Atm Draw Limit

Atm Draw Limit - Wells fargo atm withdrawal and deposit limit. Web if your atm limit is $300 each day and you need $600, you could withdraw $300 on two separate days. Fact checked by ariana chávez. An atm withdrawal limit restricts the amount that a bank or credit union allows for withdrawal from an atm. Some banks or atms may limit the number of bills you can deposit. Web updated on january 4, 2024. Web how much money can you deposit at an atm? Select account services, then choose. Banks and credit unions set withdrawal limits at atms, which is the amount of cash you can take out of your account per transaction and per. Web generally, atm cash withdrawals are restricted to $300 to $1,000 daily. Web if your atm limit is $300 each day and you need $600, you could withdraw $300 on two separate days. When it comes to withdrawing money from an atm, you are limited to the amount you can withdraw in. You may set up an atm withdrawal from your checking or savings account that allows atm access using your bank. Your daily atm withdrawal limit is $808 on a personal check card. You can generally also withdraw more money than what is allowed at the. You may set up an atm withdrawal from your checking or savings account that allows atm access using your bank of america atm/debit card. Web atm withdrawal limits vary by bank and the atm network.. When it comes to withdrawing money from an atm, you are limited to the amount you can withdraw in. You may set up an atm withdrawal from your checking or savings account that allows atm access using your bank of america atm/debit card. Web the atm withdrawal limit at some banks can be as high as $5,000, while others will. Web written by | published on 8/28/2020. Updated on april 1, 2022. Web for example, your bank may limit your atm withdrawals to $500 a day, while an independent atm operator allows you to withdraw only $200. Wells fargo atm withdrawal and deposit limit. Web how much money can you deposit at an atm? To change your atm limits using online banking: Web daily withdrawal limits typically range from $300 to $5,000 with most limits falling between $500 and $3,000. Web if your atm limit is $300 each day and you need $600, you could withdraw $300 on two separate days. Web atm withdrawal limits vary by bank and the atm network. An atm. You’ll have a lower withdrawal limit if you’re taking cash out. Web if your atm limit is $300 each day and you need $600, you could withdraw $300 on two separate days. Web • updated july 29, 2022 • 4 min read • leer en español. If you need to exceed your bank’s limit, there are ways. Most atms allow. Fact checked by ariana chávez. Most atms allow withdrawals between $300 and $2,000 per day. Updated on april 1, 2022. Web your daily withdrawal limit is provided when you receive your debit card and is typically between $500 and $3,000. In that case, you would. You’ll have a lower withdrawal limit if you’re taking cash out. Fact checked by ariana chávez. Web what is an atm withdrawal limit? You can generally also withdraw more money than what is allowed at the. You may set up an atm withdrawal from your checking or savings account that allows atm access using your bank of america atm/debit card. Select account services, then choose. Web updated on january 4, 2024. Banks and credit unions set withdrawal limits at atms, which is the amount of cash you can take out of your account per transaction and per. You’ll have a lower withdrawal limit if you’re taking cash out. While this withdrawal limit might sometimes feel. If you keep your money at one of the 20 largest banks in the country, your checking account likely will have a daily atm withdrawal limit. Web most often, atm cash withdrawal limits range from $300 to $1,000 per day. Web most often, atm cash withdrawal limits range from $300 to $1,000 per day. Web for example, your bank may. Web most often, atm cash withdrawal limits range from $300 to $1,000 per day. Web if your atm limit is $300 each day and you need $600, you could withdraw $300 on two separate days. Web what is your atm withdrawal limit? Web and many financial institutions set limits on the amount that can be withdrawn from atms per day, ranging from $300 to $5,000 or more. Web we charge the variable fee for every withdrawal on your wise card over your monthly allowance, regardless of how many times you made a withdrawal that month. If you need to exceed your bank’s limit, there are ways. Have questions about the daily atm withdraw limit on your regions visa checkcard? Web your daily withdrawal limit is provided when you receive your debit card and is typically between $500 and $3,000. Wells fargo atm withdrawal and deposit limit. When it comes to withdrawing money from an atm, you are limited to the amount you can withdraw in. Fact checked by ariana chávez. If you keep your money at one of the 20 largest banks in the country, your checking account likely will have a daily atm withdrawal limit. Your daily atm withdrawal limit is $808 on a personal check card. Why are there atm withdrawal limits? Atm withdrawal limits vary based on the bank and account type. How much can you withdraw from an atm each day?

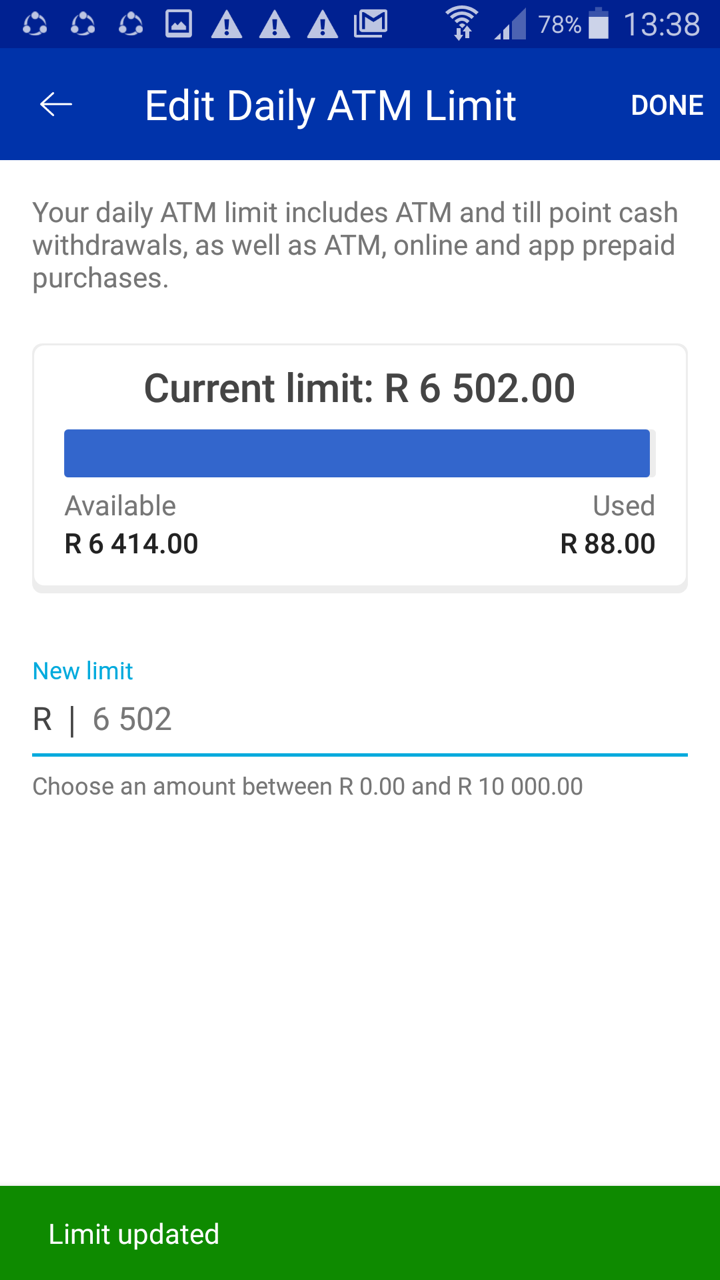

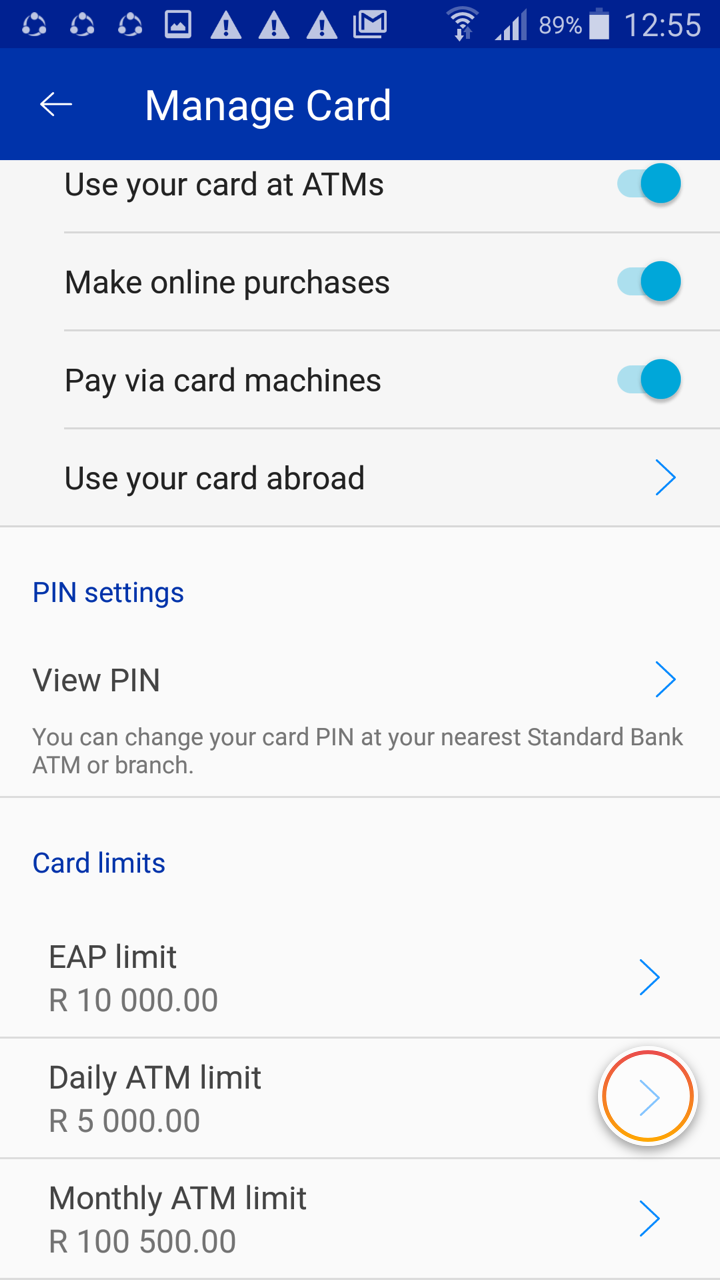

How to change your ATM limits Standard Bank

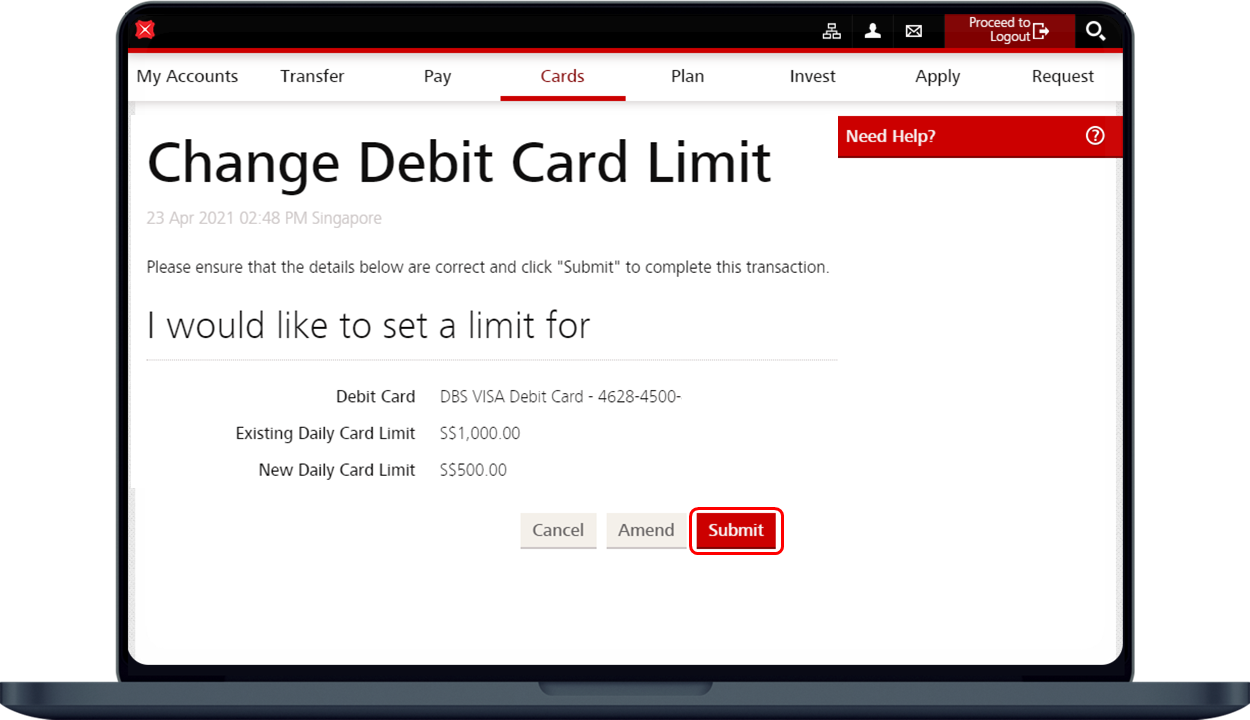

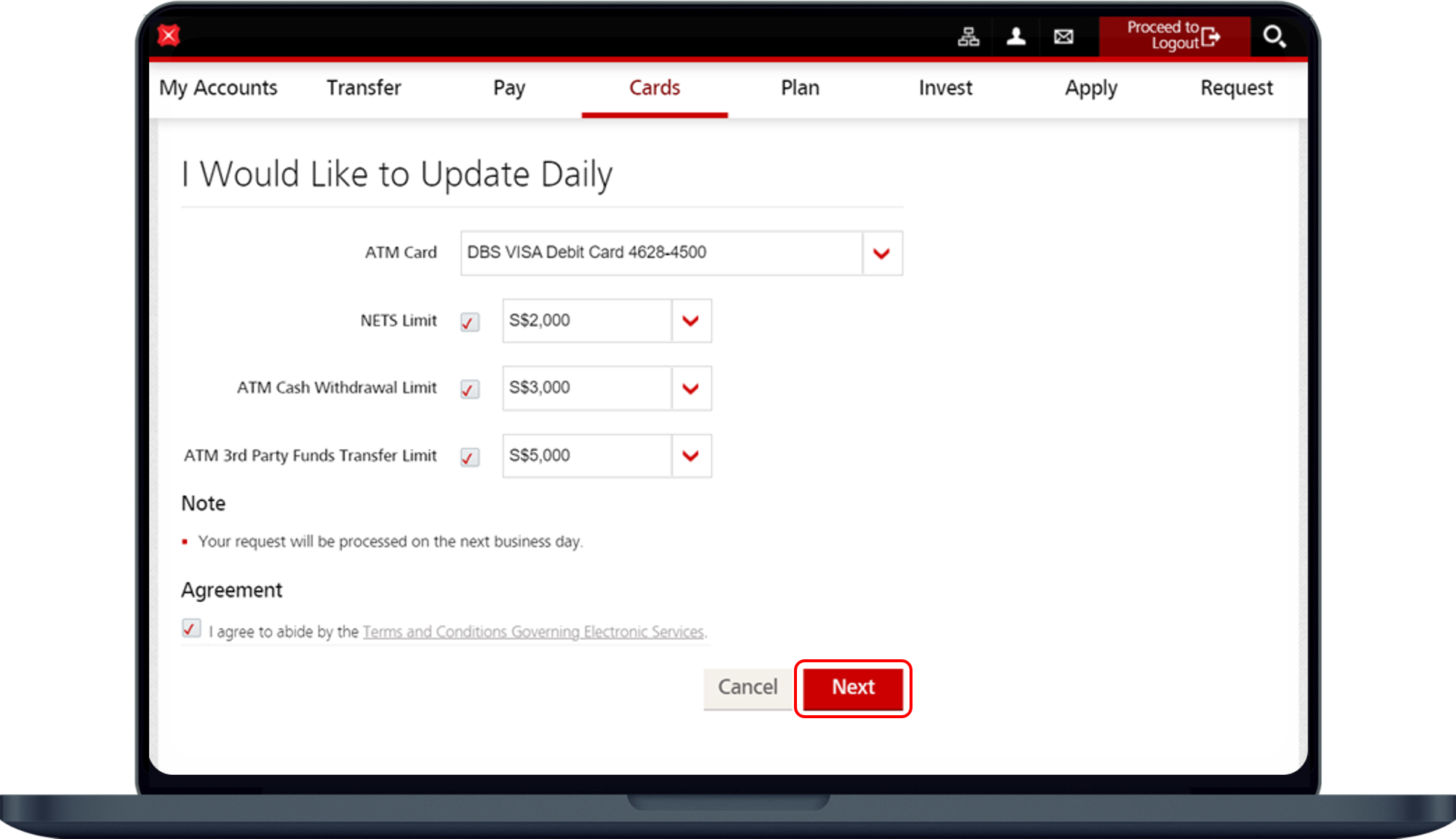

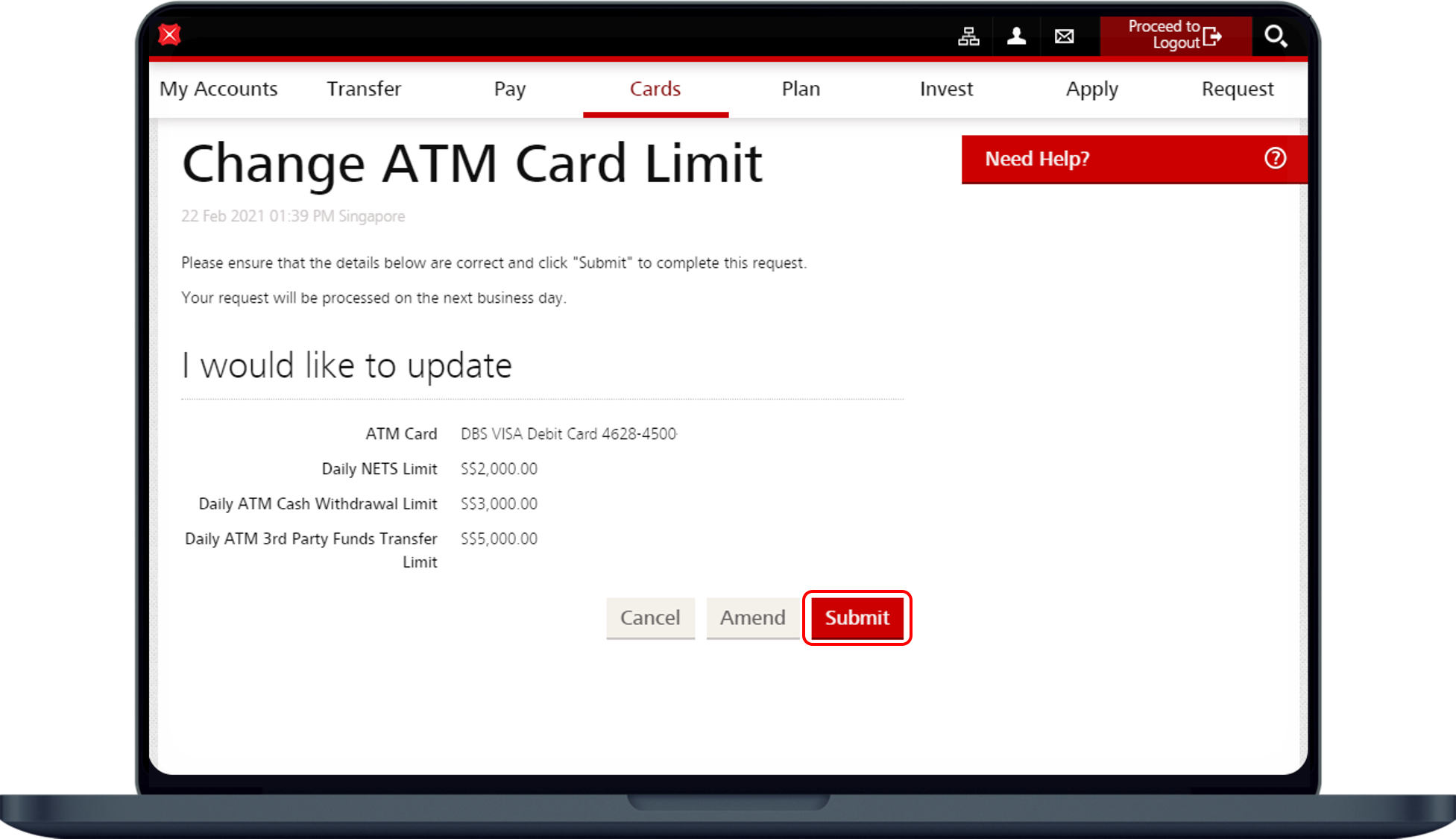

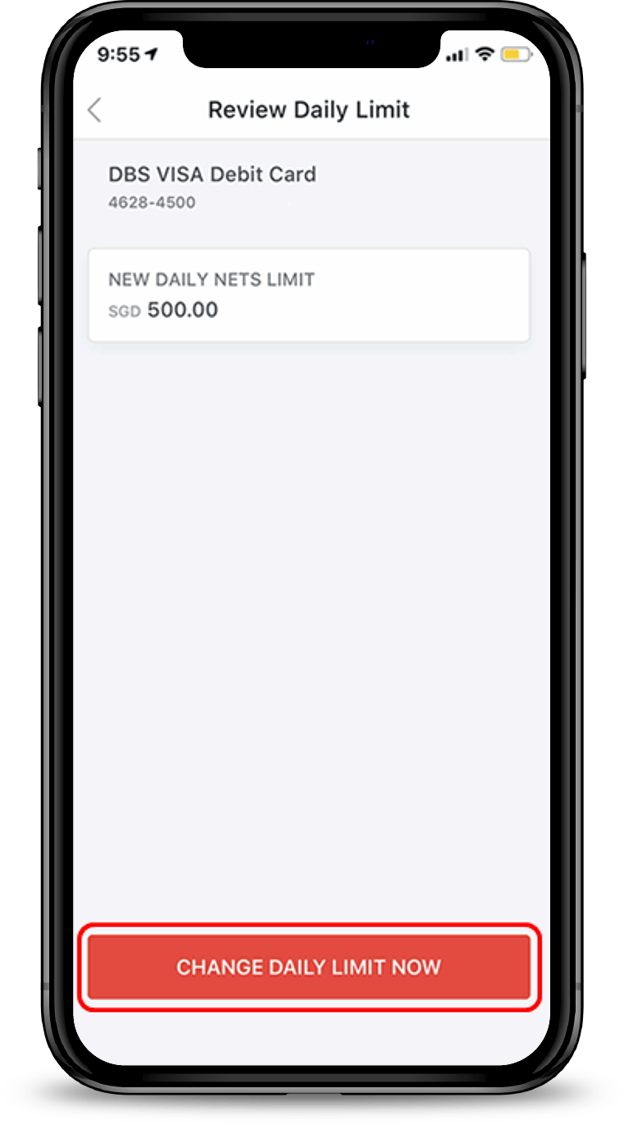

Update ATM/Debit Card Limits DBS Singapore

Update ATM/Debit Card Limits DBS Singapore

:max_bytes(150000):strip_icc()/atm-withdrawal-limits-c31d0fd30b9b404a90379804a6d9cb9c.png)

What To Do About ATM Withdrawal Limits

Update ATM/Debit Card Limits DBS Singapore

ATM Withdrawal Limit What to Know GOBankingRates

ATM Withdrawal Limit What to Know GOBankingRates

Update ATM/Debit Card Limits POSB Singapore

TD Bank ATM Withdrawal Limit, Know Your Transactions LImit The

How to change your ATM limits Standard Bank

Banks And Credit Unions Set Withdrawal Limits At Atms, Which Is The Amount Of Cash You Can Take Out Of Your Account Per Transaction And Per.

Web Marcie Geffner June 16, 2023.

This Limit Protects Customers From Large.

Web Updated On January 4, 2024.

Related Post: