How To Draw From 401K Early

How To Draw From 401K Early - Early withdrawals from a 401 (k) often. Web understanding early withdrawals. Estimate your expected expenses after retirement. Expected annual rate of return (%). This is the amount of time before you plan to retire or start withdrawing from your 401 (k). Tapping your 401 (k) early. Web a withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Let's look at the pros and cons of different types of 401 (k) loans. For 2024, you can’t put more than $7,000 into a roth, plus another $1,000 if you’re older than 50. Web taking an early withdrawal from your 401(k) or ira has serious consequences. Cashing out or taking a loan on your 401 (k) are two viable options if you're in need of funds. Updated on september 08, 2023. Web use the 401 (k) early withdrawal calculator to how much you could be giving up by withdrawing funds early. Estimate your expected expenses after retirement. Web and for some people, saving for retirement solely. Web how to withdraw early from your 401 (k) written by true tamplin, bsc, cepf®. Early withdrawals from a 401 (k) often. In addition, your modified adjusted gross income must be less than $146,000 to $161,000 (for single filers) or $230,000 to $240,000. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty. Web and for some people, saving for retirement solely in a 401 (k) could make sense. 401 (k) loans and certain hardship withdrawals will not be penalized. The internal revenue service (irs) has set the standard retirement. Web can you withdraw from your 401 (k) plan early? Projected account loss with withdrawal. Accessing your 401 (k) funds before retirement age can turn costly due to taxes and penalties. Web contribution limits for 401(k) and similar workplace retirement savings plans increased to $23,000 in 2024. For 2024, you can’t put more than $7,000 into a roth, plus another $1,000 if you’re older than 50. Understand the costs before you act. There are possible. Reviewed by subject matter experts. Web the 401 (k) early withdrawal penalty is typically 10% of the amount of your distribution, so you can calculate your tax penalty by multiplying the amount you’re planning to withdraw by 0.1. Updated on september 08, 2023. An early withdrawal from a 401 (k) means missing out on the investment growth in the fund.. Expected annual rate of return (%). How much you expect your 401 (k) to grow on. A 401 (k) loan or an early withdrawal? Estimate your expected expenses after retirement. Web can you withdraw money from a 401 (k) early? Web most 401(k) plans allow workers to withdraw money early. Web taking an early withdrawal from your 401 (k) should only be done as a last resort. Written by javier simon, cepf®. An early withdrawal from a 401 (k) means missing out on the investment growth in the fund. They sport hefty contribution limits. This is the amount of time before you plan to retire or start withdrawing from your 401 (k). Find out how to calculate your 401(k) penalty if you plan to access funds early. If any of these scenarios apply to you, the irs can waive fees. Yes, it’s possible to make an early withdrawal from a 401 (k) plan at. Our calculator will show you the true cost of cashing out your 401(k) early. Written by javier simon, cepf®. Web and for some people, saving for retirement solely in a 401 (k) could make sense. Expected annual rate of return (%). There are possible situations where you are allowed to withdraw from your account without incurring an early withdrawal penalty. They sport hefty contribution limits. How much you expect your 401 (k) to grow on. Our calculator will show you the true cost of cashing out your 401(k) early. There are possible situations where you are allowed to withdraw from your account without incurring an early withdrawal penalty or the 10% early required minimum distribution tax penalty. Web taking an. How much you expect your 401 (k) to grow on. Let's look at the pros and cons of different types of 401 (k) loans. Web taking an early withdrawal from a 401(k) retirement account before age 59½ could have steep financial penalties. Web advantages of 401 (k) accounts: Web updated on february 15, 2024. Updated on september 08, 2023. Find out how to calculate your 401(k) penalty if you plan to access funds early. Web and for some people, saving for retirement solely in a 401 (k) could make sense. Early withdrawals are typically taxed as income and may be subject to a 10% penalty. Expected annual rate of return (%). Web a withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties. Web taking an early withdrawal from your 401(k) or ira has serious consequences. Estimate your expected expenses after retirement. There are possible situations where you are allowed to withdraw from your account without incurring an early withdrawal penalty or the 10% early required minimum distribution tax penalty. Web taking an early withdrawal from your 401 (k) should only be done as a last resort. Web can you withdraw from your 401 (k) plan early?:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

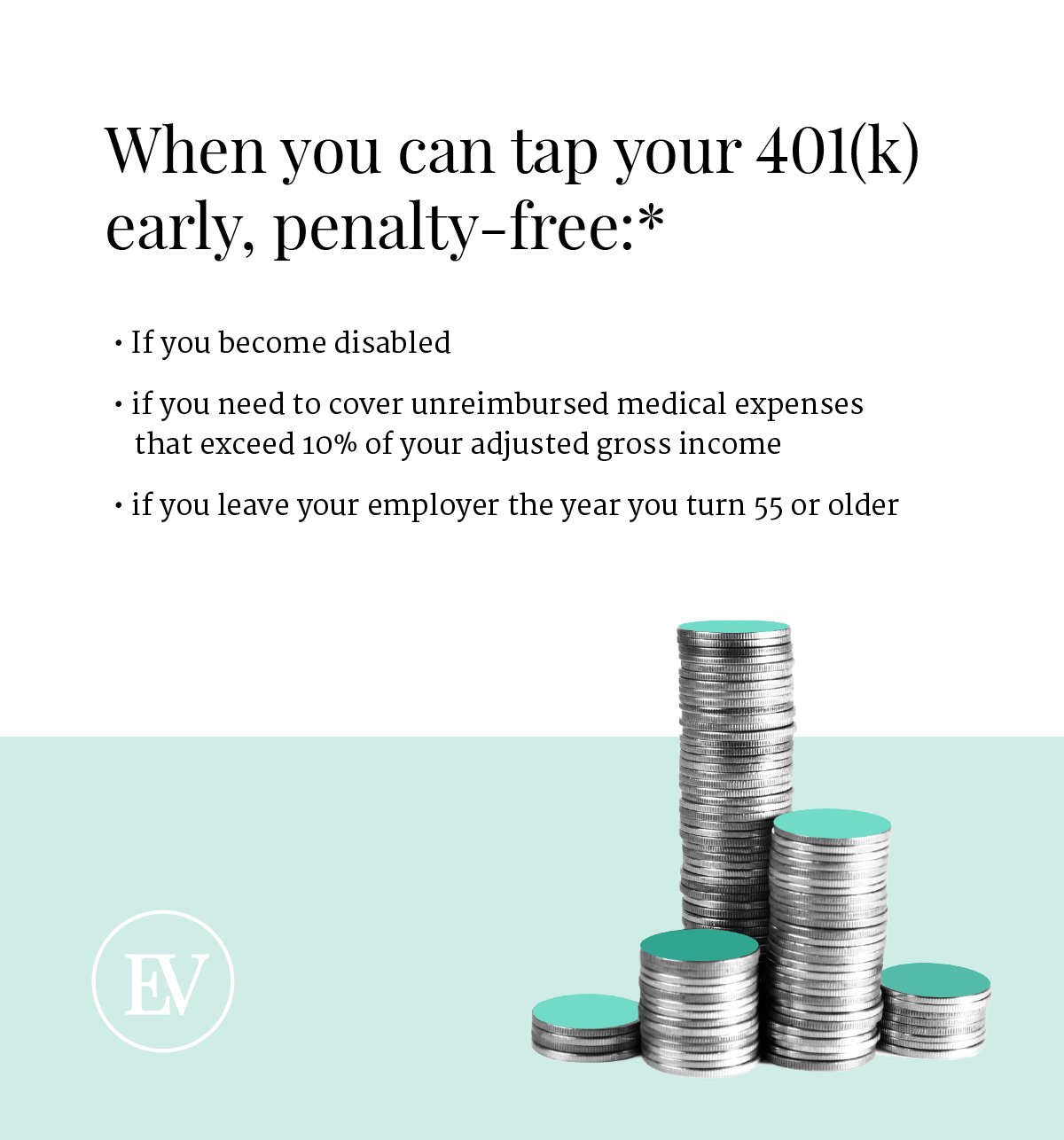

401k Early Withdrawal What to Know Before You Cash Out MintLife Blog

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

Best Guide to 401k for Business Owners 401k Small Business Owner Tips

When Can I Draw From My 401k Men's Complete Life

Your Guide to Emergency IRA and 401(k) Withdrawals — Beirne

401(k) or IRA How to Choose Where to Put Your Money Ellevest

When Can I Draw From My 401k Men's Complete Life

3 Ways to Withdraw from Your 401K wikiHow

How To Draw Money From 401k LIESSE

Web Understanding Early Withdrawals.

They Sport Hefty Contribution Limits.

Cashing Out Or Taking A Loan On Your 401 (K) Are Two Viable Options If You're In Need Of Funds.

Written By Javier Simon, Cepf®.

Related Post: