How Much Money Can You Make And Draw Social Security

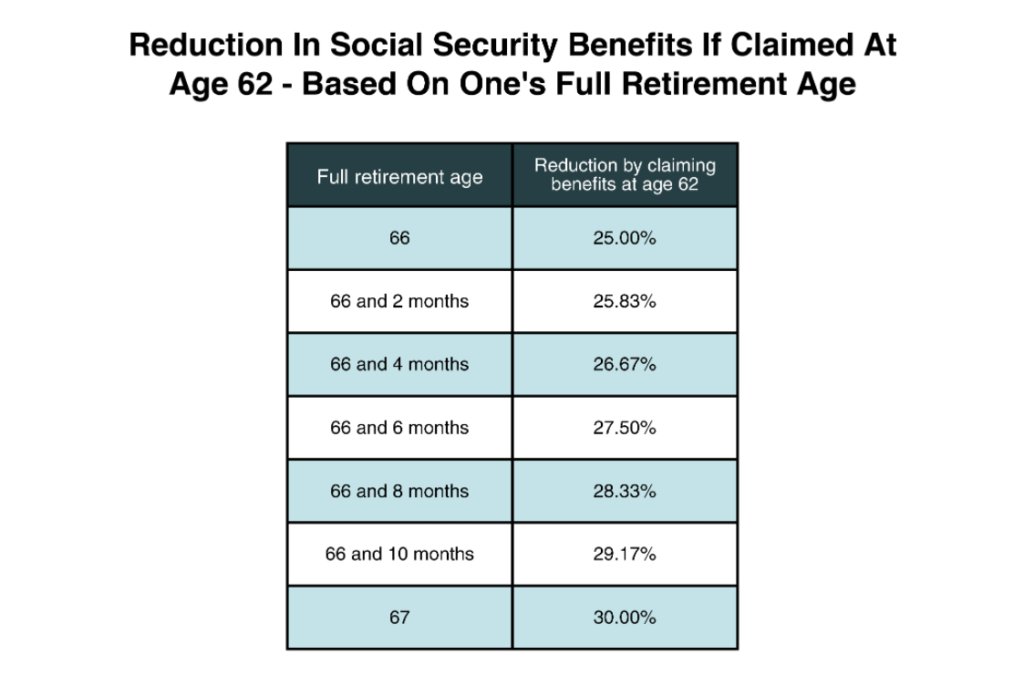

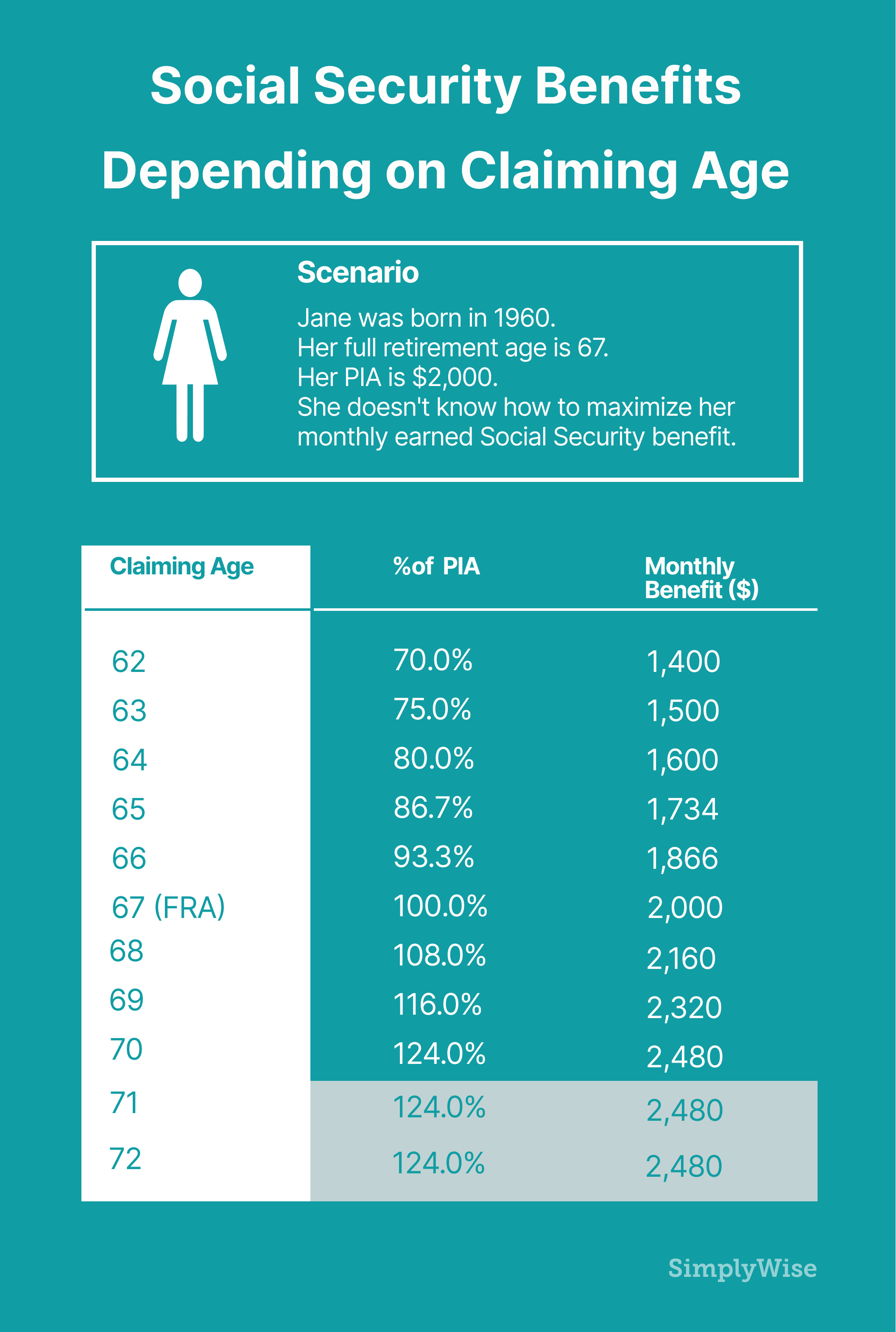

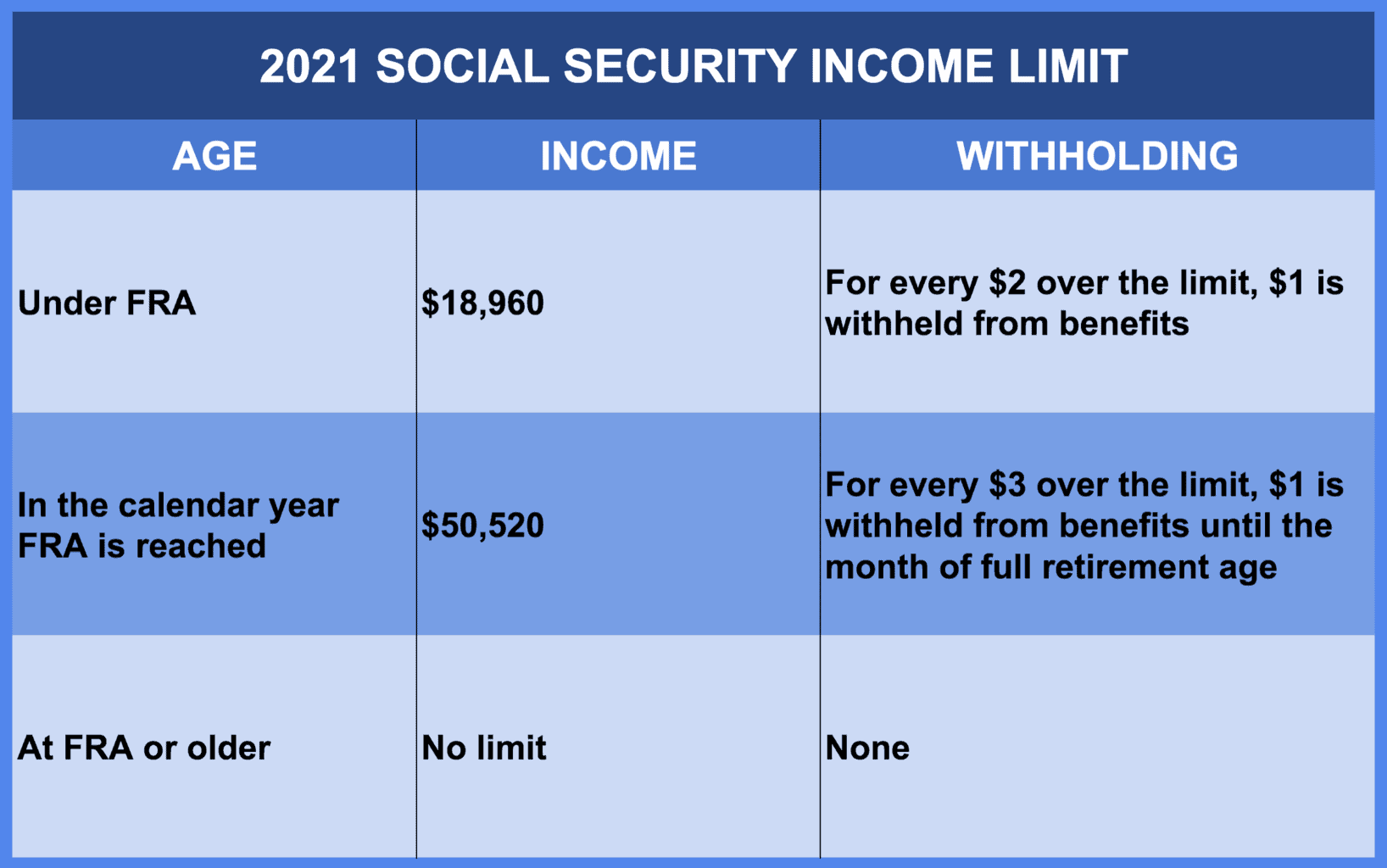

How Much Money Can You Make And Draw Social Security - Beginning in april 2024, you would receive your $600 benefit and this amount would be paid to you each month for the remainder of the year. To do this, we would withhold all benefit payments from january 2024 through march 2024. During the trial work period, there are no limits on your earnings. Past that, there is no benefit reduction, no matter how much you earn. Web the maximum possible social security benefit for someone who retires at full retirement age is $3,627 in 2023. Although the quick calculator makes an initial assumption about your past earnings, you will have the opportunity to change the assumed earnings (click on see the earnings we used after you complete and submit the form below). Web in 2024, you can earn up to $22,320 without having your social security benefits withheld. Web you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. Web there is a special rule that applies to earnings for 1 year, usually the first year of retirement. Web in 2024, people who reach full retirement age (fra) — the age at which you qualify for 100 percent of the benefit calculated from your earnings record — can earn up to $59,520 without losing benefits. ($9,600 for the year) you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. To do this, we would withhold all benefit payments from january 2024 through march 2024. Social security’s benefit calculators give you a preview of your future payments. The amount needed to earn 1 credit automatically increases each year when average wages increase.. Web how your earnings afect your social security benefits. ($9,600 for the year) you work and earn $32,320 ($10,000 more than the $22,320 limit) during the year. Above that amount, social security will deduct $1. Web the limit is $22,320 in 2024. Web if you keep working and earn that $150,000 for one more year, you might replace, say, a. You must earn a certain number of credits to be eligible for social security benefits. Be aware of the generational differences. Web we would withhold $1,300 of your social security benefits ($1 for every $2 you earn over the limit). If you retire at age 62 in 2024, the maximum amount is $2,710. If you will reach full. But beyond that point, you'll have $1 in benefits withheld per $2 of earnings. This example is based on an estimated monthly benefit of $1000 at full retirement age. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more than the limit). Web this online social security benefits calculator estimates retirement benefits based on. Web so benefit estimates made by the quick calculator are rough. You would receive $4,600 of your $9,600 in benefits for the year. Web this year, you can earn up to $19,560 without impacting your social security benefits. Web social security tax: Both you and your employer contribute 6.2 percent of your wages up to a capped amount called the. Web so benefit estimates made by the quick calculator are rough. Web adjust to the $1,827 average payment. Use social security retirement calculators to estimate your benefits. During the trial work period, there are no limits on your earnings. Web this year, you can earn up to $19,560 without impacting your social security benefits. Social security’s benefit calculators give you a preview of your future payments. Web in 2024, the highest monthly benefit you can receive at the full retirement age of 67 is $3,822. You can earn up to a maximum of 4 credits per year. Know when you can get your social security benefits. Don’t wait until after age 70. If you retire at age 62 in 2024, the maximum amount is $2,710. If you will reach full retirement age in 2024, the limit on your earnings for the months before full retirement age is. But suppose you earn that $30,000 from january to september 2024, then start social security in october. You would receive $4,600 of your $9,600 in. But suppose you earn that $30,000 from january to september 2024, then start social security in october. Both you and your employer contribute 6.2 percent of your wages up to a capped amount called the taxable maximum ($168,600 in 2024). There is no earnings cap after hitting full retirement age. Knowing how much you may receive from social security is. Web in 2024, people who reach full retirement age (fra) — the age at which you qualify for 100 percent of the benefit calculated from your earnings record — can earn up to $59,520 without losing benefits. Use social security retirement calculators to estimate your benefits. Web in that case, the earnings limit is $59,520, with $1 in benefits withheld. You must earn a certain number of credits to be eligible for social security benefits. Web you are entitled to $800 a month in benefits. To do this, we would withhold all benefit payments from january 2024 through march 2024. There is no earnings cap after hitting full retirement age. See what you might receive. Web social security tax: Knowing how much you may receive from social security is important for retirement planning. But suppose you earn that $30,000 from january to september 2024, then start social security in october. Web the limit is $22,320 in 2024. You must be at least age 22 to use the form at right. Web if you are on social security for the whole year and make $30,000 from work, you are $7,680 over the limit and lose $3,840 in benefits. Know when you can get your social security benefits. Your social security benefits would be reduced by $5,000 ($1 for every $2 you earned more than the limit). Web for 2024 that limit is $22,320. In the year you reach full retirement age, we deduct $1 in benefits for every $3 you earn above a different limit, but we only count earnings before the month you reach your full retirement age. Web the threshold isn’t terribly high:

Images Of Drawing Social Security At 62

What is Social Security? Definition, Eligibility, and Meaning

🔴How Much Social Security Benefits on 60,000 YouTube

Social Security Benefits Chart

Study Only 1 in 300 Seniors Know These 5 Social Security Rules

SOCIAL SECURITY 2022 HOW MUCH CAN I EARN WHILE ON SOCIAL SECURITY IN

2021 Limit Social Security Intelligence

How To Calculate Federal Social Security And Medicare Taxes

How Much Can I Earn Without Losing My Social Security?

Social Security Retirement Benefits Explained Sams/Hockaday & Associates

Web If You Keep Working And Earn That $150,000 For One More Year, You Might Replace, Say, A $40,000 Salary From Earlier On In Your Career In Your Social Security Benefits Calculation, Resulting In.

Don’t Wait Until After Age 70.

This Example Is Based On An Estimated Monthly Benefit Of $1000 At Full Retirement Age.

Past That, There Is No Benefit Reduction, No Matter How Much You Earn.

Related Post: