Can A 1099 Employee Draw Unemployment

Can A 1099 Employee Draw Unemployment - Historically, 1099 employees could not collect unemployment; These benefits are available to employees because their employers pay state and federal unemployment taxes. Independent contractors cannot receive unemployment benefits. Web can i qualify for unemployment insurance benefits? In most states, companies pay a tax to cover unemployment insurance so that separated employees can benefit from it. Before the pandemic, 1099 employees could not collect unemployment as they were considered independent contractors, which means they work for themselves. Web even if you aren’t eligible for unemployment while you’re working your 1099 job, you may be able to resume receiving unemployment benefits under your previous claim when your contract job. Web traditional employees have their income taxes, social security contributions, and retirement benefits withheld by their employer, leading to fewer administrative tasks. Generally speaking, if a worker has worked for a company, even as a contract employee, for a certain number of months and earned a minimum amount of money, he will be eligible for unemployment benefits. Web the legislation, signed on march 11, allows taxpayers who earned less than $150,000 in modified adjusted gross income to exclude unemployment compensation up to $20,400 if married filing jointly and $10,200 for all other eligible taxpayers. The legislation excludes only 2020 unemployment benefits from taxes. These loans are forgivable if at least 75% of the loans are spent on payroll, with the remaining amount spent on things such as mortgage, lease and utility payments. Even if your employer hired you to work as an independent contractor, the law may still consider you an employee. Web the. Historically, 1099 employees could not collect unemployment; Web other than in special circumstances, if you were paid as an independent contractor and received a 1099 form, you were not considered an employee and would not be eligible for unemployment benefits. Web changes coming to tennessee’s unemployment benefits program. This means you’ll need to file a schedule c with your annual. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect. This means you’ll need to file a schedule c with your annual tax return to report your income and expenses. While traditional unemployment benefits may not be available to 1099 employees in new york under normal circumstances, there may be exceptions and alternative programs to explore.. Before the pandemic, 1099 employees could not collect unemployment as they were considered independent contractors, which means they work for themselves. These loans are forgivable if at least 75% of the loans are spent on payroll, with the remaining amount spent on things such as mortgage, lease and utility payments. If you own a business or work as an independent. The specific number of months and the specific earnings required are determined by state laws. Generally speaking, if a worker has worked for a company, even as a contract employee, for a certain number of months and earned a minimum amount of money, he will be eligible for unemployment benefits. If you own a business or work as an independent. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect. Even if your employer hired you to work as an independent contractor, the law may still consider you an employee. The legislation excludes only 2020 unemployment benefits from taxes. This money is used to. Learn more about the mandated modifications here. This money is used to. Even if your employer hired you to work as an independent contractor, the law may still consider you an employee. Web the legislation, signed on march 11, allows taxpayers who earned less than $150,000 in modified adjusted gross income to exclude unemployment compensation up to $20,400 if married filing jointly and $10,200 for all other. In most states, companies pay a tax to cover unemployment insurance so that separated employees can benefit from it. But what if you're a 1099 employee—can you also reap the benefits of unemployment insurance? Web changes coming to tennessee’s unemployment benefits program. Web workers receiving a form 1099 typically don’t qualify for unemployment benefits. This may vary depending on the. These benefits are available to employees because their employers pay state and federal unemployment taxes. Before the pandemic, 1099 employees could not collect unemployment as they were considered independent contractors, which means they work for themselves. But what if you're a 1099 employee—can you also reap the benefits of unemployment insurance? Independent contractors cannot receive unemployment benefits. These loans are. Learn more about the mandated modifications here. That's because eligibility for state unemployment benefits is based upon being employed by an organization that was paying into the. Web changes coming to tennessee’s unemployment benefits program. But what if you're a 1099 employee—can you also reap the benefits of unemployment insurance? This means you’ll need to file a schedule c with. Ordinarily, when you're an independent contractor (also called a 1099 employee), you can't collect. These loans are forgivable if at least 75% of the loans are spent on payroll, with the remaining amount spent on things such as mortgage, lease and utility payments. Web by accessing unemployment benefits when needed, 1099 employees can mitigate financial strain and focus on stabilizing their income and livelihood. This benefit expansion program, called the pandemic unemployment assistance (pua), was created by the federal cares act stimulus bill. If you own a business or work as an independent contractor, such contributions are unlikely to apply. This money is used to. Apr 23, 2020 15 min read. The specific number of months and the specific earnings required are determined by state laws. Web even if you aren’t eligible for unemployment while you’re working your 1099 job, you may be able to resume receiving unemployment benefits under your previous claim when your contract job. Web updated february 3, 2023. Web traditional employees have their income taxes, social security contributions, and retirement benefits withheld by their employer, leading to fewer administrative tasks. Generally speaking, if a worker has worked for a company, even as a contract employee, for a certain number of months and earned a minimum amount of money, he will be eligible for unemployment benefits. This may vary depending on the state where you live. Web can 1099 employees file for unemployment? Many people immediately think of unemployment benefits as a financial safety net when economic hardship or unforeseen circumstances strike. Historically, 1099 employees could not collect unemployment;

What is a 1099? Types, details, and who receives one QuickBooks

Can a 1099 employee collect unemployment? Zippia

Can a 1099 employee collect unemployment? Zippia

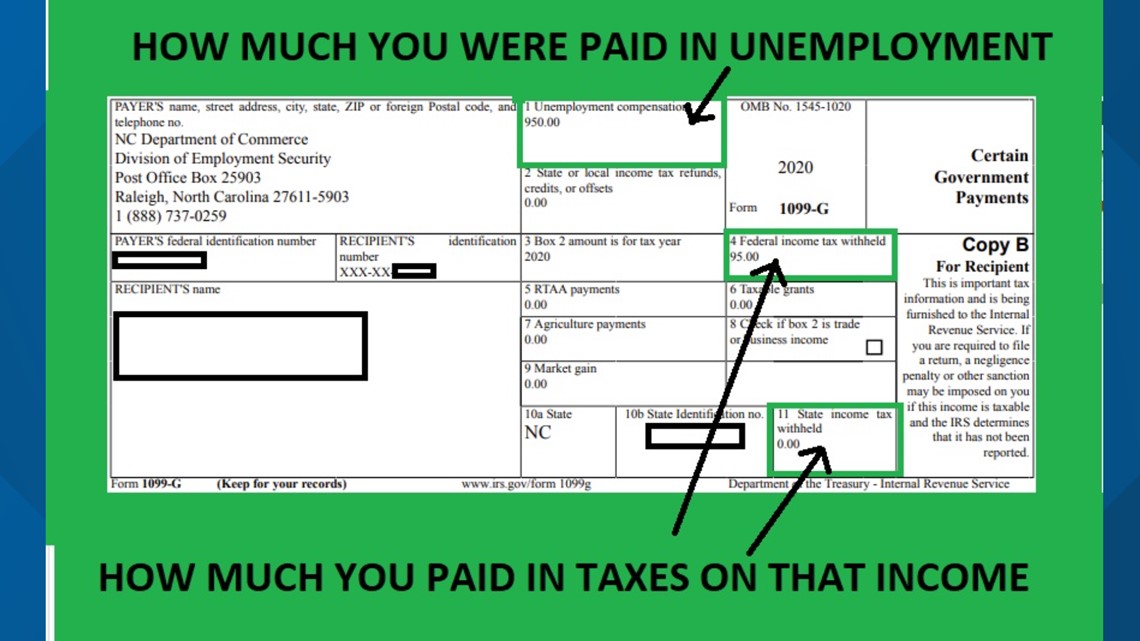

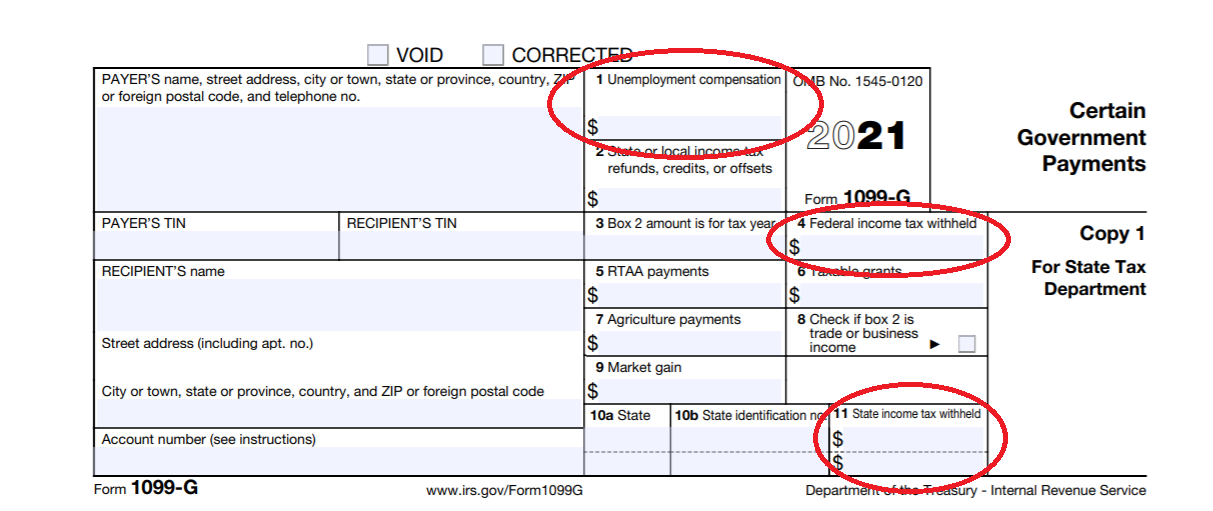

Unemployment benefits are taxable, look for a 1099G form

How to Report your Unemployment Benefits on your Federal Tax Return

1099G Unemployment Forms Necessary to File Taxes Are Now Available at

What You Need to Know About Unemployment Form 1099G National

Understanding Your Form 1099R (MSRB) Mass.gov

What is a 1099 Employee? The Definitive Guide to 1099 Status SuperMoney

Can a 1099 Collect Unemployment? got1099

Web Workers Receiving A Form 1099 Typically Don’t Qualify For Unemployment Benefits.

Unemployment Benefits Are Designed For Employees Whose Employers Pay State And Federal Unemployment Taxes To Fund The Unemployment System.

In Most States, Companies Pay A Tax To Cover Unemployment Insurance So That Separated Employees Can Benefit From It.

Web Other Than In Special Circumstances, If You Were Paid As An Independent Contractor And Received A 1099 Form, You Were Not Considered An Employee And Would Not Be Eligible For Unemployment Benefits.

Related Post: