When Can You Draw 401K

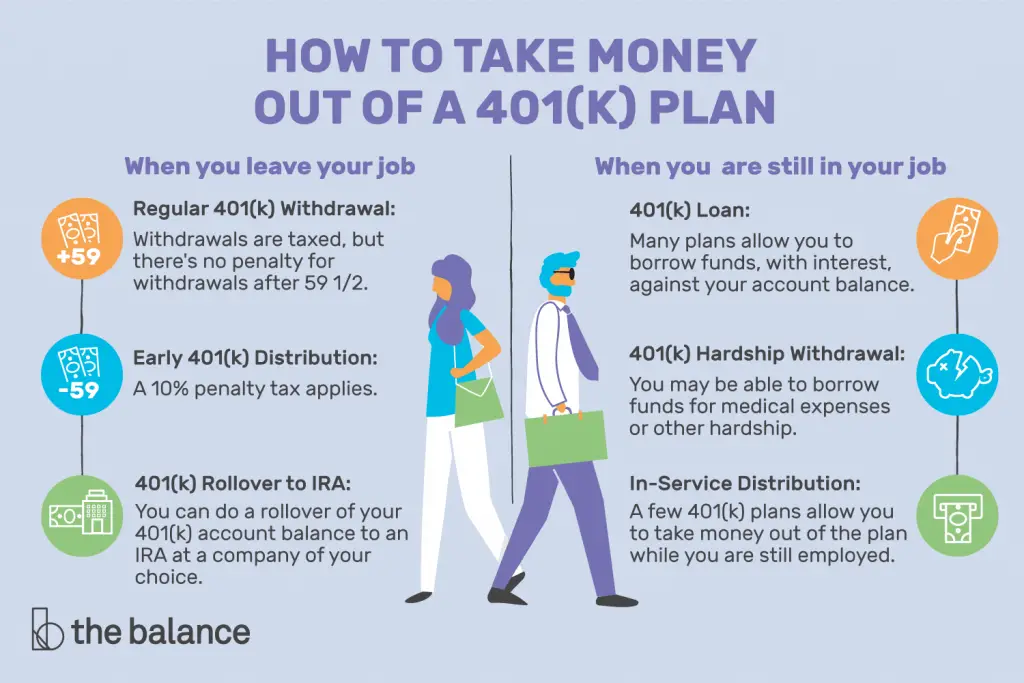

When Can You Draw 401K - Web every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Have left your employer voluntarily or involuntarily in the. You can't take loans from old 401(k) accounts. Web to use the rule of 55, you’ll need to: Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Web what is the rule of 55 and how does it work? Web what is the rule of 55 and how does it work? A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Some reasons for taking an early 401. Edited by jeff white, cepf®. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to. Written by javier simon, cepf®. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Edited by jeff white, cepf®. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Web to use the rule of 55, you’ll need to: A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Web every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Web what is the rule of 55 and how does it work? Have a 401 (k) or 403 (b) that allows rule of. Updated on december 14, 2023. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Edited by jeff white, cepf®. Web every employer's plan has. Be at least age 55 or older. Some reasons for taking an early 401. You can't take loans from old 401(k) accounts. Edited by jeff white, cepf®. Edited by jeff white, cepf®. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Web to use the rule of 55, you’ll need to: Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still. Web every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. Updated on december 14, 2023. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Be at least age 55 or older. Web what is the rule of 55 and how does it. You can't take loans from old 401(k) accounts. Be at least age 55 or older. Edited by jeff white, cepf®. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). A 401 (k) loan may be. Web first, let’s recap: Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Edited by jeff white, cepf®. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½.. Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. Web updated on february 15, 2024. Be at least age 55 or older. Updated on december 14, 2023. Some reasons for taking an early 401. Web every employer's plan has different rules for 401 (k) withdrawals and loans, so find out what your plan allows. A 401 (k) loan may be a better option than a traditional hardship withdrawal, if it's available. Web you generally must start taking withdrawals from your 401 (k) by age 73 but can avoid this requirement if you’re still working. Taking an early withdrawal from your 401 (k) should only be done as a last resort. Some reasons for taking an early 401. Updated on december 14, 2023. If you tap into it beforehand, you may face a 10% penalty tax on the withdrawal in addition to income tax that you’d owe on any type of withdrawal from a traditional 401 (k). Your plan administrator will let you know whether they allow an exception to the required minimum distribution rules if you're still working at age 72. Written by javier simon, cepf®. Web updated on february 15, 2024. Web to use the rule of 55, you’ll need to: You can't take loans from old 401(k) accounts. Have a 401 (k) or 403 (b) that allows rule of 55 withdrawals. A 401 (k) early withdrawal is any money you take out from your retirement account before you’ve reached federal retirement age, which is currently 59 ½. If you are under age 59½, in most cases you will incur a 10% early withdrawal penalty and owe. Web you can begin to withdraw from your 401 (k) without penalty when you reach age 55 through age 59½.

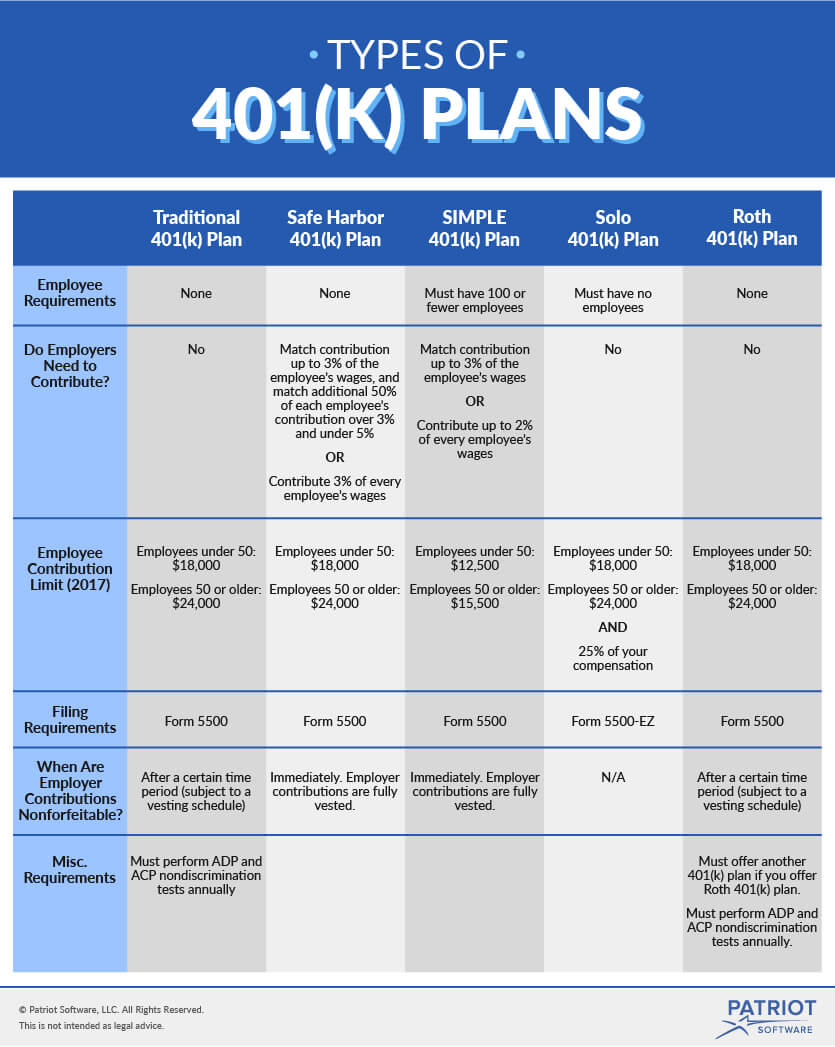

types of 401k plans visual

When Can I Draw From My 401k Men's Complete Life

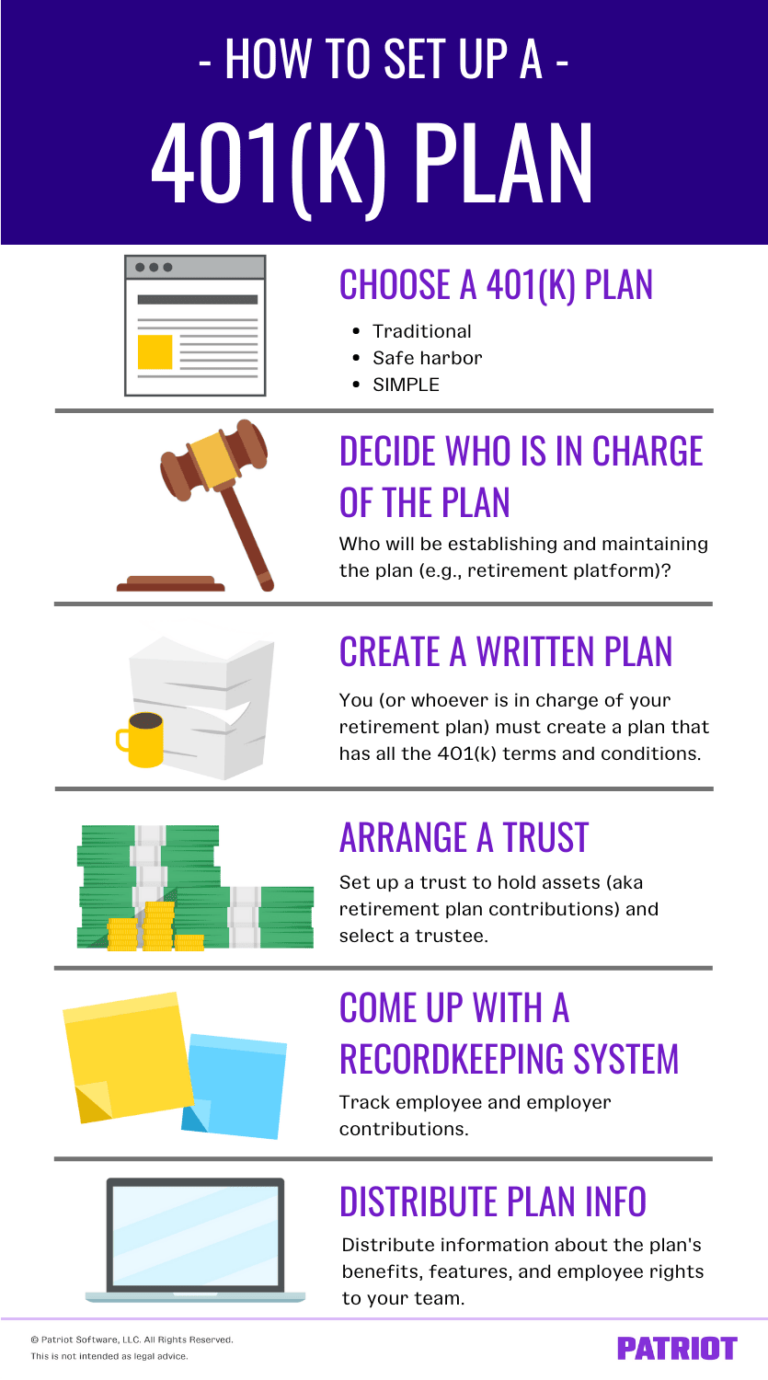

How to Set up a 401(k) Plan for Small Business Steps & More

what reasons can you withdraw from 401k without penalty covid

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money from My 401(k) Before I Retire?

How To Draw Money From 401k LIESSE

.jpg)

What Is a 401(k)? Everything You Need to Know Ramsey

How Can I Get My Money From 401k

The Maximum 401(k) Contribution Limit For 2021

When Can I Draw From My 401k Men's Complete Life

Web First, Let’s Recap:

Edited By Jeff White, Cepf®.

Edited By Jeff White, Cepf®.

Be At Least Age 55 Or Older.

Related Post: