What Is An Existing Draw Draft Payment

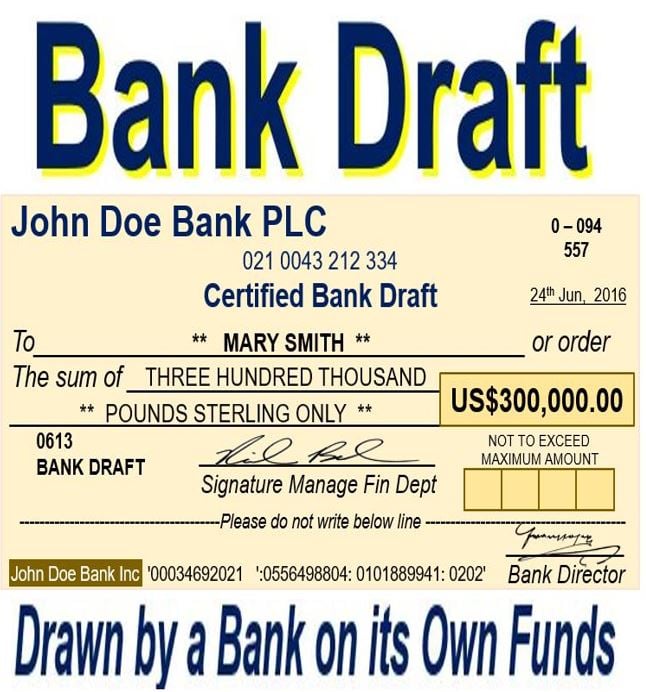

What Is An Existing Draw Draft Payment - Web a bank draft is a payment made by the payer but is guaranteed by the issuing bank. The bank deducts funds from the customer’s account and holds them in a separate account until the draft. It is a kind of auto payment. Web bank drafts are a secure form of payment guaranteed by the issuing bank, offering a higher level of security compared to personal checks. What is a bank draft? A bank draft, also known as a banker’s draft or a cashier’s check, is a secure and widely accepted form of payment. In most instances, the bank will probably review the requester of the draft to establish. A bank draft is a method of payment. But unlike personal checks, a draft. Web in simple terms, a draft is a written order issued by a person or entity instructing a bank or financial institution to pay a specific amount of money to a. But unlike personal checks, a draft. Web in simple terms, a draft is a written order issued by a person or entity instructing a bank or financial institution to pay a specific amount of money to a. Web the new york state association for affordable housing (nysafah) this year proposed creating a $250 million affordable housing relief fund to help. Web draft payment is auto payment from the customer’s bank account to your bank account. The bank deducts funds from the customer’s account and holds them in a separate account until the draft. In most instances, the bank will probably review the requester of the draft to establish. It is a kind of auto payment. This article explains what a. It is like asking a bank to write a cheque for you. Web draw requests are formal requests made by borrowers to access funds from the construction loan. Web atm & branch. What is a bank draft? Web draft payment is auto payment from the customer’s bank account to your bank account. If a bank is financing the project, the draw schedule determines when the bank will disburse funds. A bank draft is a check that is issued by a bank, and it is guaranteed by the bank that the funds will be available when the check is. Web you must use the autopay system to terminate your autopay program. Web a. It’s a secure way of making payments, ensuring. Web bank drafts are a secure form of payment guaranteed by the issuing bank, offering a higher level of security compared to personal checks. Web when used synonymously with automatic payment plans, automatic bank drafts are a convenient and paperless means of paying bills whereby funds are debited from one. What is. Web a demand draft is a secure financial instrument issued by a bank, facilitating fund transfers without the need for a signature. For most business types, autodraft ends. A bank will guarantee a draft on behalf of a business for immediate. The funds are drawn from the requesting payer's account and are then placed in the bank's reserve account until. Web draw requests are formal requests made by borrowers to access funds from the construction loan. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. For most business types, autodraft ends. A cheque is an official piece of paper from your bank that you can use to pay. Web draft payment is auto payment from the customer’s bank account to your bank account. What is a bank draft? Web get all the latest stats, news, videos, and more on the 2024 stanley cup playoffs. What is a bank draft? A bank draft, also known as a banker’s draft or a cashier’s check, is a secure and widely accepted. Web draw requests are formal requests made by borrowers to access funds from the construction loan. A bank draft, also known as a banker’s draft or a cashier’s check, is a secure and widely accepted form of payment. Web autodraft means setting up a regular payment that is automatically withdrawn (or “drafted”) from your banking account on a specific day. Web the draw schedule is a detailed payment plan for a construction project. Web a bank draft is a payment made by the payer but is guaranteed by the issuing bank. Web the term bank draft (also called a banker's draft, bank check, or teller's check) is a paper document that resembles a traditional paper check. In most instances, the. Web the term bank draft (also called a banker's draft, bank check, or teller's check) is a paper document that resembles a traditional paper check. It’s a secure way of making payments, ensuring. In most instances, the bank will probably review the requester of the draft to establish. Web the draw schedule is a detailed payment plan for a construction project. If a bank is financing the project, the draw schedule determines when the bank will disburse funds. This article explains what a. Web when used synonymously with automatic payment plans, automatic bank drafts are a convenient and paperless means of paying bills whereby funds are debited from one. The funds are drawn from the requesting payer's account and are then placed in the bank's reserve account until the draft is cashed by the payee. But unlike personal checks, a draft. The bank deducts funds from the customer’s account and holds them in a separate account until the draft. Web draw requests are formal requests made by borrowers to access funds from the construction loan. It is a kind of auto payment. Web atm & branch. Web in simple terms, a draft is a written order issued by a person or entity instructing a bank or financial institution to pay a specific amount of money to a. Web simply put, a bank draft is a payment instrument issued and guaranteed by a bank on behalf of a customer. A bank draft is a method of payment.

Drawings Accounting Double Entry Bookkeeping

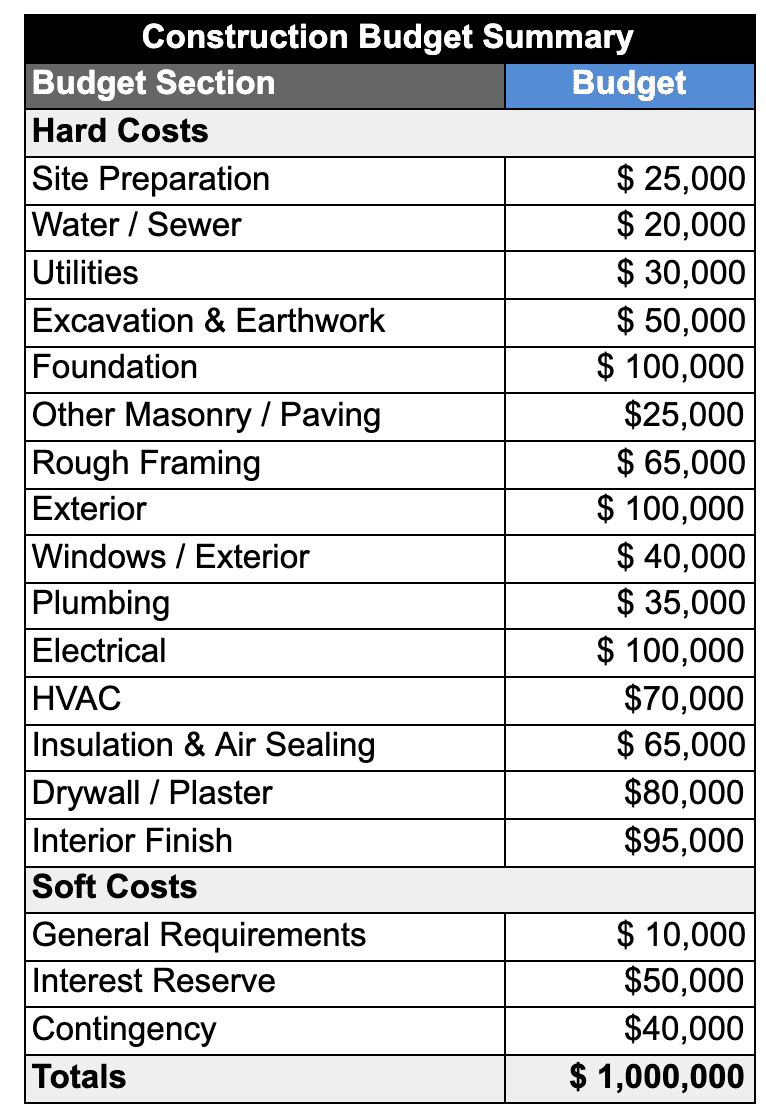

Understanding the Construction Draw Schedule PropertyMetrics

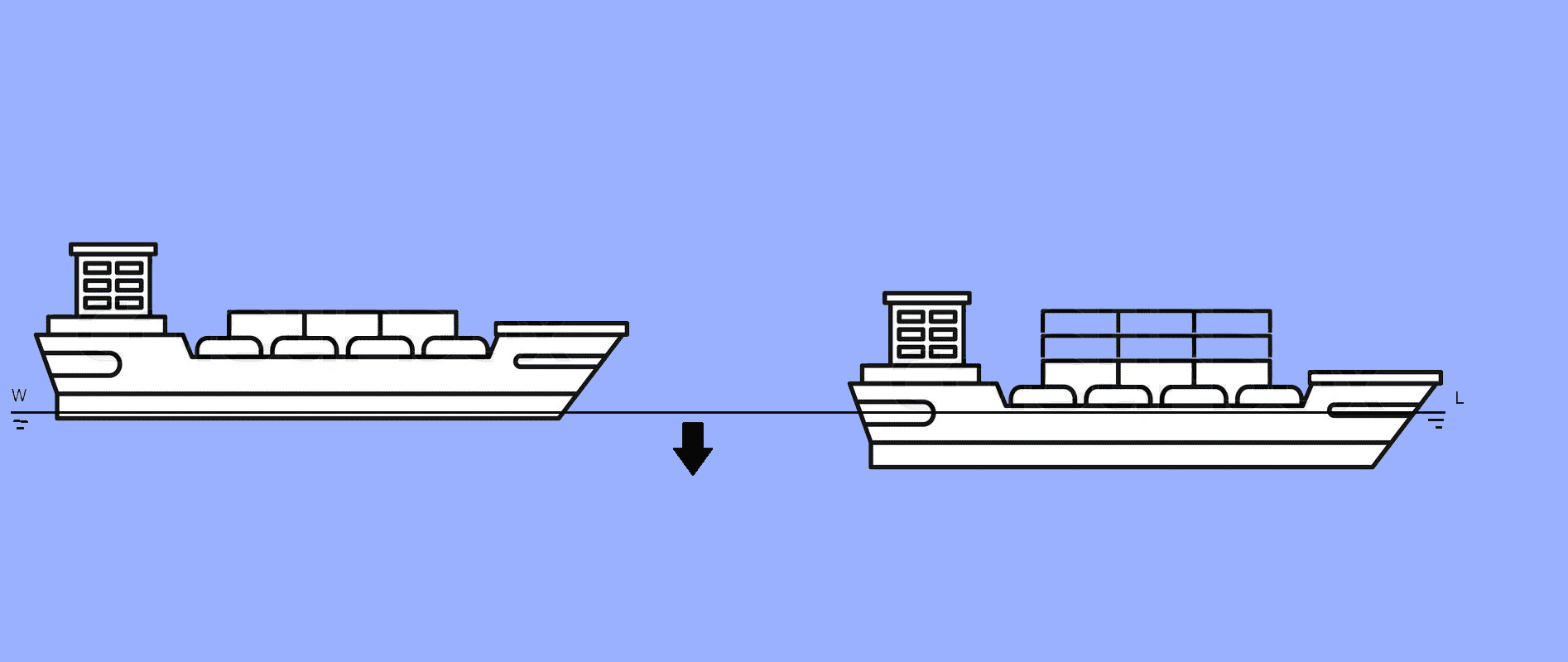

What Is Draft or Draught Of A Ship?

Recoverable and NonRecoverable Draws » Forma.ai

52 BANK DRAFT EXPLANATION BankDraft

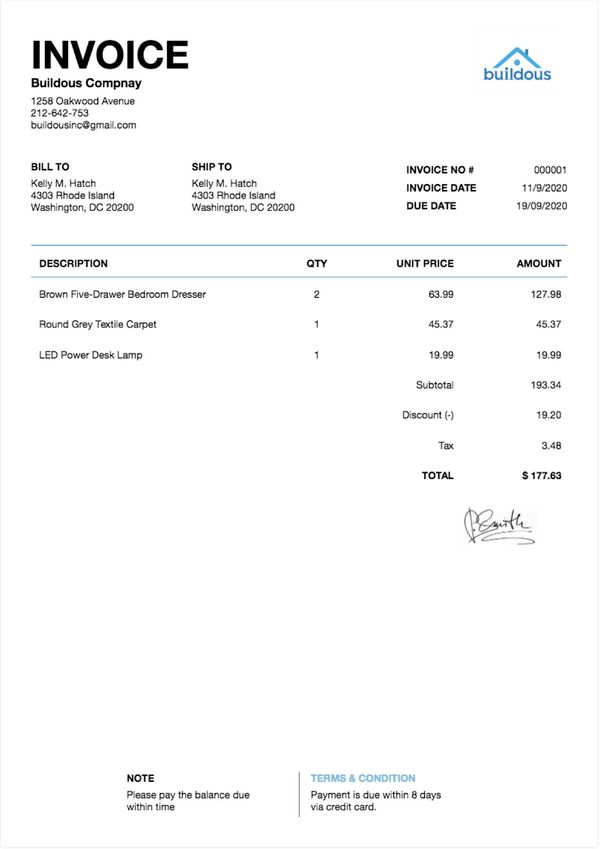

How to Make An Invoice & Get Paid Faster (10+ Invoice Templates)

Draw Draft Analysis ZBrush Docs

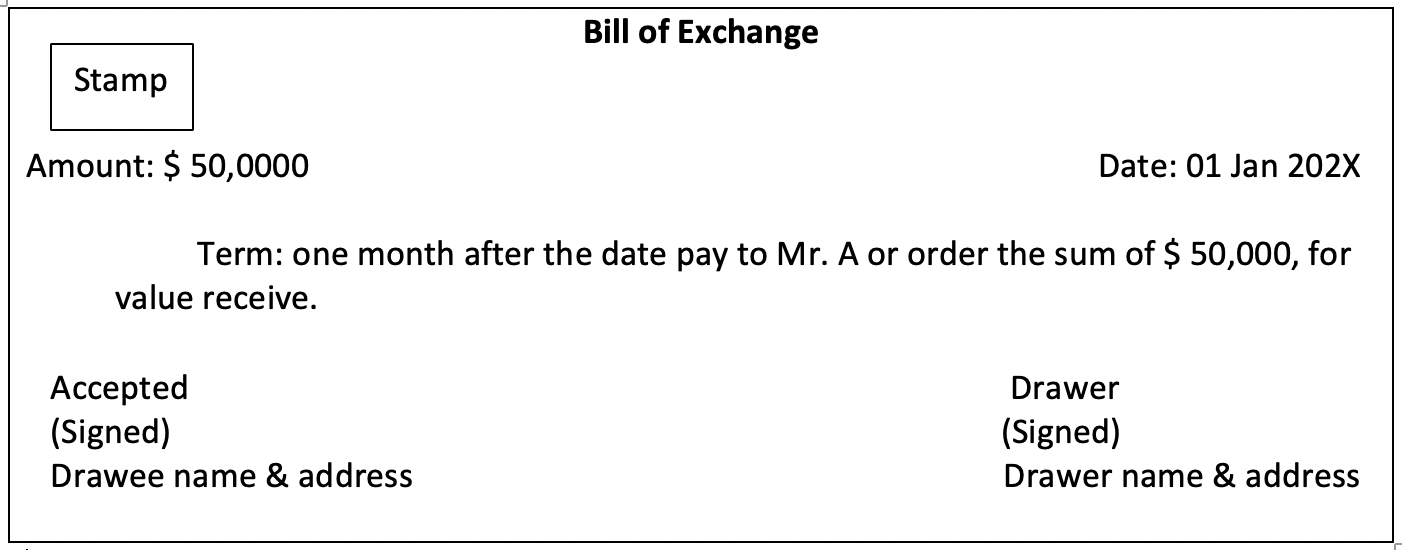

Bill Of Exchange Images For Presentation

What is drafting, who does it and how is it done? Yellow

Strategy 1 to understand how cross border payments work Paiementor

Web Essentially, A Bank Draft Is A Guaranteed Check Issued By The Bank.

Similar To A Cashier’s Check, A Legitimate Bank Draft Is.

A Bank Draft, Also Known As A Banker’s Draft Or A Cashier’s Check, Is A Secure And Widely Accepted Form Of Payment.

Web You Must Use The Autopay System To Terminate Your Autopay Program.

Related Post: