Can I Draw My Husband Is Social Security

Can I Draw My Husband Is Social Security - To qualify for spouse’s benefits, you must be one of the following: If you are filing a joint return with a spouse who is also 65 or. Web if you are an unmarried senior at least 65 years old and your gross income is more than $14,700. / updated december 01, 2023. Web if you don’t have enough social security credits to qualify for benefits on your own record, you may be able to receive benefits on your spouse’s record. Web even if your spouse waited until age 70 to collect social security, your maximum benefit would remain at 50% of the primary beneficiary’s fra benefit amount. Researchers found that although it's the least popular time to file (with only 4% of retirees filing at that age), around 57% of the study participants could have. Web the maximum spousal benefit is 50% of the other spouse's full benefit. You can file what’s called a “restricted application” for just spousal benefits if any of these is true:. Have a medical condition that. Web to start, you must be at least 61 years and 9 months old and want your benefits to start in no more than four months, according to the social security. Claim benefits on your spouse's record instead of your own. Web march 28, 2024, at 2:35 p.m. Web even if your spouse waited until age 70 to collect social. Claim benefits on your spouse's record instead of your own. As a practical matter, however, you'll get the. Web if you don’t have enough social security credits to qualify for benefits on your own record, you may be able to receive benefits on your spouse’s record. Have worked in jobs covered by social security. Not when it comes to each. You are eligible to collect spousal benefits on a living former wife’s or husband’s earnings record as long as: 62 years of age or older. Web even if your spouse waited until age 70 to collect social security, your maximum benefit would remain at 50% of the primary beneficiary’s fra benefit amount. / updated december 01, 2023. Researchers found that. Have worked in jobs covered by social security. It may be that you worked your entire life and are eligible for social security benefits accordingly. Researchers found that although it's the least popular time to file (with only 4% of retirees filing at that age), around 57% of the study participants could have. Web yes, you can collect social security's. As a practical matter, however, you'll get the. Web you are eligible for benefits both as a retired worker and as a spouse (or divorced spouse) in the first month you want your benefits to begin and. Web the maximum spousal benefit is 50% of the other spouse's full benefit. These benefits are worth up to 50% of that former.. Have a medical condition that. You can file what’s called a “restricted application” for just spousal benefits if any of these is true:. Web if you are an unmarried senior at least 65 years old and your gross income is more than $14,700. Claim benefits on your spouse's record instead of your own. Free animation videos.master the fundamentals.learn more.learn at. Web if you are an unmarried senior at least 65 years old and your gross income is more than $14,700. You are eligible to collect spousal benefits on a living former wife’s or husband’s earnings record as long as: The marriage lasted at least 10 years. If you are filing a joint return with a spouse who is also 65. Web march 28, 2024, at 2:35 p.m. Web technically, yes, you can receive both benefits on your spouse's earnings record and your own retirement payment. These benefits are worth up to 50% of that former. Web yes, you can collect social security's on a spouse's earnings record. Have a medical condition that. Have worked in jobs covered by social security. Web if you delay benefits past your fra, you'll collect your full benefit amount plus a bonus of between 24% and 32% per month, depending on your fra. Faqsprivacy assurancepersonal online accountexpert help You may be eligible if you're married, divorced, or widowed. Web you are eligible for benefits both as a. If you are filing a joint return with a spouse who is also 65 or. Web if you are an unmarried senior at least 65 years old and your gross income is more than $14,700. These benefits are worth up to 50% of that former. The marriage lasted at least 10 years. Web march 28, 2024, at 2:35 p.m. If you are filing a joint return with a spouse who is also 65 or. / updated december 01, 2023. Social security offers an online disability application you can complete at your convenience. Have a medical condition that. As a practical matter, however, you'll get the. Web march 28, 2024, at 2:35 p.m. You may be able to do this in the form of spousal benefits, or as survivor benefits if you are a. Web the maximum spousal benefit is 50% of the other spouse's full benefit. To qualify for social security disability insurance (ssdi) benefits, you must: You may be eligible if you're married, divorced, or widowed. Have worked in jobs covered by social security. Free animation videos.master the fundamentals.learn more.learn at no cost. Claim benefits on your spouse's record instead of your own. Web if you don’t have enough social security credits to qualify for benefits on your own record, you may be able to receive benefits on your spouse’s record. Web even if your spouse waited until age 70 to collect social security, your maximum benefit would remain at 50% of the primary beneficiary’s fra benefit amount. These benefits are worth up to 50% of that former.

Social Security Benefits for Spouses, ExSpouses, & Survivors Your

Social Security Benefits For Spouses

How is Social Security calculated? SimplyWise

Can I Draw Social Security from My Husband's Social Security Disability?

Can I be awarded a portion of my husband's social security pension

Can I Collect My Exspouse's or Deceased Spouse's Social Security? 🤔

🔴Can I Collect Social Security Spousal Benefits? YouTube

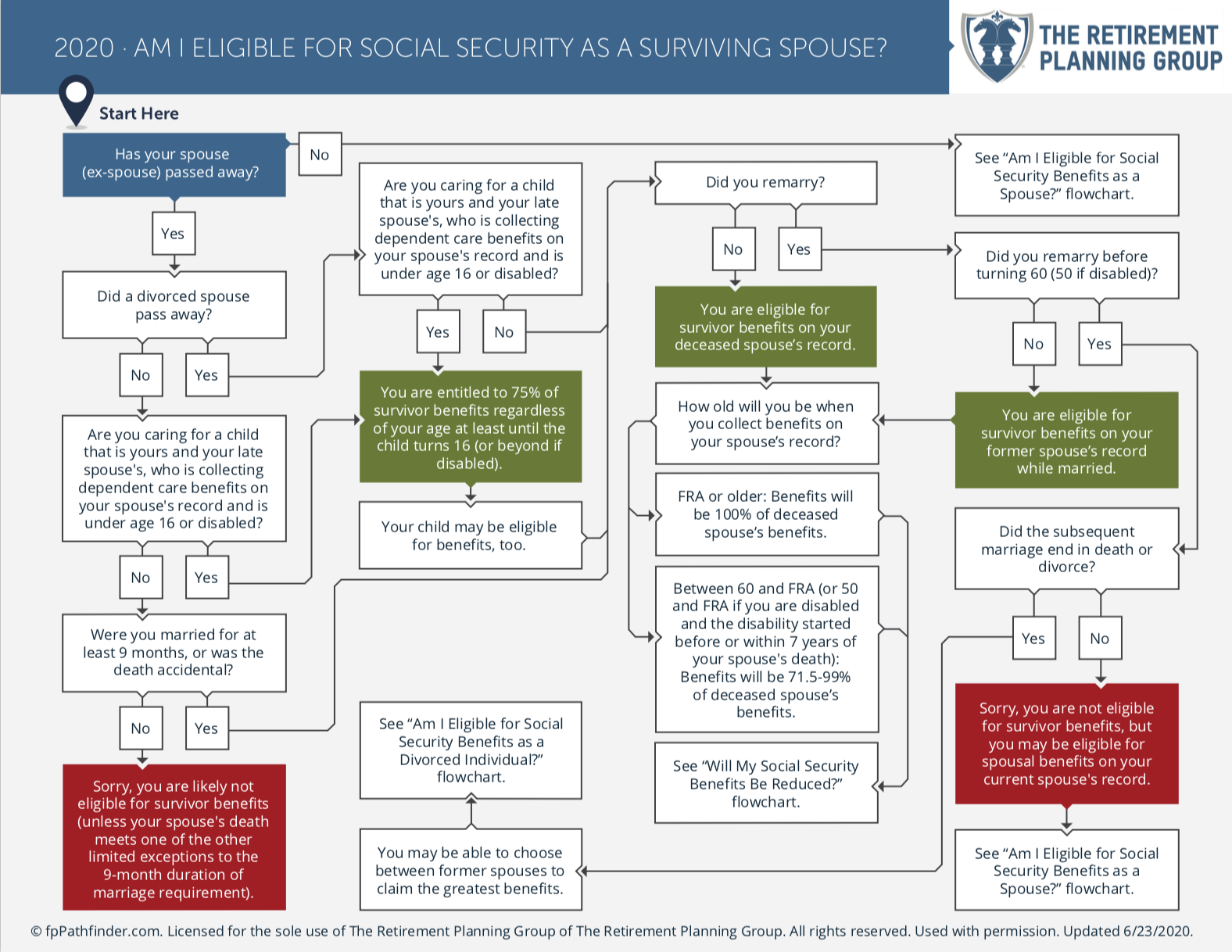

Am I Eligible for Social Security Benefits as a Surviving Spouse?

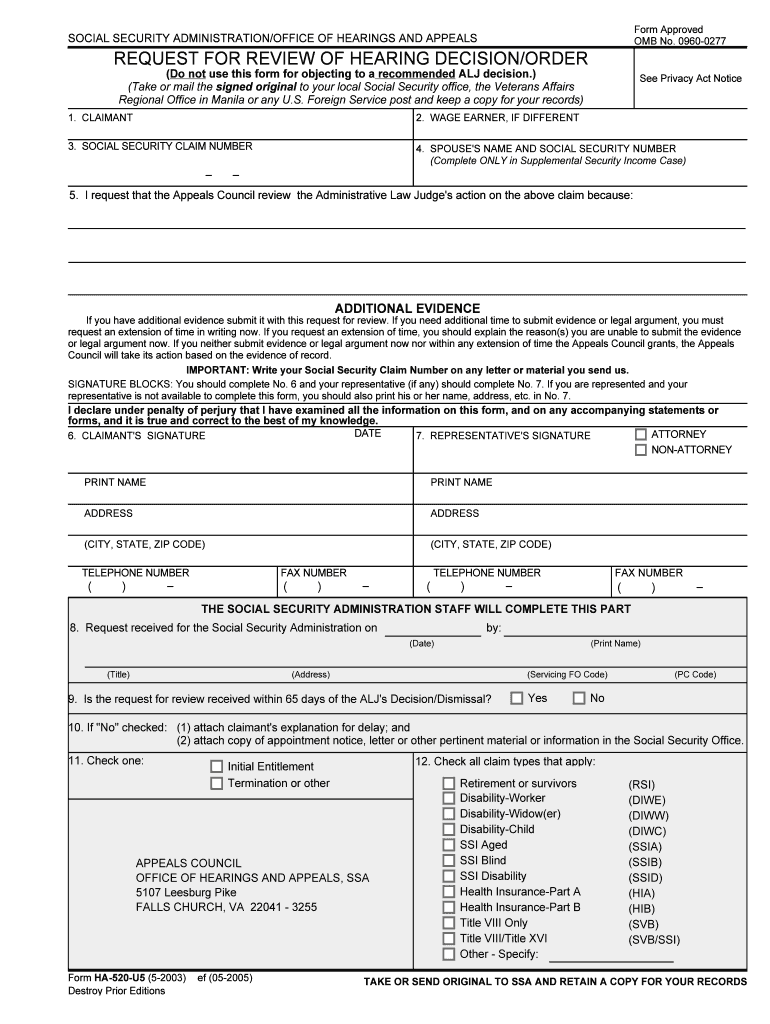

SPOUSE'S NAME and SOCIAL SECURITY NUMBER Form Fill Out and Sign

Can I Collect Social Security From My ExSpouse?

You Can File What’s Called A “Restricted Application” For Just Spousal Benefits If Any Of These Is True:.

Researchers Found That Although It's The Least Popular Time To File (With Only 4% Of Retirees Filing At That Age), Around 57% Of The Study Participants Could Have.

Web To Start, You Must Be At Least 61 Years And 9 Months Old And Want Your Benefits To Start In No More Than Four Months, According To The Social Security.

Apply From The Comfort Of Your Home Or Any.

Related Post: