How Much Money Can I Earn While Drawing Social Security

How Much Money Can I Earn While Drawing Social Security - Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of $24,000 (twice your benefits) and $18,960. You work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. Although the quick calculator makes an initial assumption about your past earnings, you will have. Web in 2024, people who reach full retirement age (fra) — the age at which you qualify for 100 percent of the benefit calculated from your earnings record — can earn. Web the threshold isn’t terribly high: Web this equates to an annual benefit of nearly $18,060. Web if you are on social security for the whole year and make $30,000 from work, you are $7,680 over the limit and lose $3,840 in benefits. Web reach full retirement age in 2024, you are considered retired in any month that your earnings are $4,960 or less and you did not perform substantial services in self. Web for 2024, the earnings limit to collect social security before fra is $22,320. Web if you are on social security for the whole year and make $30,000 from work, you are $7,680 over the limit and lose $3,840 in benefits. 50% of anything you earn over the cap. Web how your earnings afect your social security benefits. The limit is $22,320 in 2024. Your social security benefits would be reduced by $5,000 ($1. Even if you file taxes jointly, social security does not count both spouses’ incomes against one spouse’s earnings limit. Web so if you were due $12,000 from social security in 2021, the cutoff would be $42,960 — the sum of $24,000 (twice your benefits) and $18,960. Web so benefit estimates made by the quick calculator are rough. Web / updated. Web you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. Web reach full retirement age in 2024, you are considered retired in any month that your earnings are $4,960 or less and you did not perform substantial services in self. Web this equates to an annual benefit of nearly $18,060. During the trial work period,. But that limit is rising in 2024, which means seniors who are working and. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit). Web in 2024, people who reach full retirement age (fra) — the age at which you qualify for 100 percent of the benefit calculated from your earnings record — can earn.. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before. Web should your income surpass this threshold, your social security benefits will be reduced by $1 for every $2 you earn above the limit. Web / updated december 08, 2023. If you’re. Web if you are on social security for the whole year and make $30,000 from work, you are $7,680 over the limit and lose $3,840 in benefits. But that limit is rising in 2024, which means seniors who are working and. You work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. Web this is how much. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more than the limit). There are several factors that impact your benefit amount. You can earn up to $2,364 per month by claiming at age 62. Web during 2024, you plan to work and earn $24,920 ($2,600 above the $22,320 limit). The limit is $22,320. You can earn up to $2,364 per month by claiming at age 62. Web should your income surpass this threshold, your social security benefits will be reduced by $1 for every $2 you earn above the limit. Web so benefit estimates made by the quick calculator are rough. Your social security benefits would be reduced by $5,000 ($1 for every. The averages are different for men and women. You would receive $4,600 of your $9,600 in benefits for the year. You can earn up to $2,364 per month by claiming at age 62. If you’re not full retirement age in 2024, you’ll lose $1 in social security benefits for every $2 you earn above $22,320. In the year you reach. There are several factors that impact your benefit amount. You would receive $4,600 of your $9,600 in benefits for the year. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before. Your social security benefits would be reduced by $5,000 ($1 for. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld for every $3 earned over the limit. You would receive $4,600 of your $9,600 in benefits for the year. Web in 2024, people who reach full retirement age (fra) — the age at which you qualify for 100 percent of the benefit calculated from your earnings record — can earn. Web if you are on social security for the whole year and make $30,000 from work, you are $7,680 over the limit and lose $3,840 in benefits. Retired men aged 65 received an average monthly benefit. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more. Even if you file taxes jointly, social security does not count both spouses’ incomes against one spouse’s earnings limit. Web for 2024, the earnings limit to collect social security before fra is $22,320. Web for the year 2024, the maximum income you can earn after retirement is $22,320 ($1,860 per month) without having your benefits reduced. Web how your earnings afect your social security benefits. Web the threshold isn’t terribly high: Web there is a special rule that applies to earnings for 1 year, usually the first year of retirement. There are several factors that impact your benefit amount. Web for 2024 that limit is $22,320. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before. During the trial work period, there are no limits on your earnings.Introduction to Social Security Aspire Wealth Advisory

Social Security SERS

SOCIAL SECURITY 2022 HOW MUCH CAN I EARN WHILE ON SOCIAL SECURITY IN

How Much Can I Earn While On Social Security?

Social Security Benefits Chart

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

Can You Work While Applying for Social Security Benefits? Pocketsense

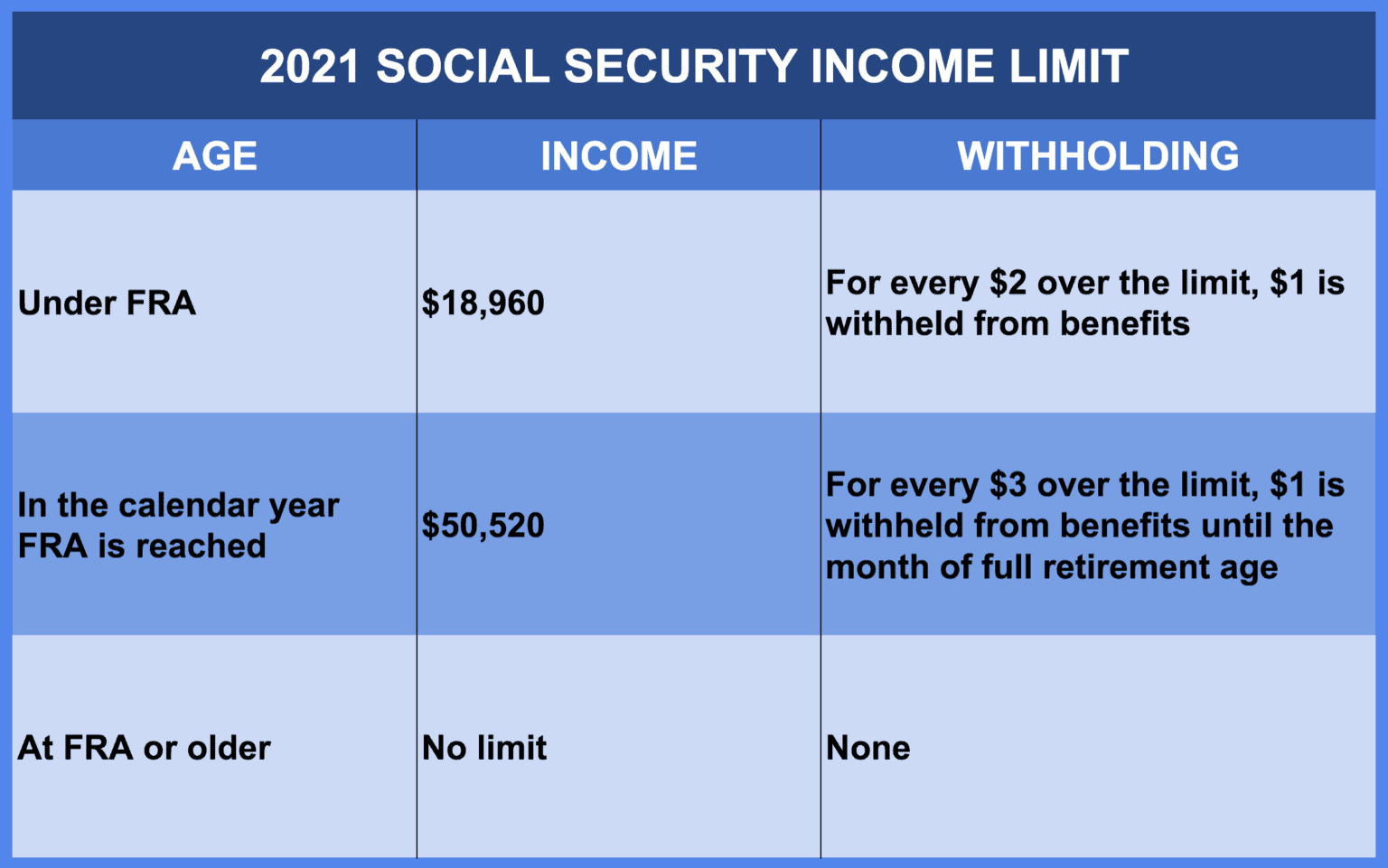

Social Security Limit 2021 Social Security Intelligence

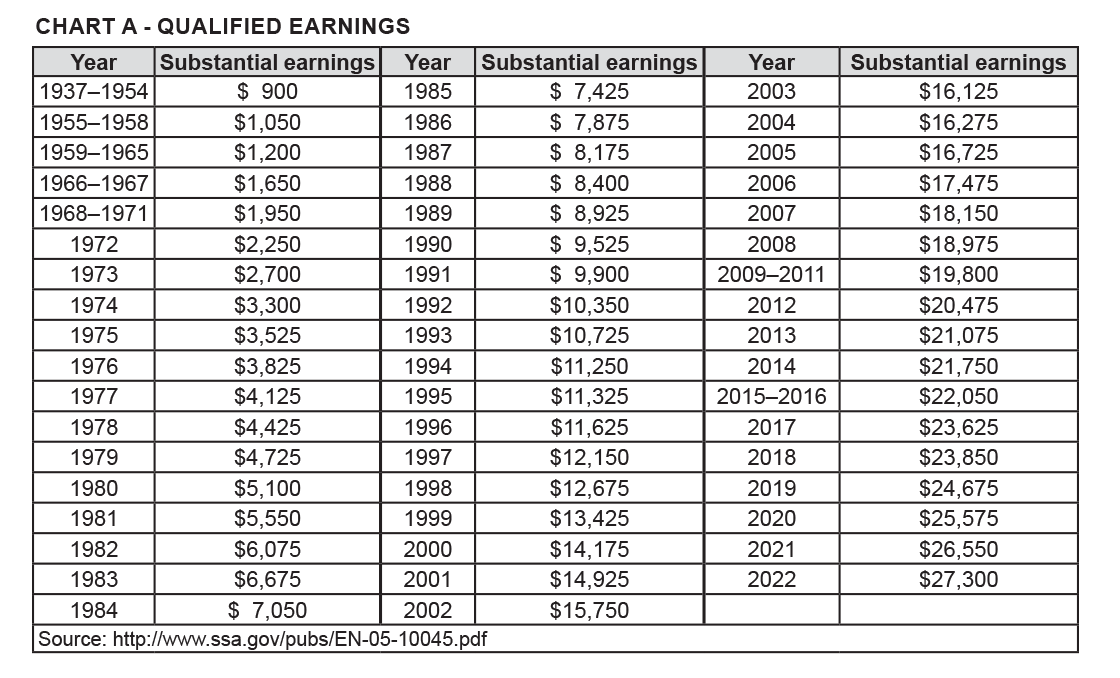

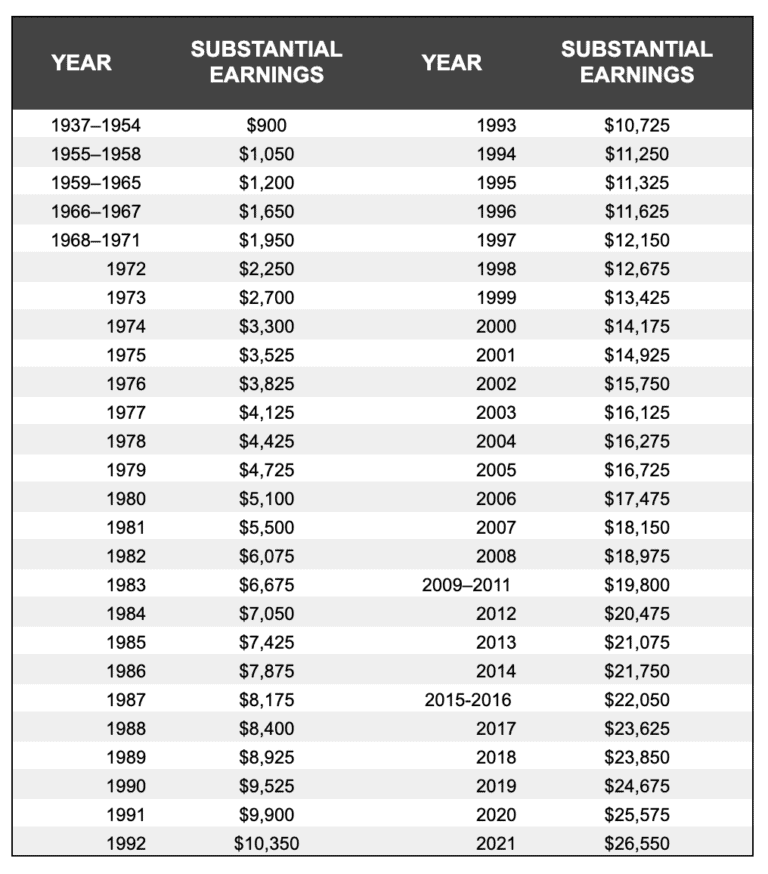

Substantial Earnings for Social Security’s Windfall Elimination

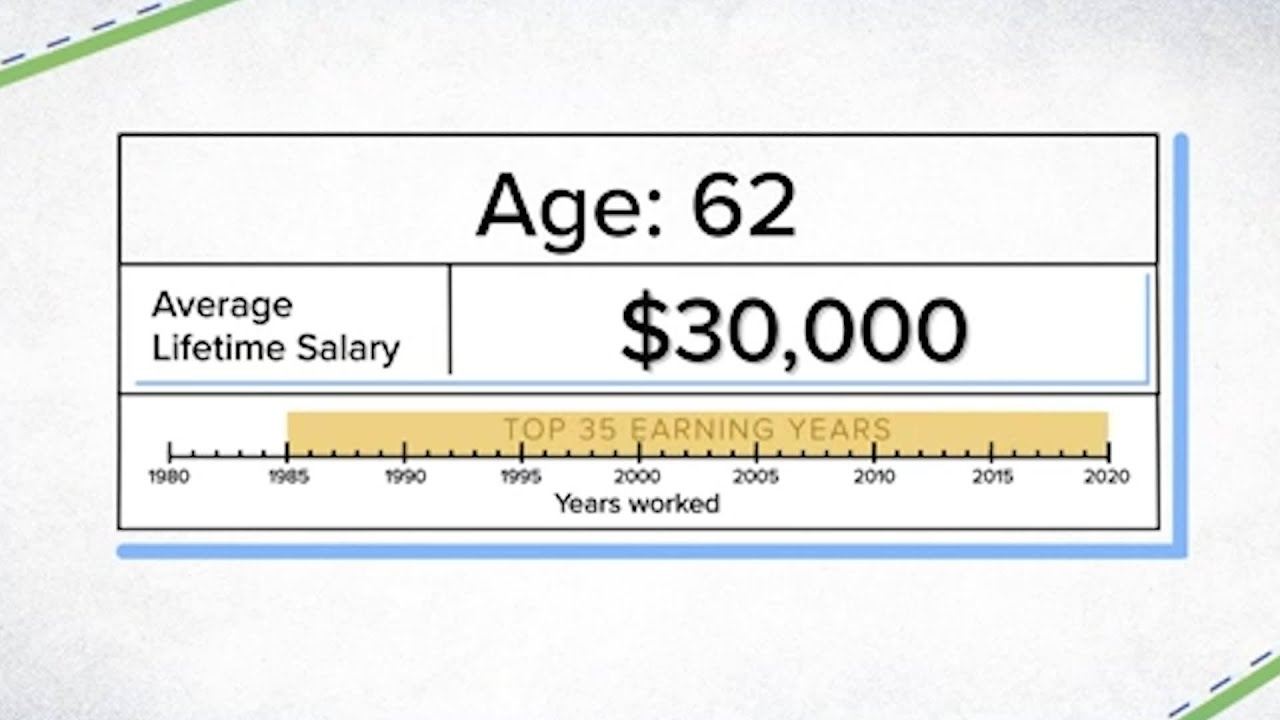

How much your Social Security benefits will be if you make 30,000

50% Of Anything You Earn Over The Cap.

Web Reach Full Retirement Age In 2024, You Are Considered Retired In Any Month That Your Earnings Are $4,960 Or Less And You Did Not Perform Substantial Services In Self.

Under This Rule, You Can Get A Full Social Security Benefit For Any Whole Month You Are.

That Applies Until The Date You Hit Fra:

Related Post: