What Age Can I Draw From Ira

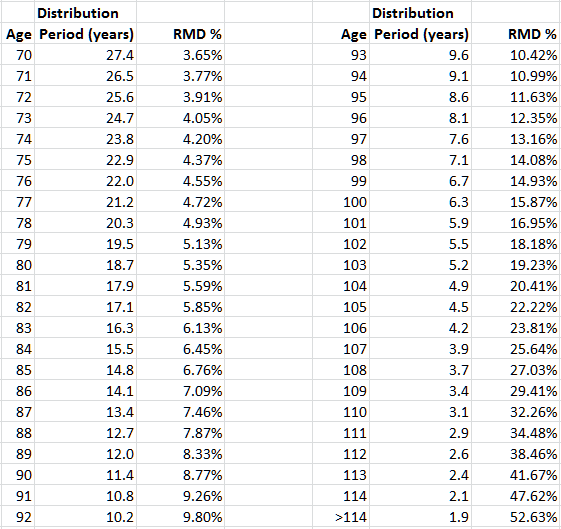

What Age Can I Draw From Ira - You can withdraw money any time after age 59½, but you’ll need to pay income taxes on part or all of any ira withdrawals you make. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. You can withdraw roth individual retirement account (ira) contributions at any time. Web generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in gross income plus a 10 percent. Generally you’ll owe income taxes and a 10% penalty if you withdraw earnings from your. If you withdraw roth ira earnings before age 59½, a. It had previously been raised from 70 1/2 to 72. Web you are required to make minimum withdrawals from traditional iras once you reach age 73. Web if you're younger than 59½ and the account is less than 5 years old. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. But you need to know what to expect from the irs. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. You can reduce taxes by sending. Web age 59 ½ and under. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. But you need to know what to expect from the irs. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. Low cost online brokerscompare ira. There is no need to show a hardship to take a distribution. You can reduce taxes by sending required minimum distributions to a. If you withdraw roth ira earnings before age 59½, a. Web age 59 ½ and under. But you need to know what to expect from the irs. Web you have to pay a 10% additional tax on the taxable amount you withdraw from your simple ira if you are under age 59½ when you withdraw the money unless you. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still. Web generally, early. There is no need to show a hardship to take a distribution. The rules impose penalties for taking money out before age 59. Generally you’ll owe income taxes and a 10% penalty if you withdraw earnings from your. Web in particular, the secure act 2.0 raised the rmd age from 72 to 73 for those who turn 72 in 2023.. But you need to know what to expect from the irs. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still. You can withdraw roth individual retirement account (ira) contributions at any time. Web once you reach age 59½, you can withdraw funds from your. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a. Web in particular, the secure act 2.0 raised the rmd age from 72 to 73 for those who turn 72 in 2023. Generally you’ll owe income taxes and. However, you may have to pay taxes and penalties on earnings in. Web if you're 59 ½ or older: Web are you under age 59 ½ and want to take an ira withdrawal? Yes, you can withdraw money early for unexpected needs. You can withdraw roth individual retirement account (ira) contributions at any time. In addition, with a roth ira, you'll pay no. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. Web age 59 ½ and under. Generally you’ll owe income taxes and a 10% penalty if you withdraw earnings from your. Web at age 73 (for people born between 1951 and. Web generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in gross income plus a 10 percent. Web you are required to make minimum withdrawals from traditional iras once you reach age 73. But you'll still owe the income tax if it's a traditional ira. Yes, you can withdraw money early. Web you are required to make minimum withdrawals from traditional iras once you reach age 73. The rmd rules require individuals to take withdrawals from their iras (including simple iras and sep iras) every year once they reach age 72 (73 if the. Web at age 73 (for people born between 1951 and 1959) and age 75 (born in 1960 or later), you are required to withdraw money from every type of ira but a. Generally you’ll owe income taxes and a 10% penalty if you withdraw earnings from your. Web you have to pay a 10% additional tax on the taxable amount you withdraw from your simple ira if you are under age 59½ when you withdraw the money unless you. If you withdraw roth ira earnings before age 59½, a. It had previously been raised from 70 1/2 to 72. The standard age to avoid penalties for an early withdrawal from either a traditional ira or roth ira is age 59½. The rules impose penalties for taking money out before age 59. Web once you reach age 73 you are required to take annual required minimum distributions (rmds) from your retirement accounts. The age to avoid early withdrawal penalties. But you'll still owe the income tax if it's a traditional ira. Web are you under age 59 ½ and want to take an ira withdrawal? You can withdraw roth individual retirement account (ira) contributions at any time. The rmd rules require traditional ira, and sep, sarsep, and simple ira account holders to begin taking distributions at age 72, even if they're still. Are you over age 59 ½ and want to withdraw?

Step by Step How to Draw Ira from 11eyes

What is a Traditional IRA Edward Jones

How To Draw Ira 如何画艾勒 YouTube

Step by Step How to Draw Ira from 11eyes

Worksheet of IRA Deduction Tax 2023 YouTube

Learn How to Draw Ira Fingerman from Harvey Beaks (Harvey Beaks) Step

Drawing Down Your IRA What You Can Expect Seeking Alpha

How to Draw Ira from 11eyes (11eyes) Step by Step

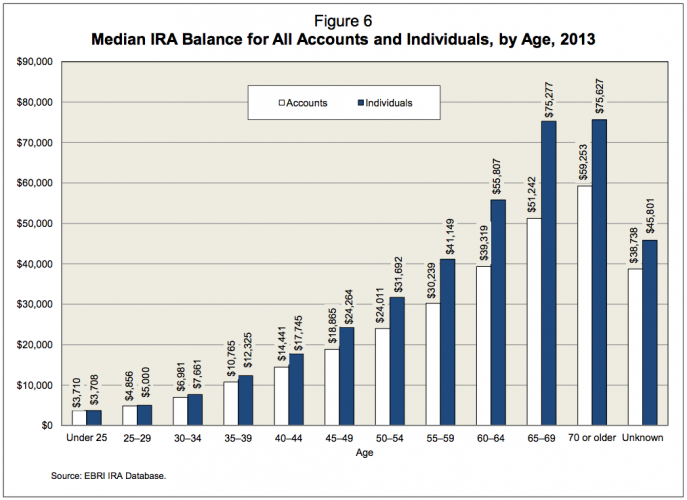

How Much Should I Have Saved In My Traditional IRA At Various Ages?

Learn How to Draw Ira Fingerman from Harvey Beaks (Harvey Beaks) Step

Web If You're 59 ½ Or Older:

However, You May Have To Pay Taxes And Penalties On Earnings In.

Web If You're Younger Than 59½ And The Account Is Less Than 5 Years Old.

You Can Reduce Taxes By Sending Required Minimum Distributions To A.

Related Post: