Special Drawing Rights Imf

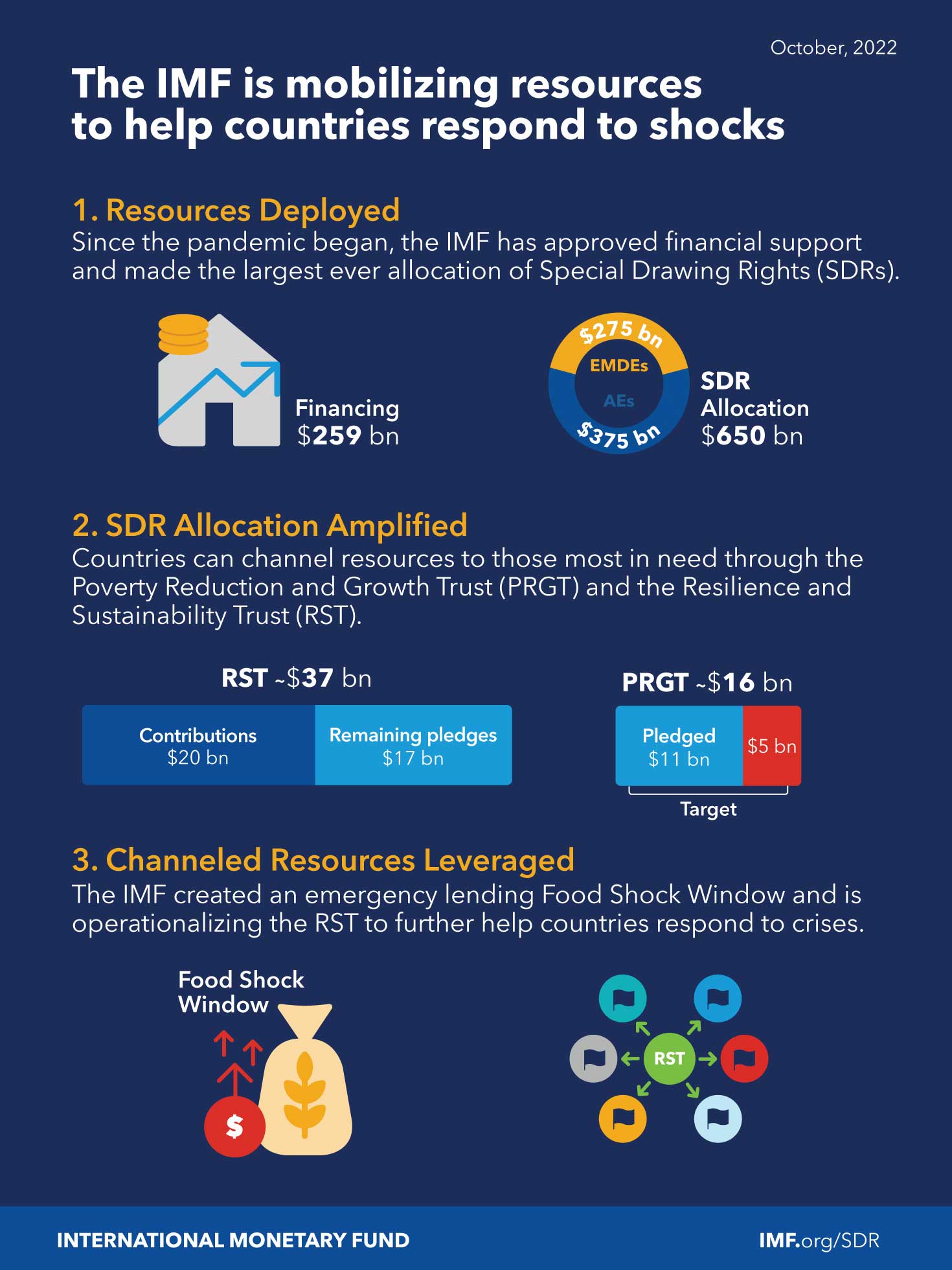

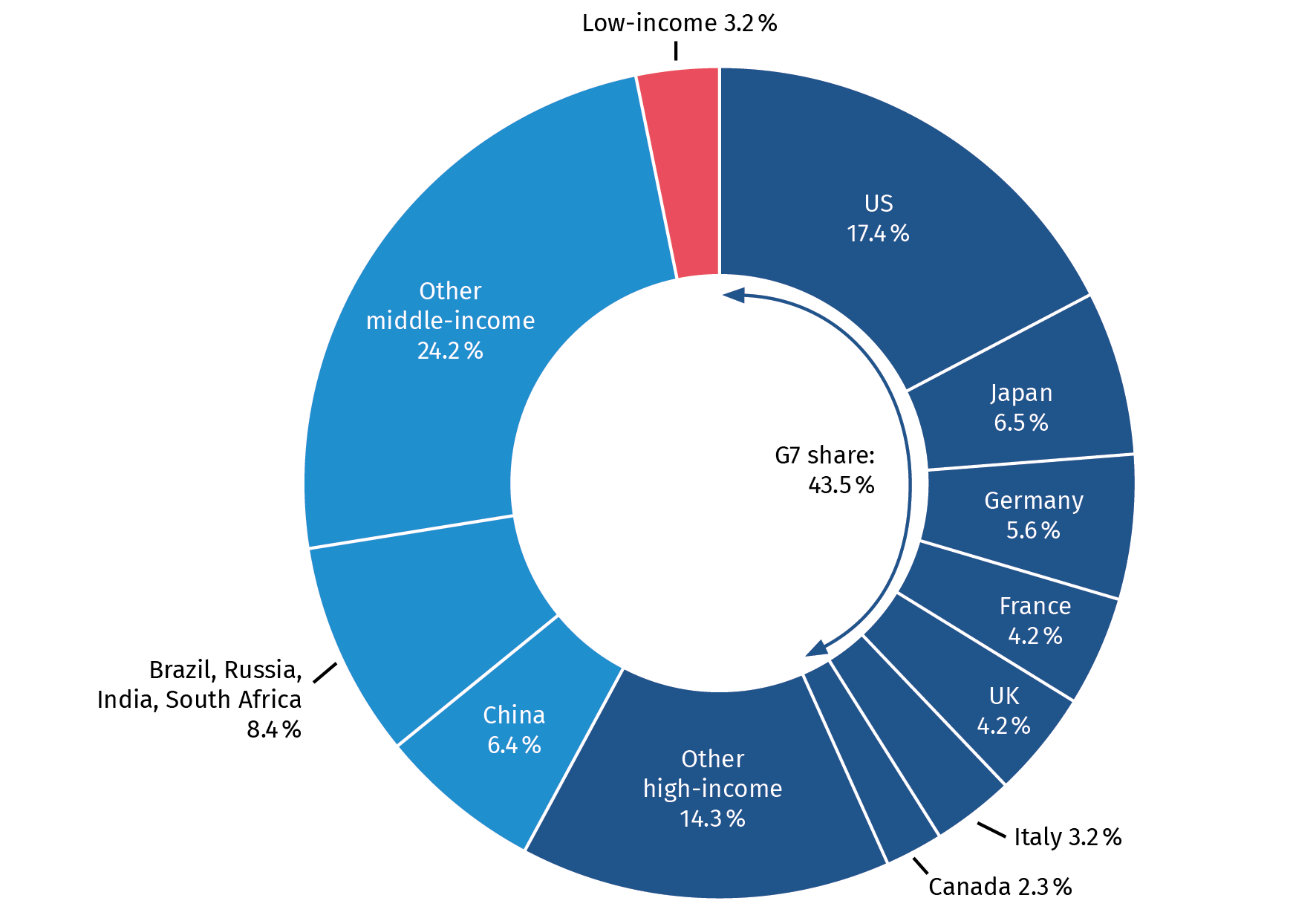

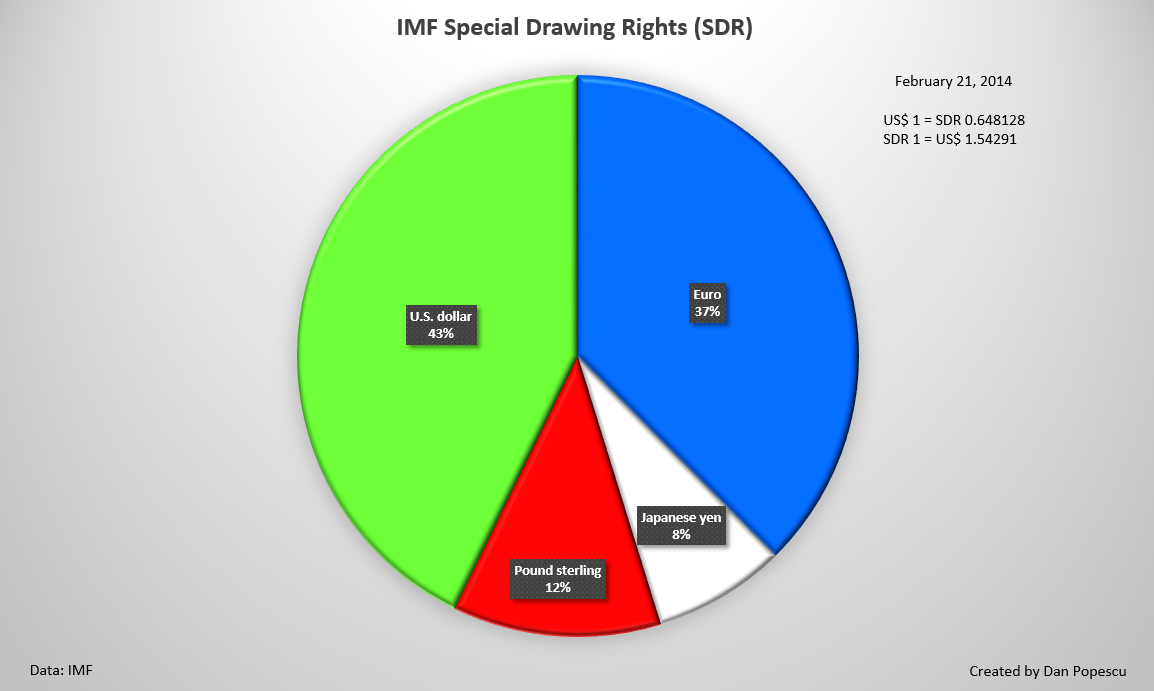

Special Drawing Rights Imf - This report follows up on the impact of the allocation for the global economy. They represent a claim to currency held by imf member countries for which they may be exchanged. Web special drawing rights, or s.d.r.s, were created in the 1960s and are essentially a line of credit that can be cashed in for hard currency by member countries of the i.m.f. It argues that structural adjustment, measured by the number of adjustment loans from the imf and world bank, reduces the sensitivity of poverty reduction to the rate of growth. Dollar, japanese yen, euro, pound sterling and chinese renminbi. Web special drawing rights (sdr) sdr info hub. What is the purpose of the sdr? Web the currency value of the sdr is determined by summing the values in u.s. Dollars, based on market exchange rates, of a basket of major currencies (the u.s. The sdr is an international reserve asset created by the imf to supplement the official reserves of its member countries. Web on october 1, 2016, the international monetary fund (imf) added the chinese renminbi (referred to as the “yuan” when it is used as a unit of account) to the currencies that comprise its special drawing rights (sdr) basket.1 the value of an sdr is determined by the values of the currencies and their weights in the. Web a general. Why look at sdr rechannelling for food security. Use of special drawing rights to acquire currency and to repay international monetary fund debt. Web this chapter examines the impact of the structural adjustment programs of the international monetary fund (imf) and the world bank on poverty reduction. Dollar, euro, japanese yen, pound sterling and the chinese renminbi). Web a general. The sdr allocation is based on the imf’s quota. To deal with the inability of the existing system to create an adequate quantity of reserves without requiring the united states to run large deficits, a new kind of reserve called special drawing rights (sdrs) was devised by the international monetary fund. Dollars, based on market exchange rates, of a basket. Web special drawing rights (sdr) refer to an international type of monetary reserve currency created by the international monetary fund (imf) in 1969. Web the quotas are increased periodically as a means of boosting the imf's resources in the form of special drawing rights. Web special drawing rights (sdr) english. Web special drawing rights, or s.d.r.s, were created in the. Web the bottom line. Gallagher professor and director of the. They represent a claim to currency held by imf member countries for which they may be exchanged. Web in august 2021, the imf’s board of governors (bog) approved a historic general allocation of special drawing rights (sdr) equivalent to usd 650 billion. Web this chapter examines the impact of the. Why look at sdr rechannelling for food security. This report follows up on the impact of the allocation for the global economy. Web special drawing rights (sdr) english. Web abstract on july 28, 1969 the amendment of the articles of agreement of the international monetary fund took effect, and on august 6, 1969 the special drawing account came into being.. Sdrs are units of account for the imf, and not a currency per se. Web in august 2021, the imf’s board of governors (bog) approved a historic general allocation of special drawing rights (sdr) equivalent to usd 650 billion. Web special drawing rights (sdr) english. The board of governors of the imf has approved a general allocation of special drawing. The board of governors of the imf has approved a general allocation of special drawing rights (sdrs) equivalent to us$650 billion (about sdr 456 billion) on august 2, 2021, to boost global liquidity. [14] the current managing director (md) and chairwoman of the imf is bulgarian economist kristalina georgieva,. Web an allocation of imf special drawing rights (sdrs) would help. The sdr is based on a basket of international currencies comprising the u.s. Use of special drawing rights for fiscal purposes in africa. Why look at sdr rechannelling for food security. Dollars, based on market exchange rates, of a basket of major currencies (the u.s. Use of special drawing rights to acquire currency and to repay international monetary fund debt. Web the currency value of the sdr is determined by summing the values in u.s. Special drawing rights are a world reserve asset whose value is based on a basket of four major international currencies. Web in august 2021, the imf’s board of governors (bog) approved a historic general allocation of special drawing rights (sdr) equivalent to usd 650 billion.. The sdr is not a currency, but its value is based on a basket of five currencies—the us dollar, the euro, the chinese renminbi, the japanese yen, and the british pound sterling. Web the quotas are increased periodically as a means of boosting the imf's resources in the form of special drawing rights. Gallagher professor and director of the. Web in august 2021, the imf’s board of governors (bog) approved a historic general allocation of special drawing rights (sdr) equivalent to usd 650 billion. The sdr allocation is based on the imf’s quota. Web the bottom line. Web special drawing rights, or s.d.r.s, were created in the 1960s and are essentially a line of credit that can be cashed in for hard currency by member countries of the i.m.f. The sdr is based on a basket of international currencies comprising the u.s. What lessons have been learned from the use of special drawing rights? The sdr is an international reserve asset created by the imf to supplement the official reserves of its member countries. Web on monday, imf member countries start receiving their shares of the new $650bn special drawing rights allocation — the largest in the fund’s history. Web special drawing rights (sdr) sdr info hub. On october 3, 1969 the board of governors decided that a total of special drawing rights equivalent to approximately $9.5 billion would be allocated during the period of. Web imf special drawing rights: Plot and compare country data. The sdr currency value is calculated daily except on imf holidays, or whenever the imf is closed for business, or.

International Fund (IMF) What is IMF SDR What is Special

Special Contribution 1.5 IMF Special Drawing Rights a historic

Chart of the week IMF Special Drawing Rights ICAEW

Special Drawing Rights can help developing countries to build back greener

Special Drawing Rights

Special Drawing Rights (SDR)

BUSINESS IMF’s special drawing rights infographic

sdr ppt. Special Drawing Rights International Fund

Gold And The Special Drawing Rights (SDR) 1969Present

Special Drawing rights IMF YouTube

Use Of Special Drawing Rights To Acquire Currency And To Repay International Monetary Fund Debt.

Web A General Allocation Of Special Drawing Rights (Sdrs) Equivalent To About Us$650 Billion Became Effective On August 23, 2021.

Web Special Drawing Rights (Sdrs, Code Xdr) Are Supplementary Foreign Exchange Reserve Assets Defined And Maintained By The International Monetary Fund (Imf).

Web On October 1, 2016, The International Monetary Fund (Imf) Added The Chinese Renminbi (Referred To As The “Yuan” When It Is Used As A Unit Of Account) To The Currencies That Comprise Its Special Drawing Rights (Sdr) Basket.1 The Value Of An Sdr Is Determined By The Values Of The Currencies And Their Weights In The.

Related Post: