At What Age Can You Draw From 401K Without Penalty

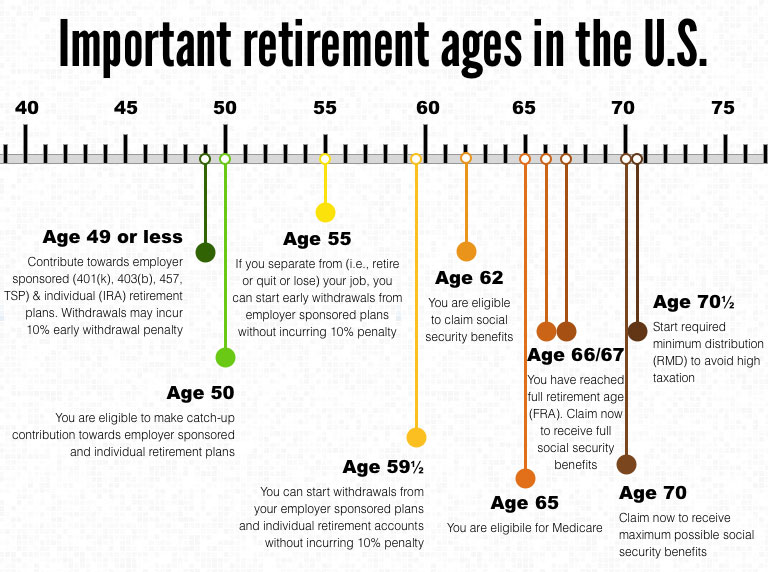

At What Age Can You Draw From 401K Without Penalty - Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a penalty. Web under particular circumstances, you can withdraw from a 401 (k) between 55 and 59½ without being penalized. You can't take loans from old 401(k) accounts. Web the rule of 55 would allow you to take money from your 401 (k) or 403 (b) without having to pay the 10% early withdrawal penalty. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. However, you don’t have to be downsized or fired to apply the. Some reasons for taking an early 401. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Web you reach age 59½ or experience financial hardship. But just because 401 (k) withdrawals are allowed in the above situations doesn’t mean they’re all treated the same. But just because 401 (k) withdrawals are allowed in the above situations doesn’t mean they’re all treated the same. Web the rule of 55 would allow you to take money from your 401 (k) or 403 (b) without having to pay the 10% early withdrawal penalty. If you tap into it beforehand, you may face a 10% penalty tax on. Web you reach age 59½ or experience financial hardship. But just because 401 (k) withdrawals are allowed in the above situations doesn’t mean they’re all treated the same. Web under particular circumstances, you can withdraw from a 401 (k) between 55 and 59½ without being penalized. Your plan administrator will let you know whether they allow an exception to the. You can't take loans from old 401(k) accounts. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a penalty. Some reasons for taking an early 401. Web under particular circumstances, you can withdraw. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Web you reach age 59½ or experience financial hardship. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. You can't take loans from old 401(k) accounts. Web the rule of 55 would allow you to take money from your 401 (k) or 403 (b) without having to. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. But just because 401 (k) withdrawals are allowed in the above situations doesn’t mean they’re all treated the same. Web under particular circumstances, you can withdraw from a 401 (k) between 55 and 59½ without. However, you don’t have to be downsized or fired to apply the. Web the rule of 55 would allow you to take money from your 401 (k) or 403 (b) without having to pay the 10% early withdrawal penalty. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Web. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k) or 403 (b) without having to pay a penalty. But just because 401 (k) withdrawals are allowed in the above situations doesn’t mean they’re all treated the same. However, you don’t. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web one exception to the 401 (k) early withdrawal penalty is known as the rule of 55, and it can allow you to take distributions from your 401 (k). Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. However, you don’t have to be downsized or fired to apply the. Some reasons for taking an early 401. Web under particular circumstances, you can withdraw from a 401. Some reasons for taking an early 401. Web you reach age 59½ or experience financial hardship. Web under particular circumstances, you can withdraw from a 401 (k) between 55 and 59½ without being penalized. However, you don’t have to be downsized or fired to apply the. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of ordinary income taxes. Web the rule of 55 would allow you to take money from your 401 (k) or 403 (b) without having to pay the 10% early withdrawal penalty. You can't take loans from old 401(k) accounts. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½.

Important ages for retirement savings, benefits and withdrawals 401k

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

401k Early Withdrawal What to Know Before You Cash Out MintLife Blog

what reasons can you withdraw from 401k without penalty covid

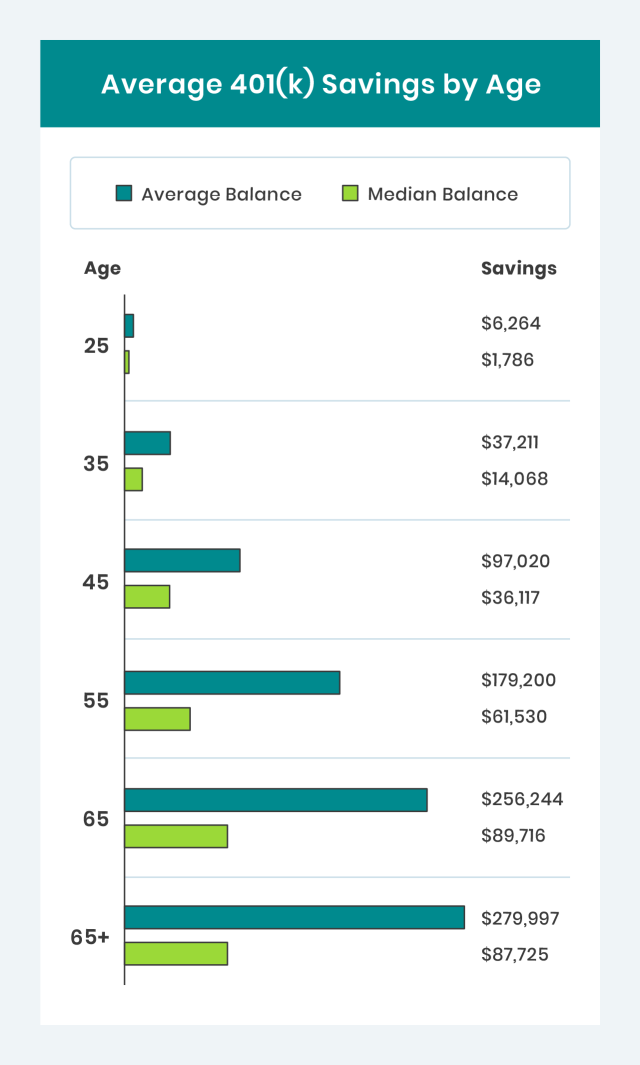

Average 401(k) Balance by Age Your Retirement Timeline

How to Move 401k to Gold IRA Without Penalty — The Complete Guide by

401k By Age PreTax Savings Goals For Retirement Financial Samurai

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

401k Savings By Age How Much Should You Save For Retirement

Web One Exception To The 401 (K) Early Withdrawal Penalty Is Known As The Rule Of 55, And It Can Allow You To Take Distributions From Your 401 (K) Or 403 (B) Without Having To Pay A Penalty.

But Just Because 401 (K) Withdrawals Are Allowed In The Above Situations Doesn’t Mean They’re All Treated The Same.

If You Tap Into It Beforehand, You May Face A 10% Penalty Tax On The Withdrawal In Addition To Income Tax That You’d Owe On Any Type Of Withdrawal From A Traditional 401 (K).

Related Post: