What Age Can You Draw Your 401K

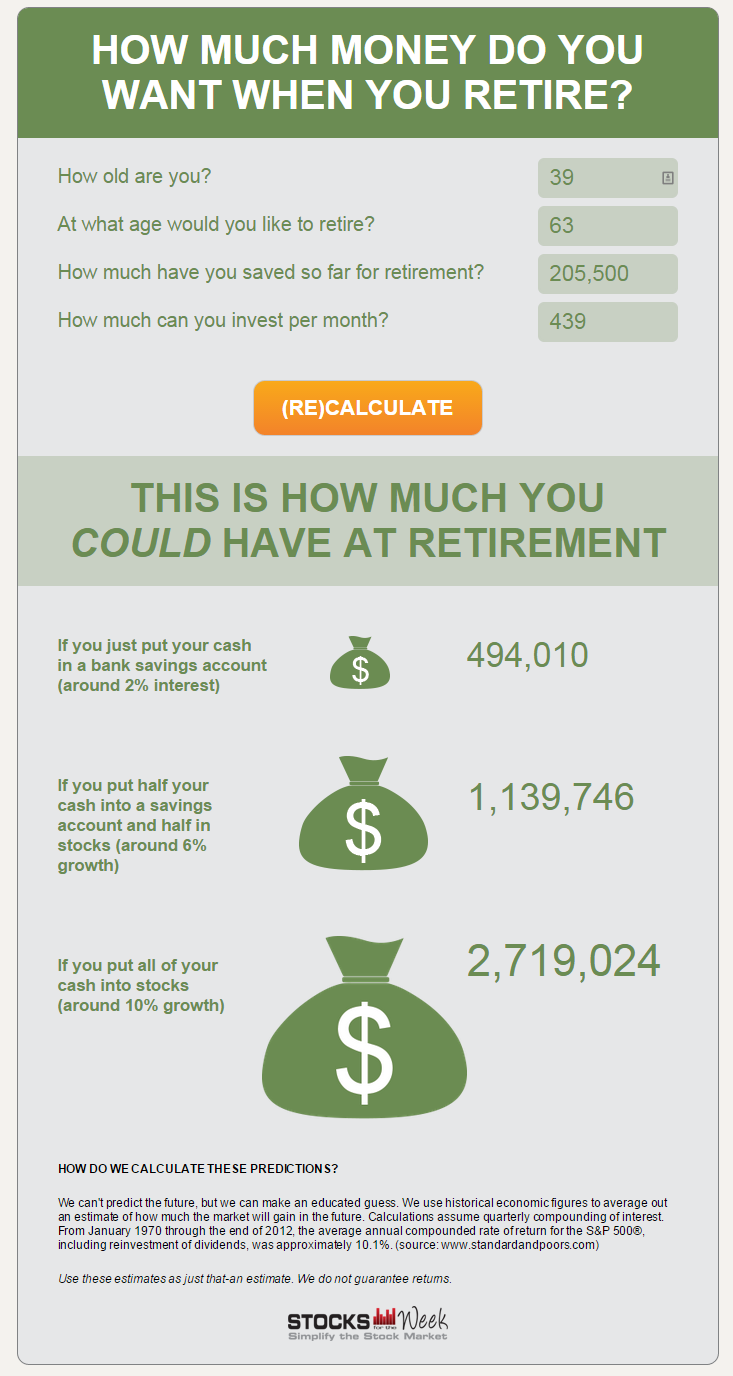

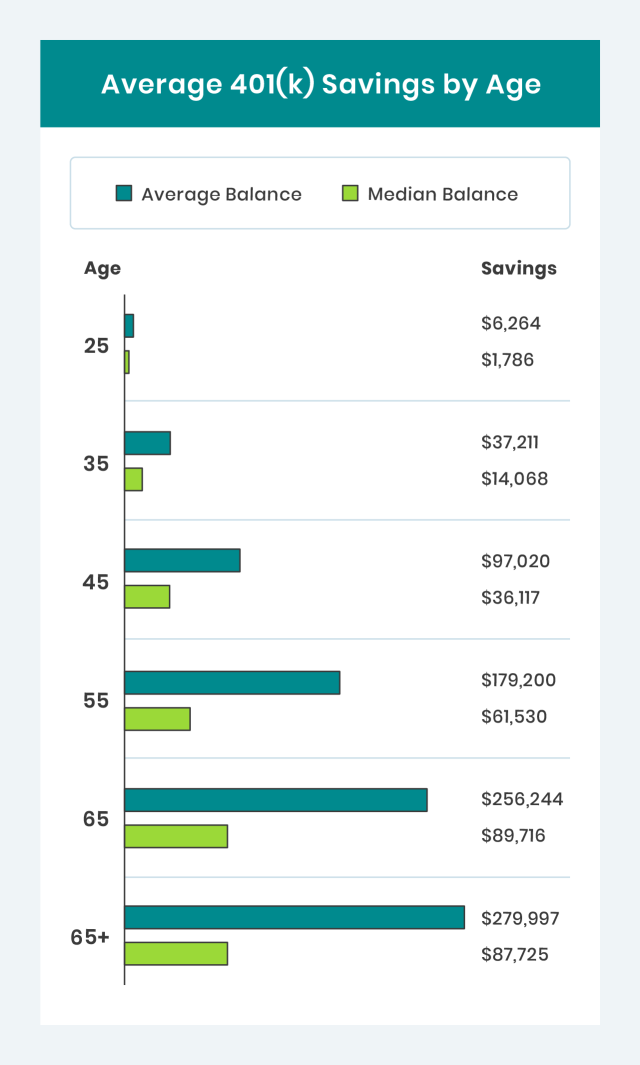

What Age Can You Draw Your 401K - Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. Turn age 59 1/2 (even if still employed); A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Use raises or bonuses as. Web in 2024, you can contribute a maximum of $23,000 in your 401(k), plus an additional $7,500 if you're age 50 or older. Scroll the section below that correlates with your age, and you’ll find the rules applicable to you. This is known as the rule of 55. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. April 13, 2022, at 5:34 p.m. Web the terms of roth 401 (k) accounts also stipulate that required minimum distributions (rmds) must begin by age 73, or age 70½ if you reached that age by jan. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. Web and if you withdraw money from your 401 (k) prior to age 59½, not only will you have to pay taxes, you’ll typically also be hit with a 10 percent penalty. Some reasons. You’re not age 55 yet. This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a.; While there are typically penalties for withdrawing funds prior to retirement age, a hardship withdrawal allows certain individuals to access specific funds within retirement accounts without. Scroll the section below that correlates with your age, and you’ll find the. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). When it comes to when you can withdraw 401(k) funds, age 59½ is the magic number. In most, but not all, circumstances, this triggers an early. Turn age 59 1/2 (even if still employed); In certain circumstances, the plan administrator must obtain your consent before making a distribution. Depending on the terms of the plan, distributions may be: Check with your employer to see whether you're allowed to withdraw from your 401(k) while working. Web and if you withdraw money from your 401 (k) prior to. Web if your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. A penalty tax usually applies to. Web you reach age 59½ or experience a financial hardship. Explore all your options for getting cash before tapping your 401 (k) savings. You’re not age 55 yet. Web reviewed by emily brandon. Web can you withdraw money from a 401(k) plan? In most, but not all, circumstances, this triggers an early withdrawal penalty of. Web understanding early withdrawals. It’s even harder to tap 401 (k) funds without paying regular income tax. Web a 401 (k) hardship withdrawal is the process of accessing funds in your workplace 401 (k) account before retirement age (currently age 59 ½). However, there are strategies for getting access to funds without triggering distribution taxes and penalties. It depends on your age. Scroll the section below that correlates with your age, and you’ll find the rules applicable. Web understanding early withdrawals. Web for 2023, the age at which account owners must start taking required minimum distributions goes up from age 72 to age 73, so individuals born in 1951 must receive their first required minimum distribution by april 1, 2025. Web you can generally take 401(k) withdrawals before age 59½ if you become disabled, you have a. It depends on your age. Web however, you may need to take some proactive steps in order to retire comfortably. When it comes to when you can withdraw 401(k) funds, age 59½ is the magic number. Web the terms of roth 401 (k) accounts also stipulate that required minimum distributions (rmds) must begin by age 73, or age 70½ if. Web a 401 (k) hardship withdrawal is the process of accessing funds in your workplace 401 (k) account before retirement age (currently age 59 ½). However, there are strategies for getting access to funds without triggering distribution taxes and penalties. Web the terms of roth 401 (k) accounts also stipulate that required minimum distributions (rmds) must begin by age 73,. Web to take advantage of this, consumers need to add a line to their monthly budget for retirement savings or “pay themselves first.”. Web if your employer allows it, it’s possible to get money out of a 401 (k) plan before age 59½. Web as a general rule, if you withdraw funds before age 59 ½, you’ll trigger an irs tax penalty of 10%. With the rule of 55, those who leave a job in the year they turn 55 or later can remove funds from that employer’s 401. Web a 401 (k) hardship withdrawal is the process of accessing funds in your workplace 401 (k) account before retirement age (currently age 59 ½). Web in 2024, you can contribute a maximum of $23,000 in your 401(k), plus an additional $7,500 if you're age 50 or older. That's the limit set by federal law, but keep in mind that your situation could be complicated if you continue working into your 60s. Web however, you may need to take some proactive steps in order to retire comfortably. This year, you can contribute up to $23,000 to a 401(k) and $7,000 to an i.r.a.; The median 401 (k) balance for americans ages 40 to 49 is $38,600 as of the fourth quarter of 2023, according to. Early withdrawals occur if you receive money from a 401 (k) before age 59 1/2. If you need funds, you may be able to tap into your 401 (k) funds without penalty, even if you're under 59½. Web reviewed by emily brandon. Web you can generally take 401(k) withdrawals before age 59½ if you become disabled, you have a severance from employment, your 401(k) plan is terminated or you experience financial hardship. The good news is that there’s a way to take your distributions a few years early without incurring this penalty. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½.

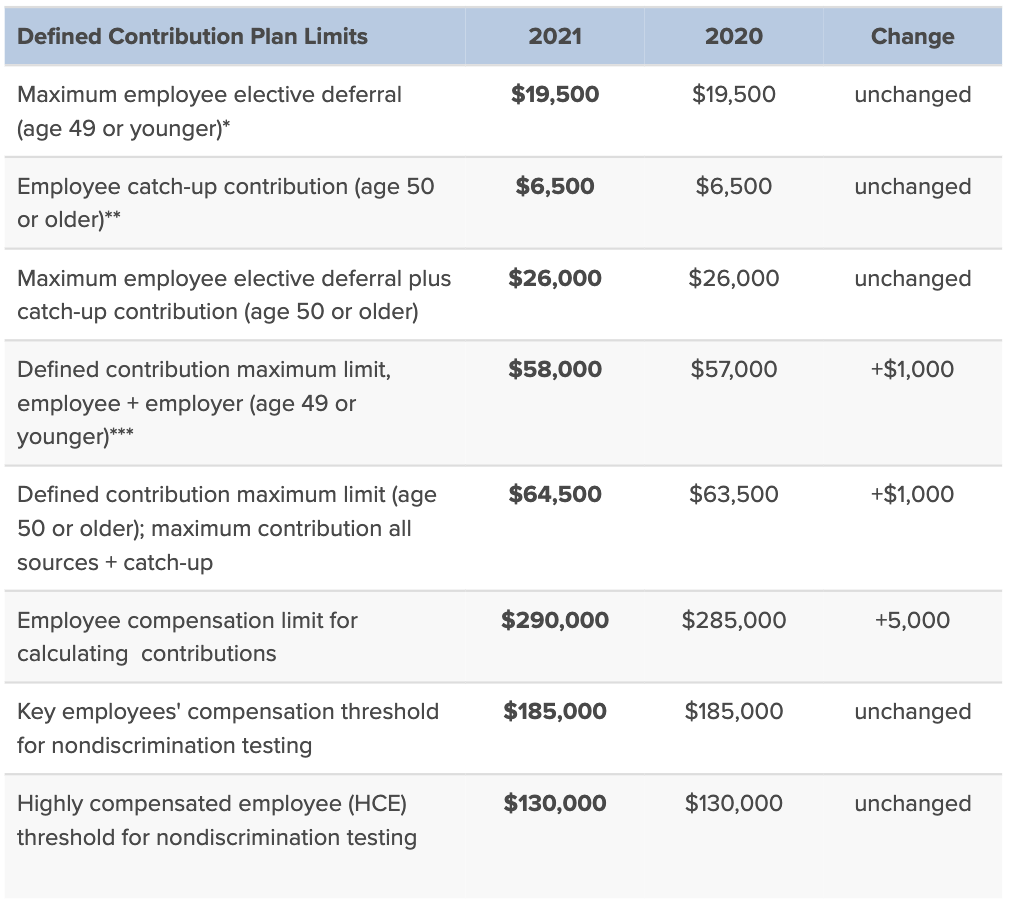

The Average And Median 401(k) Account Balance By Age

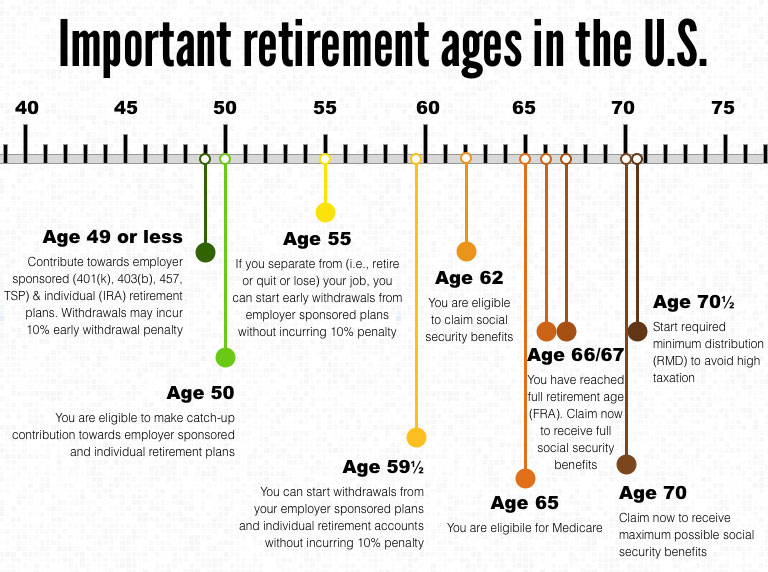

Important ages for retirement savings, benefits and withdrawals 401k

401k Savings By Age How Much Should You Save For Retirement

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png)

Can I Borrow Against My 401k To Start A Business businesser

How to Estimate How Much Your 401k will be Worth at Retirement

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!

Why The Median 401(k) Retirement Balance By Age Is So Low

Average 401(k) Balance by Age Your Retirement Timeline

What is the Average 401k Balance by Age? (See How You Compare) Dollar

401k By Age PreTax Savings Goals For Retirement Financial Samurai

When It Comes To When You Can Withdraw 401(K) Funds, Age 59½ Is The Magic Number.

Web Can You Withdraw Money From A 401(K) Plan?

Web Whether You Can Take Regular Withdrawals From Your 401(K) Plan When You Retire Depends On The Rules For Your Employer’s Plan.

Taking That Route Is Not Always Advisable, Though, As Early Withdrawals Deplete Retirement Savings.

Related Post: