What Is A Special Drawing Right

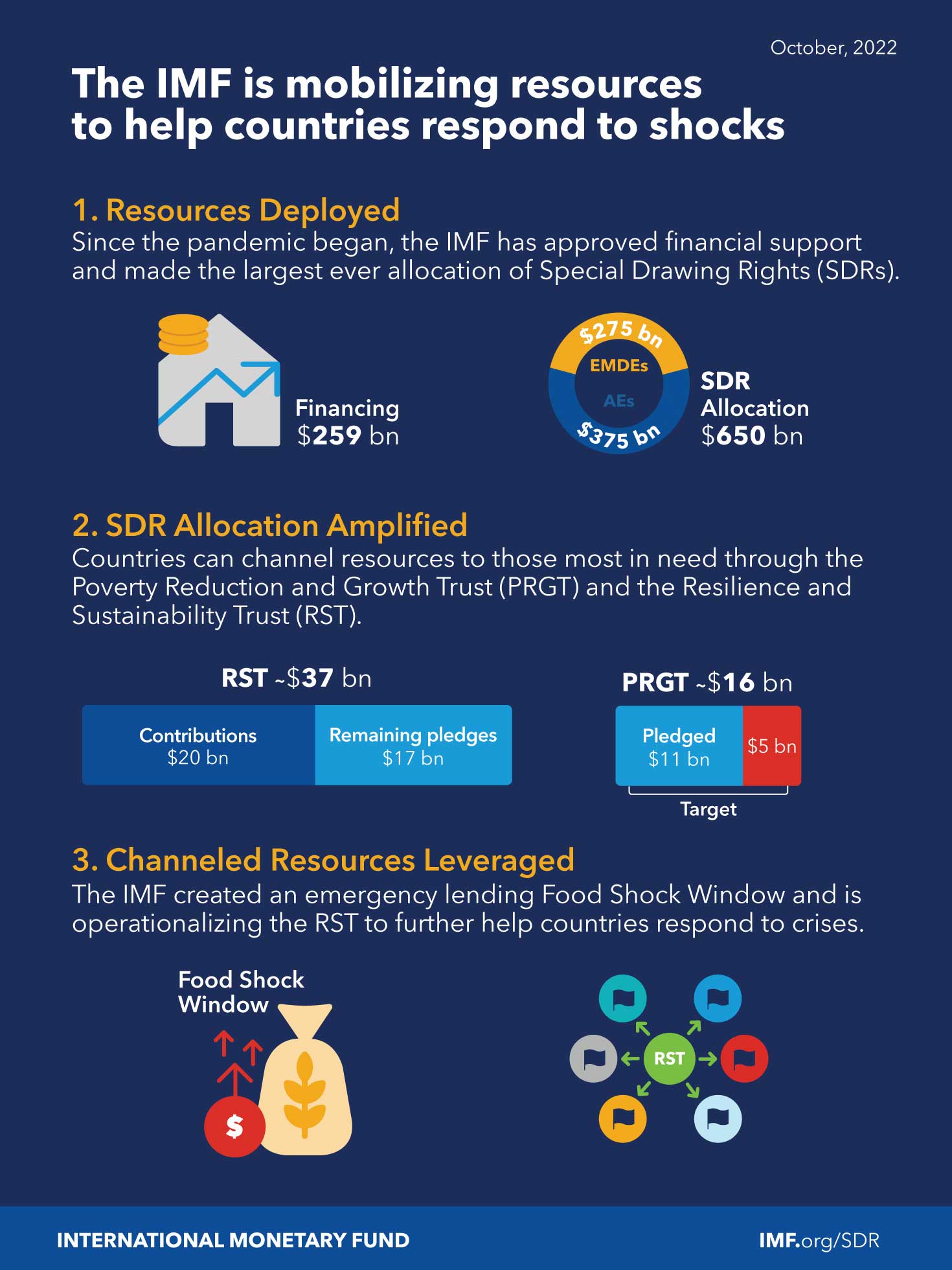

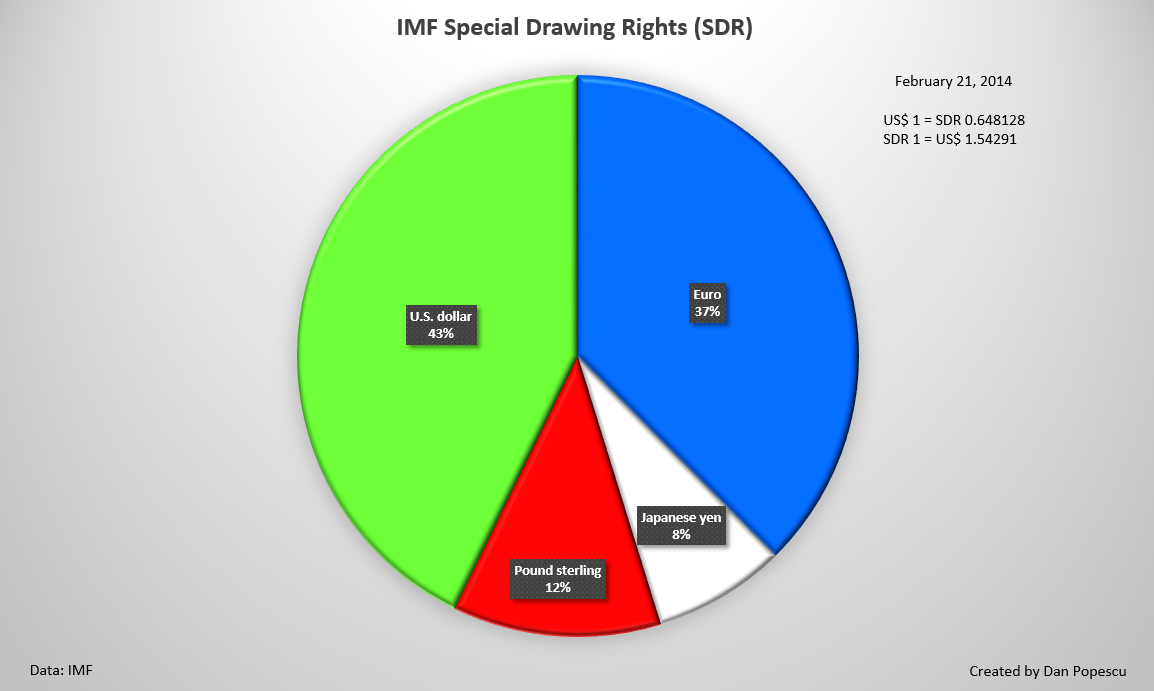

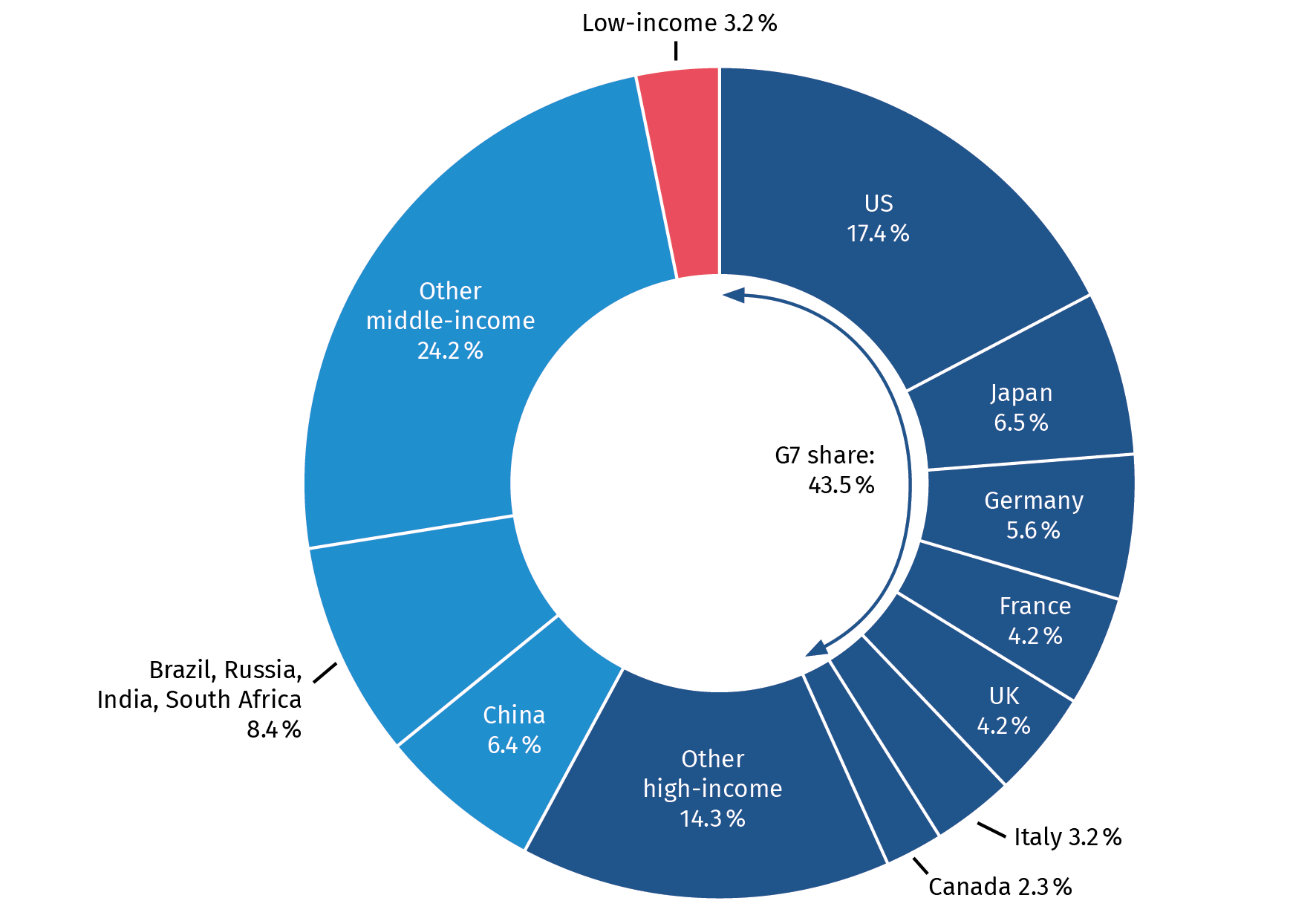

What Is A Special Drawing Right - Rather than a currency, it is a claim on the freely useable currencies of. Sdrs are units of account for the imf, and not a currency per se. Web of the special drawing right in dollars is the same for both the previous and new valuation baskets on the transition day. Ways to use special drawing rights. It operates as a supplement to the existing. Sdrs are used by the imf to make emergency loans and are. Web what is a special drawing right? Established in 1969, sdrs act as a supplement to conventional reserve assets like gold and u.s. Web what the heck are special drawing rights (sdrs)? The sdr is an international reserve asset. Web of the special drawing right in dollars is the same for both the previous and new valuation baskets on the transition day. Dollar, euro, japanese yen, pound sterling and the chinese renminbi). Web special drawing rights (sdrs) are an international reserve asset, created by the imf in 1969 to supplement its member countries’ official reserves. The sdr is based. 5.4k views 2 years ago. Web the bottom line. What are the purpose and benefits of the 2021 general sdr allocation?. Web special drawing rights (sdrs, code xdr) are supplementary foreign exchange reserve assets defined and maintained by the international monetary fund (imf). Web the currency value of the sdr is determined by summing the values in u.s. Web special drawing rights (sdr) english. Web the currency value of the sdr is determined by summing the values in u.s. Web special drawing rights (sdrs, code xdr) are supplementary foreign exchange reserve assets defined and maintained by the international monetary fund (imf). Dollar, euro, japanese yen, pound sterling and the chinese renminbi). Web special drawing rights. They serve as a supplement to existing member countries’ money reserves, enhancing international liquidity. The special drawing right or sdr is an international reserve asset created by the imf to supplement the official reserves of. Dollar, japanese yen, euro, pound sterling and chinese renminbi. Web the bottom line. The sdr is based on a basket of international currencies comprising the. Special drawing right, established and created by the imf in 1969, is a supplement reserve of foreign exchange assets comprising leading currencies across the globe for settling international transactions. It serves as the unit of account of the imf. They serve as a supplement to existing member countries’ money reserves, enhancing international liquidity. Web of the special drawing right in. The sdr is not a currency, but its value is based on a basket of five currencies—the us dollar, the euro, the chinese renminbi, the japanese yen, and the british pound sterling. Web the currency value of the sdr is determined by summing the values in u.s. Web questions and answers on special drawing rights. Web special drawing rights (sdrs). A general allocation of special drawing rights (sdrs) equivalent to about us$650 billion became effective on august 23, 2021. Web supplementary foreign exchange reserves are defined and maintained by the international monetary fund (imf) and are known as special drawing rights. Sdrs are units of account for the imf, and not a currency per se. The sdr is not a. Web what is special drawing rights? Web special drawing rights (sdrs) are an international monetary reserve currency created by the international monetary fund (imf) in 1969. Web learn more about special drawing. The sdr currency value is calculated daily except on imf holidays, or whenever the imf is closed for business, or. Ways to use special drawing rights. Web special drawing rights (sdrs) are an asset, though not money in the classic sense because they can’t be used to buy things. Dollar, euro, japanese yen, pound sterling and the chinese renminbi). Sdrs can be used in two distinct monetary layers. Web what the heck are special drawing rights (sdrs)? The sdr is based on a basket of international. It operates as a supplement to the existing. 134k views 7 years ago imf financial operations. The primary motive is to provide additional liquidity. Sdrs can be used in two distinct monetary layers. Web special drawing rights (sdrs) are an international monetary reserve currency created by the international monetary fund (imf) in 1969. The primary motive is to provide additional liquidity. The sdr is an international reserve asset, created by the imf in 1969 to supplement its member countries’ official reserves. Web a special drawing right (sdr or xdr) is a reserve asset issued by the international monetary fund (imf). Web special drawing rights (sdrs) are an international reserve asset, created by the imf in 1969 to supplement its member countries’ official reserves. The sdr is not a currency, but its value is based on a basket of five currencies—the us dollar, the euro, the chinese renminbi, the japanese yen, and the british pound sterling. A general allocation of special drawing rights (sdrs) equivalent to about us$650 billion became effective on august 23, 2021. Dollar, japanese yen, euro, pound sterling and chinese renminbi. Web questions and answers on special drawing rights. Web special drawing rights (sdrs) are an international monetary reserve currency created by the international monetary fund (imf) in 1969. Rather than a currency, it is a claim on the freely useable currencies of. Established in 1969, sdrs act as a supplement to conventional reserve assets like gold and u.s. Sdrs can be used in two distinct monetary layers. The sdr is an international reserve asset. The value of sdrs is based on the average values of the u.s. It serves as the unit of account of the imf. Learn more q&a on sdrs.

Free of Charge Creative Commons special drawing rights Image Financial 3

What You Should Know About Special Drawing Rights (SDRs) The Daily

PPT International business environment PowerPoint Presentation, free

Special Drawing rights IMF YouTube

Special Drawing Rights

Gold And The Special Drawing Rights (SDR) 1969Present

Special Drawing Rights To The Point Drishti IAS YouTube

Special Drawing Rights can help developing countries to build back greener

Special Drawing Rights (SDR) Challenges, Uses, Significance

Special Contribution 1.5 IMF Special Drawing Rights a historic

They Represent A Claim To Currency Held By Imf Member Countries For Which They May Be Exchanged.

These Q&As Cover Recent Questions About An Sdr Allocation.

The Sdr Currency Value Is Calculated Daily Except On Imf Holidays, Or Whenever The Imf Is Closed For Business, Or.

Dollar, Euro, Japanese Yen, Pound Sterling And The Chinese Renminbi).

Related Post: