after you reach age 59½. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the irs agreed not to impose an extra (excise) tax or penalty on. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a roth—whether you need it. Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Web specifically, if a taxpayer did not take a specified rmd in. Web you have the option, but not the obligation, to take from your ira without penalty once you've turned 59 1/2, assuming you don't qualify for any listed exceptions. But it's still critical to know how your withdrawal may be taxed. Web are you over age 59 ½ and want to withdraw? Generally you’ll owe income taxes and a 10%. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. That means, once you hit age 59 1/2, you can take money out of your account without penalty. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the irs agreed not to impose an extra (excise) tax or penalty on that. An individual can contribute funds to a roth ira, up to. That means, once you hit age 59 1/2, you can take money out of your account without penalty. Web the ira withdrawal age is 59 1/2 years old these days. Web required minimum distributions (rmds) are minimum amounts that ira and retirement plan account owners generally must withdraw annually starting with the year they reach. The rmd rules require individuals to take withdrawals from their iras (including simple iras and sep iras) every year once they reach age 72 (73 if the account. The rmd for each year is calculated by. Your spouse can also withdraw $10,000 from their own ira without paying an early. Government imposes a 10 percent penalty on any withdrawals before age 59 1/2. Web generally, withdrawals before age 59 1/2 incur a 10% penalty on top of income taxes. Web the standard age to avoid penalties for an early withdrawal from either a traditional ira or roth ira is age 59½. If you withdraw roth ira earnings before age 59½, a 10% penalty usually. Find, research & decidediscover all your optionsplan for your retirement Web you have the option, but not the obligation, to take from your ira without penalty once you've turned 59 1/2, assuming you don't qualify for any listed exceptions. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a roth—whether you need it. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty.

Early Withdrawal From Your Traditional IRA

Ira Types Chart

Roth IRA Withdrawal Rules and Penalties First Finance News

11Step Guide To IRA Distributions Ira, Step guide, Money matters

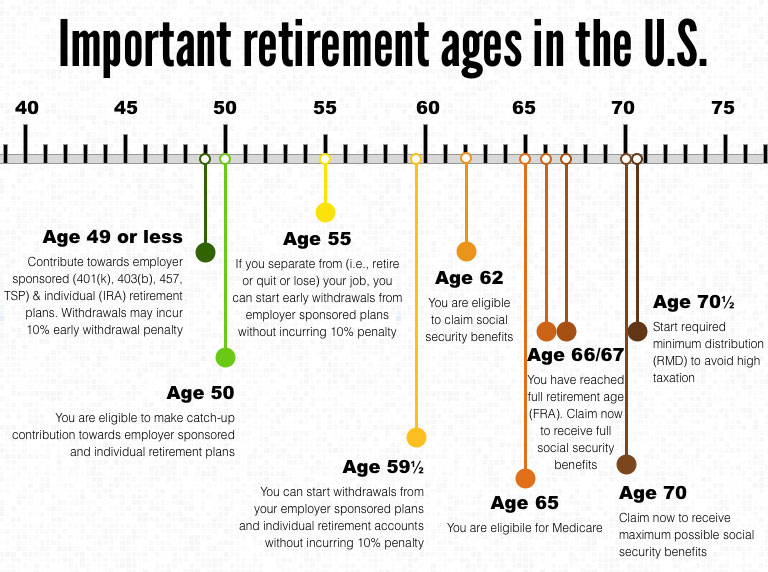

Important ages for retirement savings, benefits and withdrawals 401k

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits

How to Make a Penalty Free IRA Withdrawal 2020 3 CARES Act Rules

Roth IRA Withdrawal Rules and Penalties First Finance News

Exceptions to the IRA Early Withdrawal Penalty in 2023 Inherited ira

Retire Early AND Withdraw From Your IRA Penalty Free! YouTube

Web In The Case Of Both A Traditional And Roth Ira, You Can Start Withdrawing Funds (Or In Official Terms, Take Distributions) After You Reach Age 59½.

At Age 73 And Over, You Must Begin.

You Can Withdraw Roth Individual Retirement Account (Ira) Contributions At Any Time.

However, You May Have To Pay Taxes And Penalties On Earnings In.

Related Post: