At What Age Can I Draw From 401K Without Penalty

At What Age Can I Draw From 401K Without Penalty - But if you’re withdrawing roth funds, you may not have to pay taxes on your contributions. For example, you won’t be able to withdraw your roth 401(k) contributions until age 59½ or you experience another qualifying event such as disability, termination of employment, financial hardship, or death. Web the age 55 rule. Account owners can delay taking their first rmd until april 1 following the later of the calendar year they reach age 72 or, in a workplace retirement plan, retire. Web required minimum distributions, or rmds, are minimum amounts that many retirement plan and ira account owners must generally withdraw annually after they reach age 72. In 2024, retirees will reach full retirement age. Web here's a look at the pros and cons of 401(k) accounts. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). That can be quite a significant amount. With a roth 401 (k) (not offered by all employer plans), your money also. Web the irs dictates you can withdraw funds from your 401 (k) account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work. Contributions and earnings in a roth 401 (k) can be withdrawn without. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings.. That can be quite a significant amount. This rule applies whether it is voluntary termination or not. With a roth 401 (k) (not offered by all employer plans), your money also. However, that doesn’t mean there are no. The costs of early 401 (k) withdrawals. This rule applies whether it is voluntary termination or not. This means you can contribute $5,150 to your hsa if you have. The rule of 55 is an irs rule that allows certain workers to avoid the 10% early withdrawal penalty when taking money out of workplace retirement plans before age 59½. Some reasons for taking an early 401. Web. The costs of early 401 (k) withdrawals. Account owners can delay taking their first rmd until april 1 following the later of the calendar year they reach age 72 or, in a workplace retirement plan, retire. That can be quite a significant amount. If joblessness lingers, individuals face a second question: This rule applies whether it is voluntary termination or. There are some exceptions to these rules for 401 (k) plans and other qualified plans. Web here's a look at the pros and cons of 401(k) accounts. Understanding the rules about roth 401 (k) accounts can keep you from losing part of your retirement savings. Web the irs dictates you can withdraw funds from your 401 (k) account without penalty. Web generally, if you withdraw money from a 401 (k) before the plan’s normal retirement age or from an ira before turning 59 ½, you’ll pay an additional 10 percent in income tax as a penalty. Account owners can delay taking their first rmd until april 1 following the later of the calendar year they reach age 72 or, in. If joblessness lingers, individuals face a second question: With a roth 401 (k) (not offered by all employer plans), your money also. What happens if you haven't reached age 59½ and need to tap into your 401 (k)? Account owners can delay taking their first rmd until april 1 following the later of the calendar year they reach age 72. Web here's a look at the pros and cons of 401(k) accounts. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. If you become unemployed in the. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55,. Once you reach 59½, you can take distributions from your 401(k) plan without being subject to the 10% penalty. With a roth 401 (k) (not offered by all employer plans), your money also. Web here’s how it works: Web here's a look at the pros and cons of 401(k) accounts. If you become unemployed in the. Web still, those with a full retirement age of 67 can boost their monthly payment by 24% by waiting until 70. If joblessness lingers, individuals face a second question: This is known as the rule of 55. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early. Sometimes those consequences might be worth it—and they may even be entirely. In most, but not all, circumstances, this triggers an early withdrawal penalty of. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a penalty. Contributions and earnings in a roth 401 (k) can be withdrawn without. There are some exceptions to these rules for 401 (k) plans and other qualified plans. Web here’s how it works: Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Account owners can delay taking their first rmd until april 1 following the later of the calendar year they reach age 72 or, in a workplace retirement plan, retire. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). You can make a 401 (k) withdrawal in a lump sum, but in most cases, if you do and are younger than 59½, you'll pay a 10% early withdrawal penalty in addition to taxes. This is known as the rule of 55. Web the age 55 rule. Web taking an early withdrawal from a 401 (k) retirement account before age 59½ could have steep financial penalties. There are some caveats to this age restriction. What happens if you haven't reached age 59½ and need to tap into your 401 (k)? For example, you won’t be able to withdraw your roth 401(k) contributions until age 59½ or you experience another qualifying event such as disability, termination of employment, financial hardship, or death.

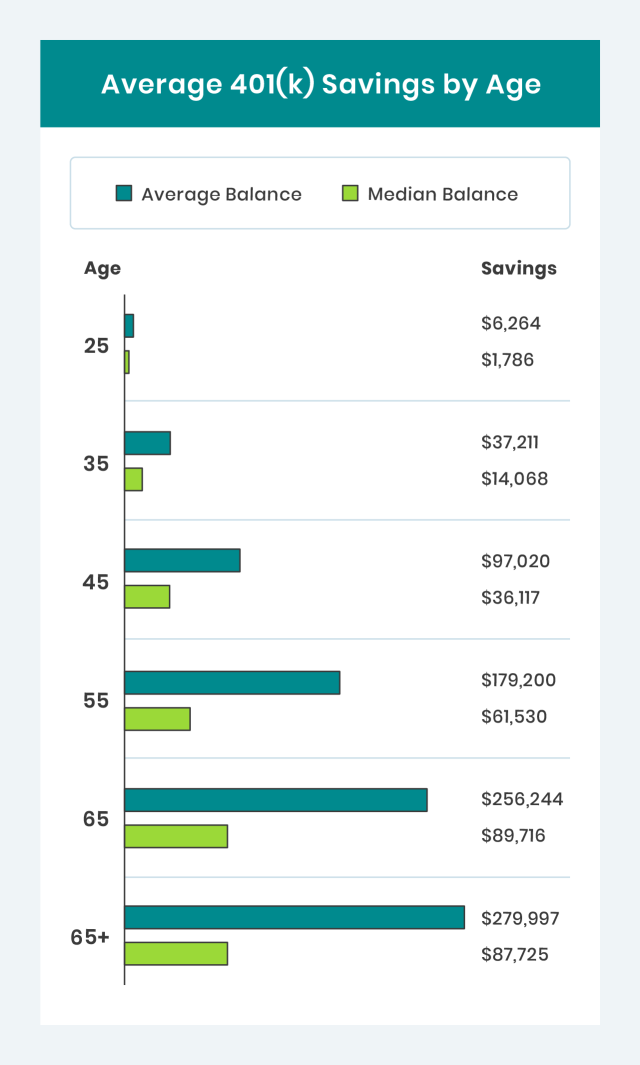

Average 401(k) Balance by Age Your Retirement Timeline

Important ages for retirement savings, benefits and withdrawals 401k

401k Savings By Age How Much Should You Save For Retirement

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

Why The Median 401(k) Retirement Balance By Age Is So Low

401k By Age PreTax Savings Goals For Retirement Financial Samurai

401k balance by age 2022 Inflation Protection

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

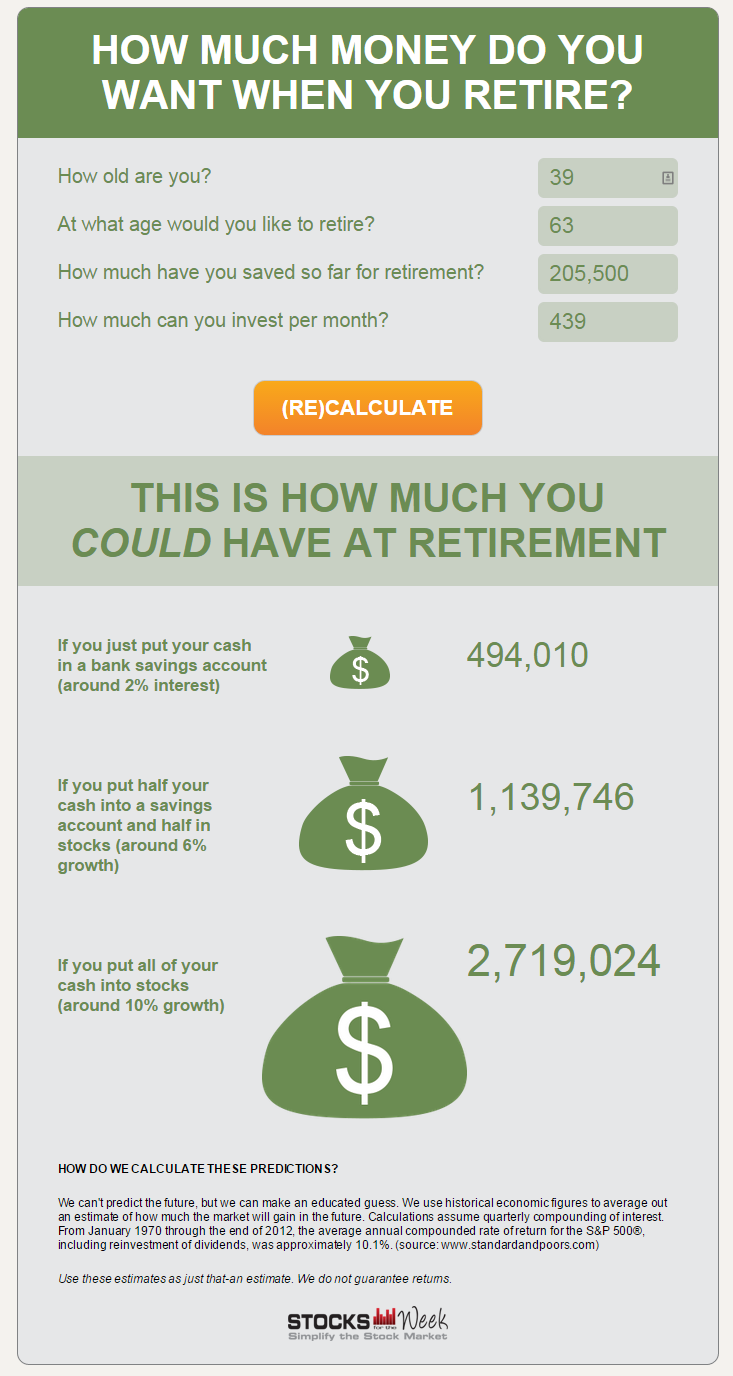

How to Estimate How Much Your 401k will be Worth at Retirement

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

The Costs Of Early 401 (K) Withdrawals.

This Means You Can Contribute $5,150 To Your Hsa If You Have.

But If You’re Withdrawing Roth Funds, You May Not Have To Pay Taxes On Your Contributions.

Web As With Traditional Iras, Older Individuals Are Allowed To Contribute An Extra $1,000 Per Person To Their Hsas Once They Reach Age 55.

Related Post: