How Old To Draw From Ira

How Old To Draw From Ira - You can withdraw money any time after age 59½, but you’ll need to pay income taxes on part or all of any ira withdrawals you make. The converted amount is included in your gross income for the year, though it. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; Web there are a few rules for taking money out of your 401 (k) or ira account before you reach retirement age. Generally you’ll owe income taxes and a. 45+ years experienceserving all 50 stateseasy setuppersonalized service Web age 59 ½ and under. When you set up your roth ira account you will be asked to select investments you want to buy with your contributions. Web you are required to make minimum withdrawals from traditional iras once you reach age 73. If you’ve inherited an individual retirement account since 2020, you could have a shorter timeline to withdraw the money, which can trigger tax. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. If you're younger than 59½ and the account. Web age 59 ½ and under. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a. However, you may have to pay taxes and penalties on earnings in. 45+ years experienceserving all 50 stateseasy setuppersonalized service Web there. Generally you’ll owe income taxes and a. The converted amount is included in your gross income for the year, though it. Web in an ira conversion, you rollover money from a traditional ira or 401 (k) to a roth ira. You can withdraw roth individual retirement account (ira) contributions at any time. Web you're only permitted to withdraw the earnings. Web there are a few rules for taking money out of your 401 (k) or ira account before you reach retirement age. Web you can take money without penalty from a traditional ira once you reach age 59 1/2, and you must begin taking money out of an ira at age 70 1/2 according to a. The rmd rules require. However, you may have to pay taxes and penalties on earnings in. Other rules apply when you're ready to retire and enjoy. The converted amount is included in your gross income for the year, though it. Web in an ira conversion, you rollover money from a traditional ira or 401 (k) to a roth ira. If you withdraw roth ira. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. In addition, with a roth ira, you'll pay no. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; Web at age 73 (for people born between. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still. Web are you over age 59 ½ and want to withdraw? You can reduce taxes by sending required minimum distributions to a. When you set up your roth ira account you will be asked to. But it's still critical to know how your withdrawal may be taxed. Web americans will get new protections for the trillions of dollars that moved out of their 401 (k)s and into individual retirement accounts, under labor department. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even. Web nerdwallet advisory llc. Web you're only permitted to withdraw the earnings from your contributions after you reach age 59½, according to the irs, and if you've held the account for at least five. Web july 21, 2023, at 9:21 a.m. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement. Web there are a few rules for taking money out of your 401 (k) or ira account before you reach retirement age. If you withdraw roth ira earnings before age 59½, a 10%. Web you can take money without penalty from a traditional ira once you reach age 59 1/2, and you must begin taking money out of an ira. If you’ve inherited an individual retirement account since 2020, you could have a shorter timeline to withdraw the money, which can trigger tax. The rmd rules require individuals to take withdrawals from their iras (including simple iras and sep iras) every year once they reach age 72 (73 if the. You can withdraw money any time after age 59½, but you’ll need to pay income taxes on part or all of any ira withdrawals you make. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. Web are you over age 59 ½ and want to withdraw? When you set up your roth ira account you will be asked to select investments you want to buy with your contributions. Generally you’ll owe income taxes and a. If you're younger than 59½ and the account is less than 5 years old. In addition, with a roth ira, you'll pay no. Web age 59 ½ and under. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a. Web there are certain circumstances where you can take an early ira withdrawal before the age of 59.5 and avoid the 10% penalty; Web you can take money without penalty from a traditional ira once you reach age 59 1/2, and you must begin taking money out of an ira at age 70 1/2 according to a. Web you're only permitted to withdraw the earnings from your contributions after you reach age 59½, according to the irs, and if you've held the account for at least five. Other rules apply when you're ready to retire and enjoy. However, you may have to pay taxes and penalties on earnings in.

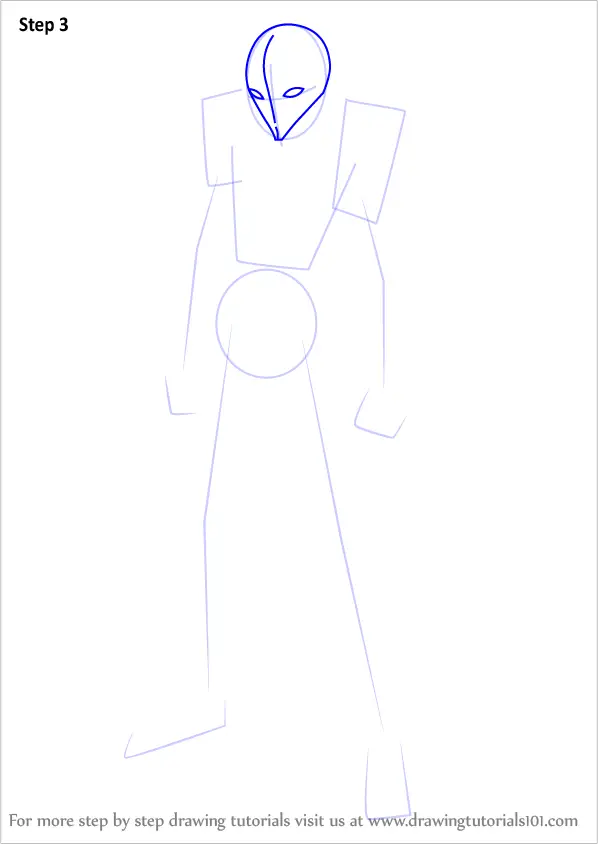

How to Draw Ira from 11eyes (11eyes) Step by Step

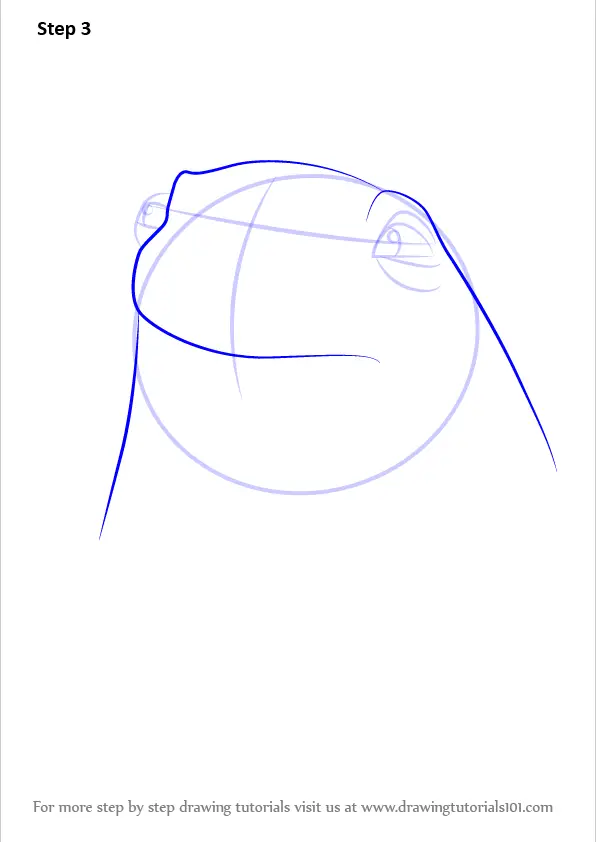

How to draw Anger from Inside Out Cómo dibujar a Ira de Del Revés

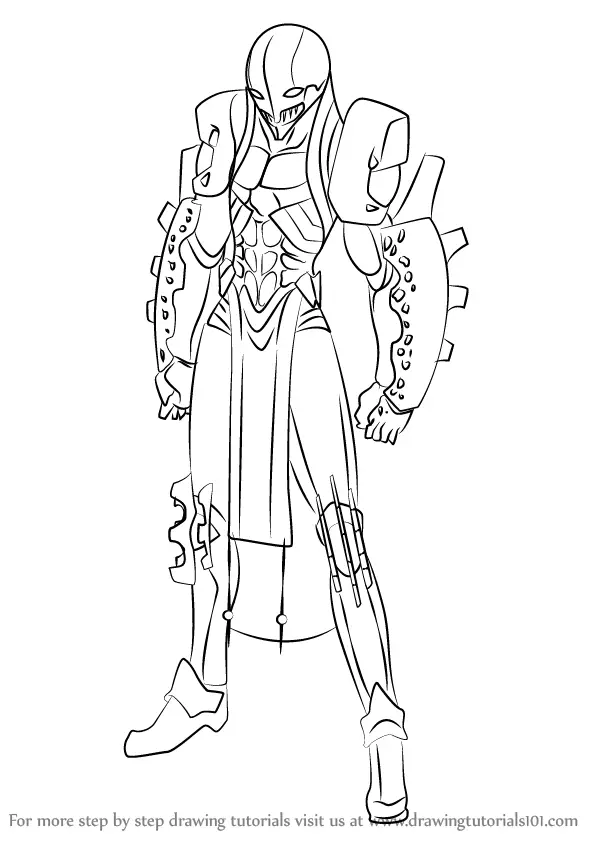

Step by Step How to Draw Ira from 11eyes

Step by Step How to Draw Don Ira Feinberg from Shark Tale

Step by Step How to Draw Ira from 11eyes

Learn How to Draw Ira Gamagori from Kill la Kill (Kill la Kill) Step by

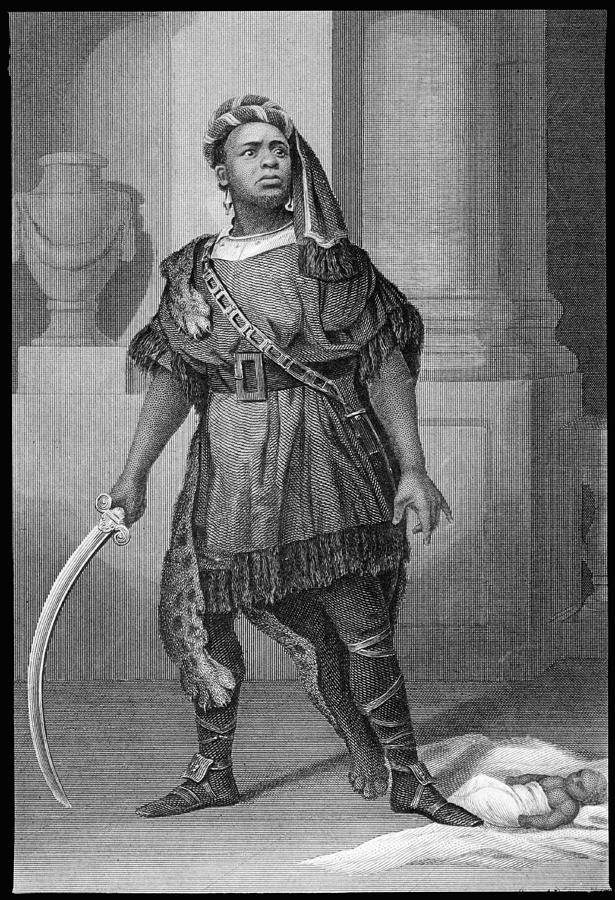

Ira Frederick Aldridge Known Drawing by Mary Evans Picture Library

Learn How to Draw Ira Gamagori from Kill la Kill (Kill la Kill) Step by

HOW TO DRAW ANGRY EMOJI YouTube

How to Draw Ira Fingerman from Harvey Beaks (Harvey Beaks) Step by Step

The Rmd Rules Require Traditional Ira, And Sep, Sarsep, And Simple Ira Account Holders To Begin Taking Distributions At Age 72, Even If They're Still.

Web July 21, 2023, At 9:21 A.m.

Web There Are A Few Rules For Taking Money Out Of Your 401 (K) Or Ira Account Before You Reach Retirement Age.

Web Americans Will Get New Protections For The Trillions Of Dollars That Moved Out Of Their 401 (K)S And Into Individual Retirement Accounts, Under Labor Department.

Related Post: