When Can I Draw From My Ira Without Penalty

When Can I Draw From My Ira Without Penalty - But it's still critical to know how your withdrawal may be taxed. The irs requires that you start taking minimum required distributions when you reach 70½ years old. Withdrawal rules for roth iras are more flexible than those for traditional iras and 401 (k)s. But if you're younger than that, you will get hit with a penalty for. But you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at. Government imposes a 10 percent penalty on any withdrawals before age 59 1/2. Generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. Web to avoid the penalty on your earnings, you must wait five years from january 1 of the tax year you make your first roth ira contribution or rollover. You have to pay a 10% additional tax on the taxable amount you withdraw from your simple ira if you are under age 59½ when you withdraw the money unless you qualify for another exception to this tax. As mentioned previously, required minimum distributions take effect only later in life. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the irs agreed not to impose an extra (excise) tax or penalty on that amount in 2022. Web you can withdraw roth ira contributions at any time without owing taxes or a penalty. There is no need to show a. Web specifically, if a taxpayer did not take a specified rmd in 2021 or 2022 related to an inherited ira, the irs agreed not to impose an extra (excise) tax or penalty on that amount in 2022. You have to pay a 10% additional tax on the taxable amount you withdraw from your simple ira if you are under age. Web are you over age 59 ½ and want to withdraw? Web if you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important to know what to expect in potential taxes and penalties, along with possible exceptions and other options for cash. If you have multiple roth iras, you only need to. Generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. Web you can withdraw roth ira contributions at any time without owing taxes or a penalty. You could owe taxes and a penalty if you withdraw earnings before age 59 1/2. Early. You have to pay a 10% additional tax on the taxable amount you withdraw from your simple ira if you are under age 59½ when you withdraw the money unless you qualify for another exception to this tax. However, some early distributions qualify for a waiver of that penalty — for instance,. Web are you over age 59 ½ and. Generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. Web updated april 1, 2024. Web if you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important to know what to expect in potential. Since both accounts have annual contribution limits and potentially different tax benefits. Account holders reaching age 72 in 2022 must take their first rmd by april 1, 2023, and the second rmd by december 31, 2023, and each year thereafter. The irs requires that you start taking minimum required distributions when you reach 70½ years old. Web specifically, if a. But you don't have to start at that age — you can choose to let the account sit and grow for another 11 years if you choose. Web there are exceptions to the 10 percent penalty. In addition, with a roth ira, you'll pay no taxes on withdrawals, provided your account has been open for at least 5 years.** While. Money in a traditional ira. But you don't have to start at that age — you can choose to let the account sit and grow for another 11 years if you choose. Account holders can withdraw their contributions without incurring taxes or. Web unfortunately, the u.s. Once you turn age 59 1/2, you can withdraw any amount from your ira. Web best traditional ira cd option: Early withdrawal of earnings can lead to a 10% penalty and income. But it's still critical to know how your withdrawal may be taxed. With the possibility to withdraw up to $10,000 from an ira without. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. Ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. The irs requires that you start taking minimum required distributions when you reach 70½ years old. Generally, early withdrawal from an individual retirement account (ira) prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. Money in a traditional ira. Web unfortunately, the u.s. If you're 59 ½ or older you're usually all clear. Web for example, you can park up to $7,000 or $8,000 in an ira, you can add some or all of that $25,000 to your regular, taxable brokerage account, you can send some or all of it to one or more mutual. Web if you’re under age 59½ and need to withdraw from your ira for whatever reason, you can—but it’s important to know what to expect in potential taxes and penalties, along with possible exceptions and other options for cash. An individual can contribute funds to a roth ira, up to annual limits. Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. But you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at. In addition, with a roth ira, you'll pay no taxes on withdrawals, provided your account has been open for at least 5 years.** You won't be responsible for taking money out of your ira until you turn 72. There is no need to show a hardship to take a distribution. Web are you over age 59 ½ and want to withdraw? Government imposes a 10 percent penalty on any withdrawals before age 59 1/2.

Historical Roth IRA Contribution Limits Since The Beginning

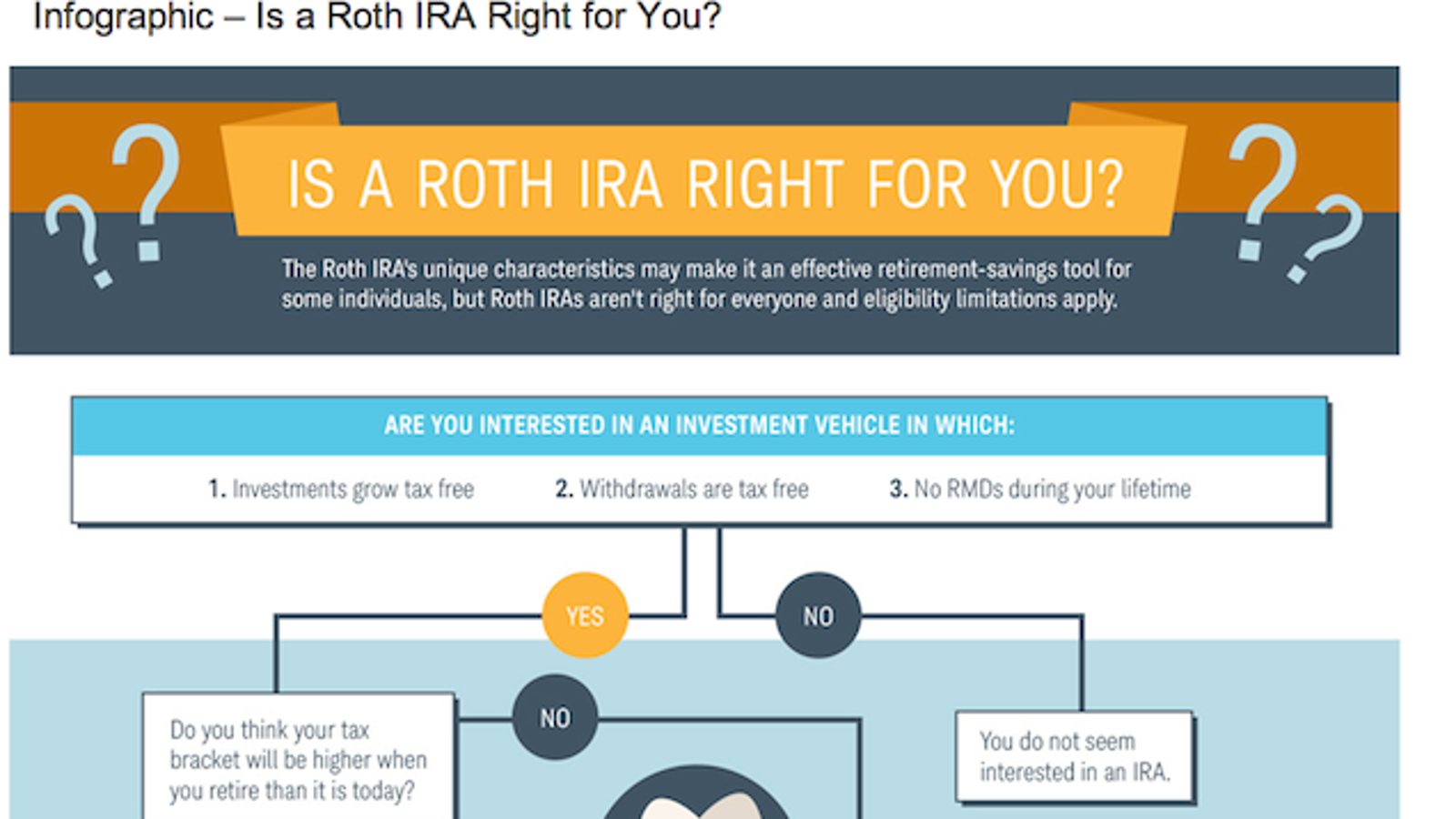

Roth IRA Withdrawal Rules and Penalties The TurboTax Blog

What is a Traditional IRA Edward Jones

Roth IRA Withdrawal Rules and Penalties First Finance News

Roth IRA penalties Inflation Protection

Early withdrawal from IRA WITHOUT 10 penalty. YouTube

Roth Ira Early Withdrawals When To Withdraw Potential

sep ira withdrawal rules Choosing Your Gold IRA

Ways To Avoid the IRA EarlyWithdrawal Penalty

What Reasons Can You Withdraw From Ira Without Penalty Bepvndesignst

Web You Can Withdraw Your Roth Ira Contributions At Any Time Without Penalty.

Web Regardless Of Whether You Withdrew Money From Your Ira Earlier, Everyone With A Traditional Ira Must Begin Taking Required Minimum Distributions, Or Rmds, At Age 73.

Early Withdrawal From A Traditional, Rollover Or Sep Ira.

But It's Still Critical To Know How Your Withdrawal May Be Taxed.

Related Post: