Owners Drawings

Owners Drawings - The account in which the draws are recorded is a contra owner’s capital account or contra owner’s equity account since its debit balance is contrary to the normal credit balance of the owner’s equity or capital account. The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. Web an owner’s drawing account, often simply referred to as a “draw account,” is a separate account in the general ledger of a business that tracks the amount of money or other assets that the business owner has withdrawn for personal. Many small business owners compensate themselves using a draw rather than paying themselves a salary. Business owners may use an owner’s draw rather than taking a salary from the business. First derby for the others. Web what is an owner’s draw? In simple terms, an owner’s draw is withdrawing money from your business and using it for personal use. You should only take an owner's draw if your business profits. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Web what is an owner’s draw? The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. December 18, 2017 1 min read. Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Web in accounting,. You should only take an owner's draw if your business profits. Business owners might use a draw for compensation versus paying themselves a salary. Bernsen finished sixth with storm the court in 2020. An owner of a c corporation may not. Web an owner's draw is how the owner of a sole proprietorship, or one of the partners in a. Web also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. Small business owners often use their personal assets as an investment in their companies with the expectation that they can later withdraw funds as needed. An owner of a sole proprietorship, partnership, llc, or. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Web an owner’s draw refers to an owner taking funds out of the business for personal use. In simple terms, an owner’s draw is withdrawing money from your business and using it for personal use. Adam beschizza, 0 for. Web an owner’s draw refers to an owner taking funds out of the business for personal use. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. It might seem like raiding the company for. The money is used for personal. An owner of a sole proprietorship, partnership, llc,. Many small business owners compensate themselves using a draw rather than paying themselves a salary. An owner of a sole proprietorship, partnership, llc, or s corporation may take an owner's draw; Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Web an. Web we have written a few articles on owners drawings, in particular dealing with interest charges and tax. These draws can be in the form of cash or other assets, such as bonds. And the two photos she. Learn all about owner's draws: Web an owner's draw is a distribution of funds taken by the owner of a sole proprietorship. Small business owners often use their personal assets as an investment in their companies with the expectation that they can later withdraw funds as needed. Web an owner's draw is money taken out by a business owner from the company for personal use. This is a contra equity account that is paired with and offsets the owner's capital account. Web. Business owners may use an owner’s draw rather than taking a salary from the business. The owner's drawing account is used to record the amounts withdrawn from a sole proprietorship by its owner. Web also known as the owner’s draw, the draw method is when the sole proprietor or partner in a partnership takes company money for personal use. Web. How do business owners get paid? An owner of a sole proprietorship, partnership, llc, or s corporation may take an owner's draw; Web owner’s draw or owner’s withdrawal is an account used to track when funds are taken out of the business by the business owner for personal use. Web in accounting, an owner's draw is when an accountant withdraws. In simple terms, an owner’s draw is withdrawing money from your business and using it for personal use. The way it works is simple, it’s really just transferring money. Web an owner's draw is money taken out by a business owner from the company for personal use. Web taking an owner’s draw is a relatively simple process since it should not trigger a “taxable event.”. First derby for the others. Web an owner's draw is an amount of money an owner takes out of a business, usually by writing a check. The account in which the draws are recorded is a contra owner’s capital account or contra owner’s equity account since its debit balance is contrary to the normal credit balance of the owner’s equity or capital account. Finished seventh with enforceable in 2020. Well as it sounds it’s essentially the owner taking money out of their business in lieu of a salary. The money is used for personal. Erin is an art historian and lawyer and an amateur art detective. Web in accounting, an owner's draw is when an accountant withdraws funds from a drawing account to provide the business owner with personal income. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. Web an owner's draw is how the owner of a sole proprietorship, or one of the partners in a partnership, can take money from the company if needed. This is a contra equity account that is paired with and offsets the owner's capital account. Make sure your business is profitable.

Custom Pet and Owner Portrait Dog Cartoon Cute Illustration Etsy

Owners Drawing at Explore collection of Owners Drawing

Custom Pet and Owner Portrait Dog Cartoon Cute Illustration Etsy

Custom Pet and Owner Portrait Dog Cartoon Cute Illustration Drawing

A Dog and Owner Drawings Make Thoughtful Gifts

Owners Draw

Dog and Owner Portrait Custom Line Drawing From Photo Line Etsy UK

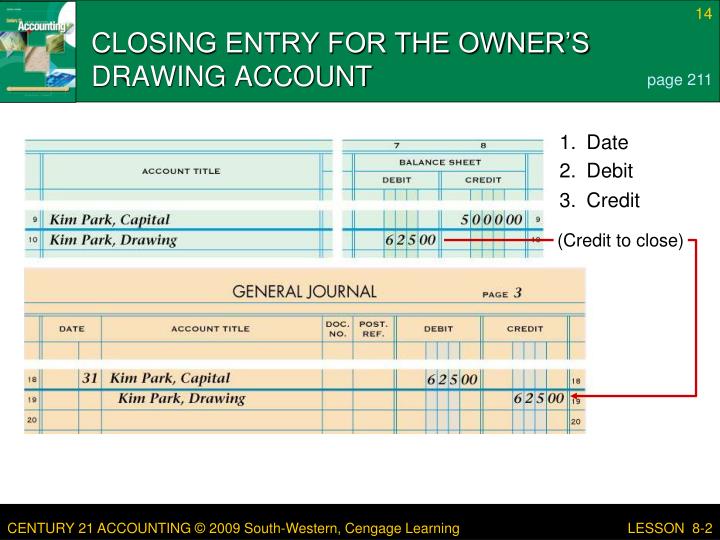

What Is an Owner's Draw? Definition, How to Record, & More

Single continuous line drawing of two young happy business owner

Owners Drawing at Explore collection of Owners Drawing

This Method Of Payment Is Common Across Various Business Structures Such As Sole Proprietorships, Partnerships, Limited Liability Companies (Llcs), And S Corporations.

David Bernsen, Tony Holmes, Michael Holmes, Norevale Farm (Leo And Sarah Dooley).

Here Are Some General Rules For Taking An Owner's Draw:

Jan 26, 2018 • 4 Minutes.

Related Post: