What Age Can I Draw From My 401K

What Age Can I Draw From My 401K - Sign up for fidelity viewpoints weekly email for our latest insights. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Web age 59½ is the earliest you can withdraw funds from an ira account and pay no penalty. As a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. Web there is no way to take a distribution from a 401 (k) without owing income taxes at the rate you’re paying the year you take the distribution. Web under particular circumstances, you can withdraw from a 401(k) between 55 and 59½ without being penalized. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Web also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the irs exceptions. When it comes to when you can withdraw 401(k) funds, age 59½ is the magic number. You can't start taking distributions from your 401 (k) and avoid the early withdrawal penalty once you reach 55. April 13, 2022, at 5:34 p.m. Web still, knowing where your peers stand can help you gauge your own progress and tell you if you should be doing more. However, you can apply the irs rule of 55 if you're older and leave your job. Check out insider's guide to the best retirement plans>> how to apply. Web the terms. With the rule of 55, those who leave a job in the year they turn 55 or later can remove funds from that employer’s 401 (k). As a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. For 2024, you can’t put more than $7,000 into a roth, plus another $1,000. Web the rule of 55 doesn't apply if you left your job at, say, age 53. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Most plans allow participants to withdraw funds from their 401 (k) at age 59 ½ without incurring a 10% early withdrawal tax penalty. Account owners can delay taking. Except in special cases, you can’t take a distribution from your plan at all until you’ve reached age 59.5. Web there is no way to take a distribution from a 401 (k) without owing income taxes at the rate you’re paying the year you take the distribution. You can make a 401 (k) withdrawal at any age, but doing so. Check out insider's guide to the best retirement plans>> how to apply. Web you reach age 59½ or experience a financial hardship. Beginning in 2023, the secure 2.0 act raised the age that you must begin taking rmds to age 73. Web first, let’s recap: Web reviewed by emily brandon. Web under particular circumstances, you can withdraw from a 401(k) between 55 and 59½ without being penalized. Web still, knowing where your peers stand can help you gauge your own progress and tell you if you should be doing more. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe. In. However, you can apply the irs rule of 55 if you're older and leave your job. Beginning in 2023, the secure 2.0 act raised the age that you must begin taking rmds to age 73. In addition, your modified adjusted gross income must be less than $146,000 to $161,000 (for single filers) or $230,000 to $240,000. Web if you can. Written by javier simon, cepf®. Account owners can delay taking their first rmd until april 1 following the later of the calendar year they reach age 72 or, in a workplace retirement plan, retire. That’s the age that serves as a cutoff for having to pay early. When it comes to when you can withdraw 401(k) funds, age 59½ is. Web age 59½ is the earliest you can withdraw funds from an ira account and pay no penalty. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Web you can generally take 401(k) withdrawals before age 59½ if you become disabled, you have. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025. Web you can generally take 401(k) withdrawals before age 59½ if you become disabled, you have a severance from employment, your. Sign up for fidelity viewpoints weekly email for our latest insights. Written by javier simon, cepf®. Web also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the irs exceptions. Web first, let’s recap: Check out insider's guide to the best retirement plans>> how to apply. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe. Web required minimum distributions, or rmds, are minimum amounts that many retirement plan and ira account owners must generally withdraw annually after they reach age 72. Web the median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to data from fidelity investments, the nation’s largest 401 (k) provider. Web you reach age 59½ or experience a financial hardship. Periodic, such as annuity or installment payments. Web under particular circumstances, you can withdraw from a 401(k) between 55 and 59½ without being penalized. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025. With the rule of 55, those who leave a job in the year they turn 55 or later can remove funds from that employer’s 401 (k). With a 401 (k) loan, you borrow money from your retirement savings account. In certain circumstances, the plan administrator must obtain your consent before making a distribution. Web the rule of 55 doesn't apply if you left your job at, say, age 53.

at what age do you have to take minimum distribution from a 401k Hoag

When Can I Draw From My 401k Men's Complete Life 401k, Canning, I can

When Can I Draw From My 401k Men's Complete Life

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

The Average And Median 401(k) Account Balance By Age

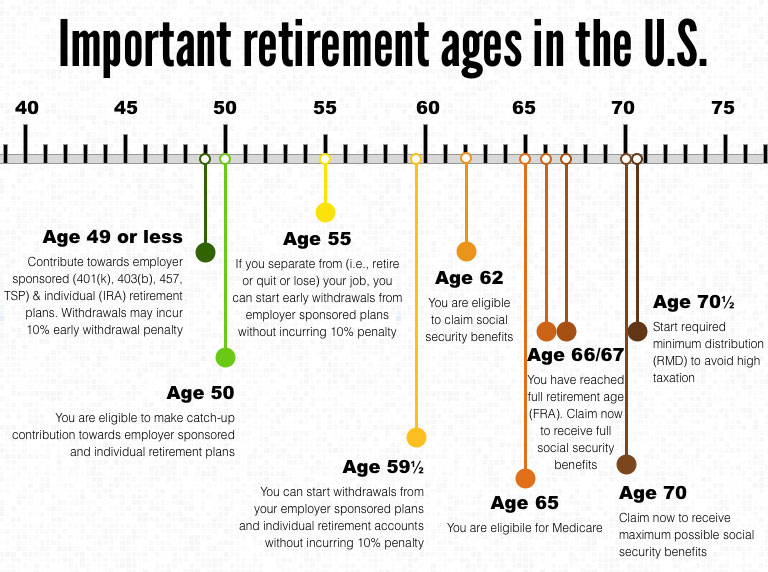

Important ages for retirement savings, benefits and withdrawals 401k

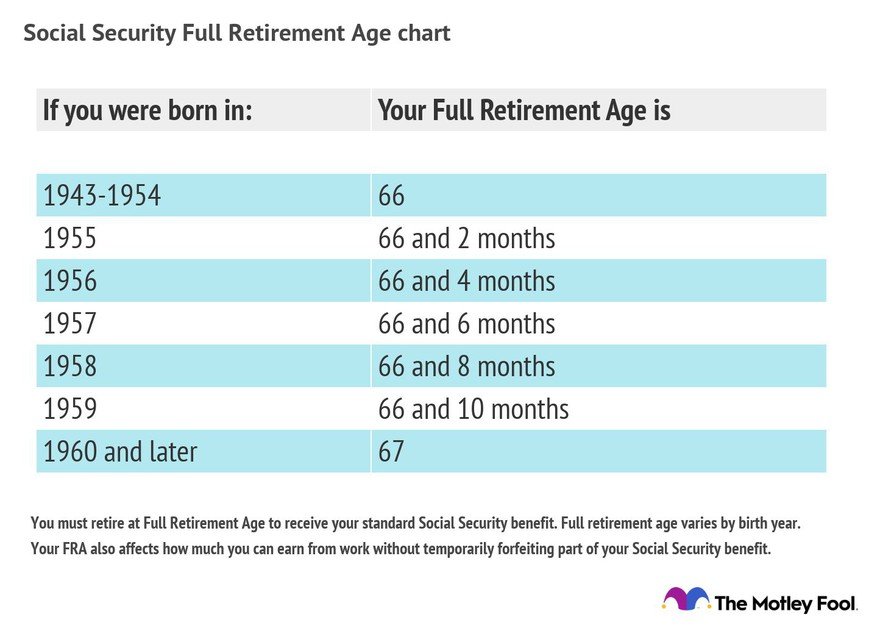

What Is My Full Retirement Age for Maximum Social Security?

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

Why The Median 401(k) Retirement Balance By Age Is So Low

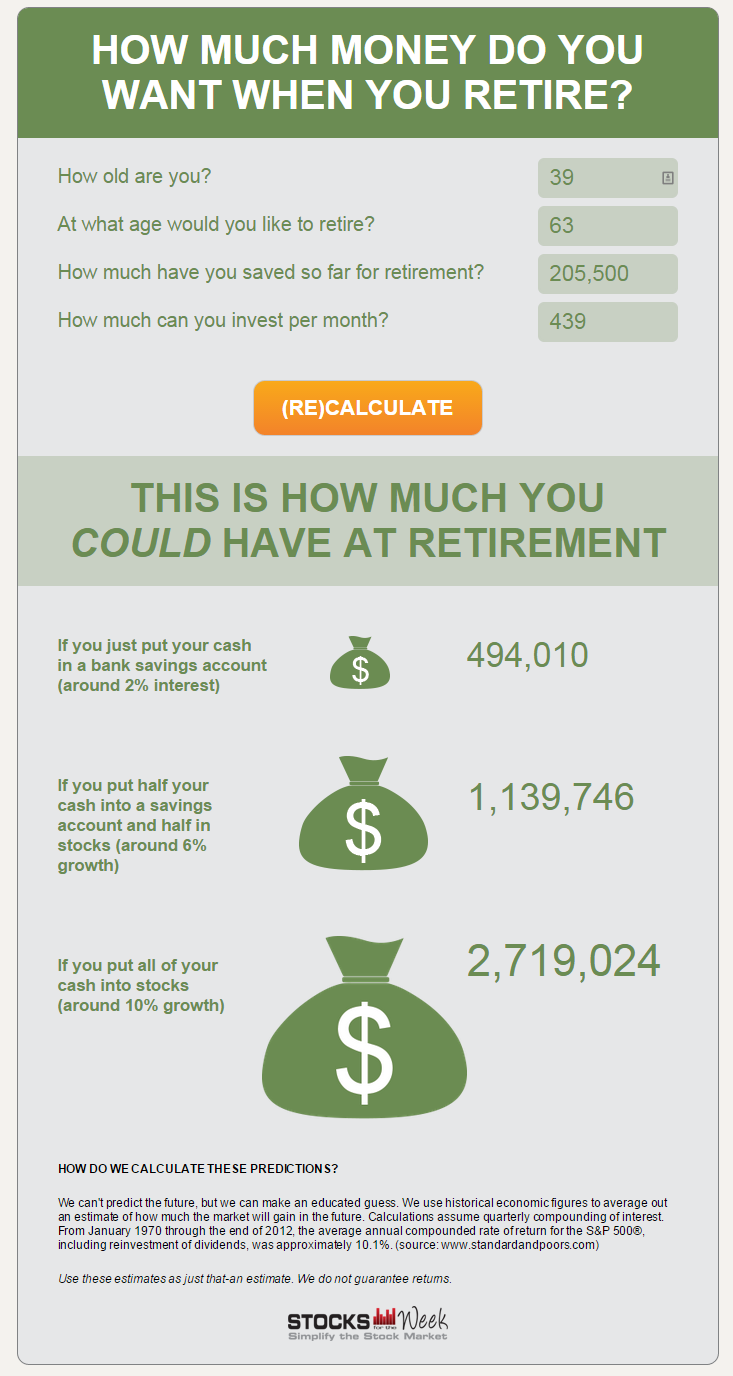

How to Estimate How Much Your 401k will be Worth at Retirement

A 401 (K) Early Withdrawal Is Any Money You Take Out From Your Retirement Account Before You’ve Reached Federal Retirement Age, Which Is Currently 59 ½.

If You Tap Into It Beforehand, You May Face A 10% Penalty Tax On The Withdrawal In Addition To Income Tax That You’d Owe On Any Type Of Withdrawal From A Traditional 401 (K).

That’s The Age That Serves As A Cutoff For Having To Pay Early.

Web Age 59½ Is The Earliest You Can Withdraw Funds From An Ira Account And Pay No Penalty.

Related Post: