S Corp Owners Draw

S Corp Owners Draw - This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. A draw lowers the owner's equity in the business. It opened its first park, the red park, at 354 jiangchuan road in july 1960. Its residents' per capita disposable income in 2021 surpassed 80,000 yuan. Web we provide a full range of integrated services in the semiconductor, optoelectronics, and other advanced technology industries. However, anytime you take a draw, you reduce the value of your business by the amount you take out. How an owner’s draw affects taxes. Web the primary method to reduce taxes as an s corporation owner is setting the right salary. Do you have to pay taxes on owner’s draw? Its forest coverage rate is 18.3 percent. They have different tax implications and are reserved for different types of businesses. Web an owner's draw is an amount of money an owner takes out of a business, usually by writing a check. Web also sometimes referred to as a draw, an owner’s draw is where you as the owner of your business takes a certain amount of money. Reduce your basis (ownership interest) in the company because they are equity transactions on. Aim for a salary sweet spot that is both high enough to appease the irs and avoid audits, but low enough. Minhang now has 126 parks and its park land and green space per capita has reached 10.65 square meters. Do you have to pay taxes. Proven customer successview company personasget a free trial24 hr free trial However, corporation owners can use salaries and dividend distributions to pay themselves. Web in an s corp, the owner’s salary is considered a business expense, just like paying any other employee. An owner’s draw is not taxable on the business’s income. Web an owner’s draw is simply a distribution. You qualify for the 20% deduction only if your total taxable income for the year is less than $157,500 (single) or $315,000 (married, filing jointly). Web also sometimes referred to as a draw, an owner’s draw is where you as the owner of your business takes a certain amount of money from your business, so that you can use it. As the owner, you can choose to take a draw if your personal equity in the business is more than the business’s liabilities. Its residents' per capita disposable income in 2021 surpassed 80,000 yuan. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). An owner of a. Payroll software can help you distribute salaries to s corp owners and employees. Aim for a salary sweet spot that is both high enough to appease the irs and avoid audits, but low enough. A salary payment is a fixed amount of pay at a set interval, similar to any other type of employee. It is vital to note that. Its forest coverage rate is 18.3 percent. It is vital to note that an owner’s draw differs from a salary. However, anytime you take a draw, you reduce the value of your business by the amount you take out. An owner of a c corporation may not. How does an owner’s draw work based on type of business? As the owner, you can choose to take a draw if your personal equity in the business is more than the business’s liabilities. Are usually either for estimated taxes, due to a specific event, or from business growth. It opened its first park, the red park, at 354 jiangchuan road in july 1960. Some of these districts are much more. An owner’s draw is not taxable on the business’s income. Convinced the draw method is for you? The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). Some of these districts are much more popular with expats than others. But how do you know which one (or both). It opened its first park, the red park, at 354 jiangchuan road in july 1960. Do you have to pay taxes on owner’s draw? Web an owner's draw is an amount of money an owner takes out of a business, usually by writing a check. However, a draw is taxable as income on the owner’s personal tax return. An owner’s. How does an owner’s draw work based on type of business? Proven customer successview company personasget a free trial24 hr free trial I'll ensure your owner withdrawals are correctly recorded in quickbooks. Web two basic methods exist for how to pay yourself as a business owner: This method of payment is common across various business structures such as sole proprietorships, partnerships, limited liability companies (llcs), and s corporations. Some of these districts are much more popular with expats than others. Aim for a salary sweet spot that is both high enough to appease the irs and avoid audits, but low enough. The company typically makes the distribution in cash, and it is not subject to payroll taxes (such as social security and medicare). An owner’s draw is not taxable on the business’s income. They have different tax implications and are reserved for different types of businesses. An owner of a sole proprietorship, partnership, llc, or s corporation may take an owner's draw; It opened its first park, the red park, at 354 jiangchuan road in july 1960. As the owner, you can choose to take a draw if your personal equity in the business is more than the business’s liabilities. Let’s see if we can draw you in a little further. Web the primary method to reduce taxes as an s corporation owner is setting the right salary. Its forest coverage rate is 18.3 percent.

Why to Form the Scorporation? Everything You Need to Know About the

💰 Should I Take an Owner's Draw or Salary in an S Corp? Hourly, Inc.

How Scorp owners can deduct health insurance

owner's drawing account definition and Business Accounting

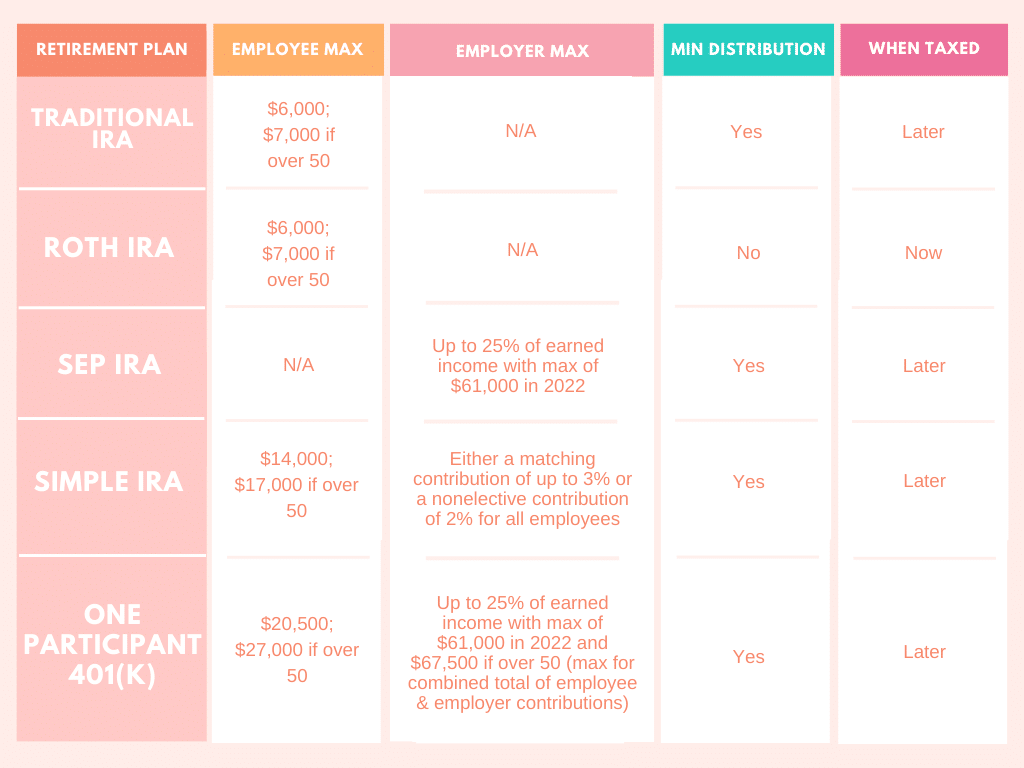

Retirement Account Options for the SCorp Owner

.png)

Reasonable salaries What every S corp owner needs to know Finaloop

I own an SCorp, how do I get paid? ClearPath Advisors

How do SCorp owners pay Themselves and what is Deductible? EPGD

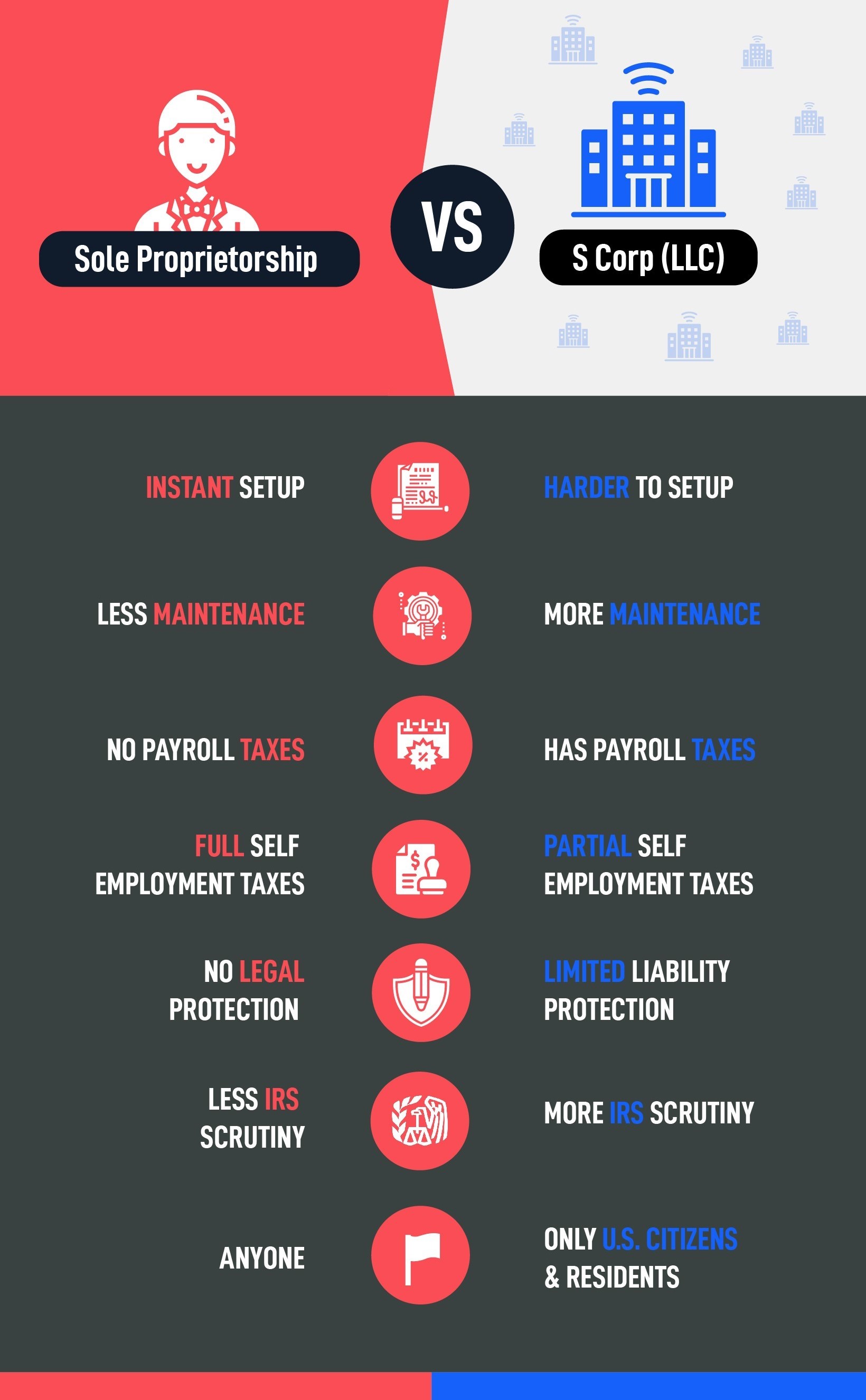

S Corp vs Sole Proprietorship Pros & Cons (Infographic 🆚)

Owner Draw Quickbooks Scorp DRAWING IDEAS

The Park Was A Combination Of Some Greenbelt From Shanghai Steam Turbine Factory, A Primary School And Some Farmland.

This Could Be Taken As A Single Sum, Or Set Up As A Regular Payment.

Web The District Is Also Improving Its Employment And Social Insurance System, While Strengthening Its Elderly Care Service.

Web Since An S Corp Is Structured As A Corporation (Which Is A Legal Entity In Its Own Right), The Profits Belong To The Corporation And Owner's Draws Are Not Available To Owners Of An S Corp.

Related Post: