At What Age Can You Start Drawing Your 401K

At What Age Can You Start Drawing Your 401K - The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still working. You must still have funds in your plan in order to do so, and the rules are the same if you've rolled your 401(k) funds into an ira. Some reasons for taking an early 401 (k). Keep in mind that you'll still have to pay income taxes on your 401 (k) distributions. Terminate service with the employer. They each save $150 per month and get an 8% average annual return on their. Complete 10 years of plan participation; You can start withdrawing 4% of the money in your 401 (k) or iras annually. Scroll the section below that correlates with your age, and you’ll find the rules applicable to you. Make adjustments to that percentage depending on your circumstances. Web to use the rule of 55, you’ll need to: If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). The internal revenue service (irs) has set the standard retirement. Turn 65 (or the plan’s normal. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Web if you meet the requirements for all of these rules then the rule of 55 might be a good fit for you to avoid paying the. And you’ll have to pay taxes on the rmd amounts in the year they are taken. Make adjustments to that percentage depending on your circumstances. The rule of 55 also applies to 403 (a) and 403 (b) plans. Taking an early withdrawal from your 401 (k) should only be done as a last resort. You generally must start taking withdrawals. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still working. Web once you reach age 72, you have to start taking required minimum distributions (rmds). Web the rule of 55 doesn't apply if you left your job at, say, age 53. Web 401 (k). This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a. Edited by jeff white, cepf®. Web you generally have to start taking withdrawals from your ira, simple ira, sep ira, or retirement plan account when you reach age 72 (73 if you reach age 72 after dec. Roth iras do not require withdrawals until. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. You can start withdrawing 4% of the money in your 401 (k) or iras annually. Web 401 (k) accounts have very generous contribution limits, much higher than. Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. Web another rule is that, after age 70.5 or 72, depending on when they were born, retirees must start taking mandatory minimum distributions from their 401 (k) plans every year. Web for 2023, the age at which account owners must start taking required minimum distributions goes up. Web you generally have to start taking withdrawals from your ira, simple ira, sep ira, or retirement plan account when you reach age 72 (73 if you reach age 72 after dec. Web you can make a 401 (k) withdrawal at any age, but doing so before age 59 ½ could trigger a 10% early distribution tax, on top of. Note that the secure 2.0 act raised the age. Web updated on october 25, 2021. You can't start taking distributions from your 401 (k) and avoid the early withdrawal penalty once you reach 55. When can a retirement plan distribute benefits? Web the terms of roth 401 (k) accounts also stipulate that required minimum distributions (rmds) must begin by age. Web to use the rule of 55, you’ll need to: This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a. Web those who contribute to workplace 401 (k)s must know the rules for 401 (k) required minimum distributions, or rmds, since rmd rules mandate that accountholders begin withdrawing money at age 73. 1 if. Jayla is 23 and hannah is 33. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. To start taking these withdrawals, you’ll just have to prove that you qualify for the plan administrator. Keep in mind that you'll still have to pay income taxes on your 401 (k) distributions. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Make adjustments to that percentage depending on your circumstances. Note that the secure 2.0 act raised the age. Turn 65 (or the plan’s normal retirement age, if earlier); Web updated on october 25, 2021. Web another rule is that, after age 70.5 or 72, depending on when they were born, retirees must start taking mandatory minimum distributions from their 401 (k) plans every year. You must still have funds in your plan in order to do so, and the rules are the same if you've rolled your 401(k) funds into an ira. It’s important, though, that you plan the timing of those withdrawals effectively. Web to use the rule of 55, you’ll need to: However, you can apply the irs rule of 55 if you're older and leave your job. Web required minimum distributions (rmds) are the minimum amounts you must withdraw from your retirement accounts each year. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still working.:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

Important ages for retirement savings, benefits and withdrawals 401k

12 of the Most Common Employee 401(k) Questions, Answered Gusto

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

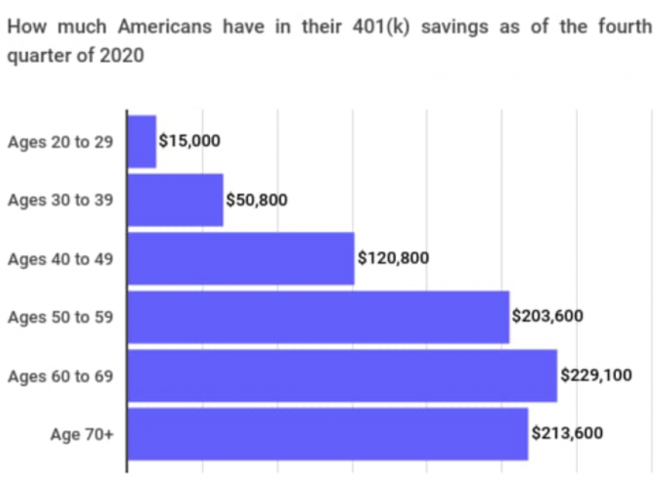

The Average And Median 401(k) Account Balance By Age

401k Savings By Age How Much Should You Save For Retirement

Social Security Age Chart When to Start Drawing Bene... Ticker Tape

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

401k By Age PreTax Savings Goals For Retirement Financial Samurai

Written By Javier Simon, Cepf®.

You’re Not Age 55 Yet.

You Can't Start Taking Distributions From Your 401 (K) And Avoid The Early Withdrawal Penalty Once You Reach 55.

When Can A Retirement Plan Distribute Benefits?

Related Post: