When Can You Draw From A Roth Ira

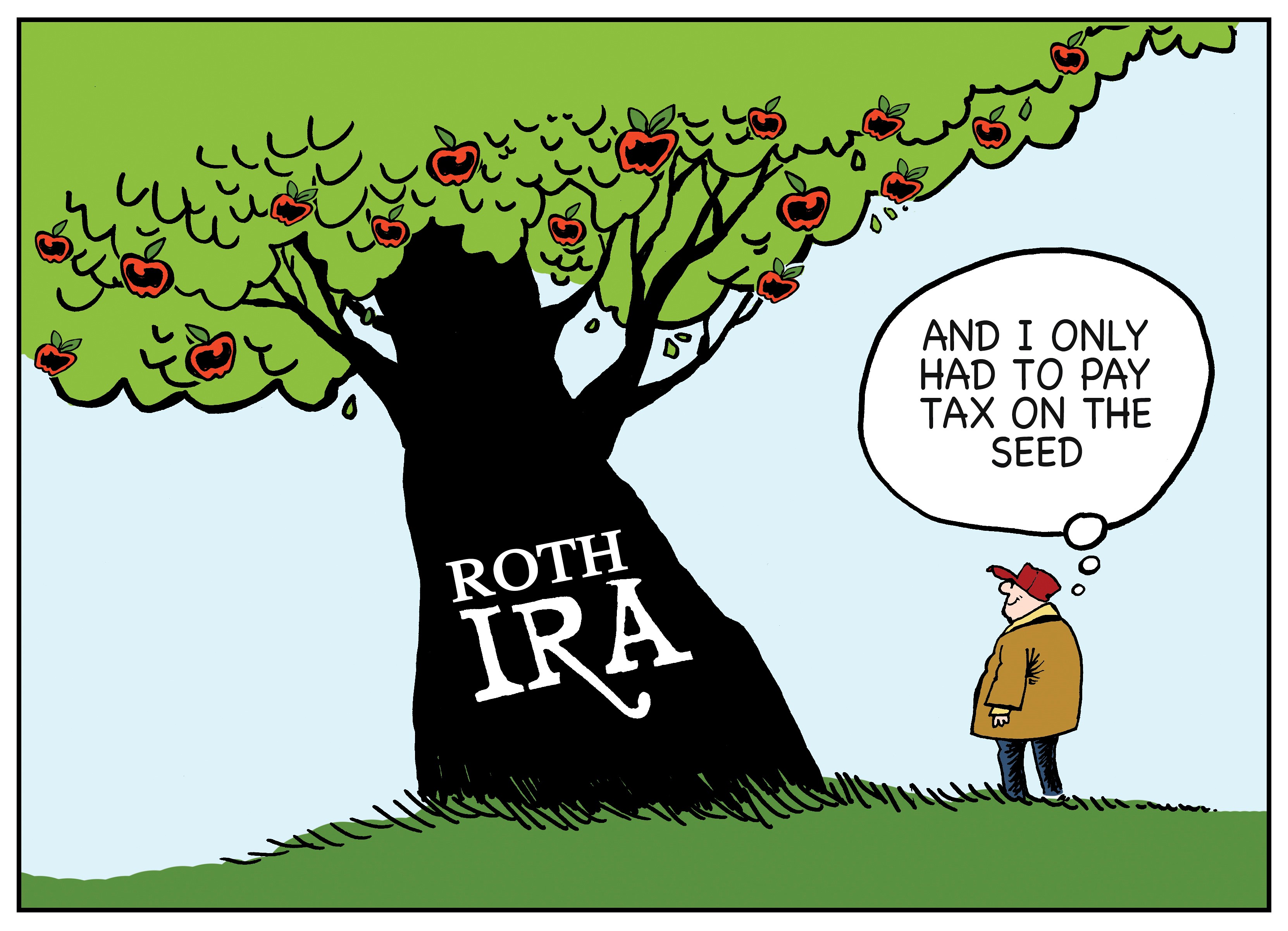

When Can You Draw From A Roth Ira - Web once you contribute money to a roth ira, you can withdraw your original contributions at any time without paying any sort of tax or penalty. Early withdrawal from a simple ira. You have to be age 59½ or older, and you must have owned the account for at least five years. The irs notes that you can make a full contribution with an magi below $146,000 or a partial one with an magi of $138,000 to $153,000 in 2024. Early withdrawal of earnings can lead to a 10% penalty and income. Roth ira earnings can incur early withdrawal taxes and penalties, depending on your age and the account's. Web you can actually withdraw some or all of your roth ira contributions up to six months after the original due date of the return, but you must file an amended return. Limits on roth ira contributions based on modified. Web when can you withdraw from a roth ira? Web when can you withdraw from a roth ira? Early withdrawal from a simple ira. The irs notes that you can make a full contribution with an magi below $146,000 or a partial one with an magi of $138,000 to $153,000 in 2024. This means there’s almost no reason not to. Web you'd only have to wait until jan. Web you can make contributions to your roth ira after. The same combined contribution limit applies to all of your roth and traditional iras. Web if you’re withdrawing roth ira earnings, to avoid triggering a 10% early withdrawal penalty, you must be at least 59 ½ years old, and your account must be open for a minimum of five years. Traditional, rollover, or sep ira. Web basically, anyone can recharacterize. Web in 2024, you can contribute up to $7,000 to an ira or, if you're age 50 or older, up to $8,000. Traditional ira · private equity · forex trading · resources Web you can actually withdraw some or all of your roth ira contributions up to six months after the original due date of the return, but you must. Web you need have had the account open for at least five years, and be at least age 59 ½, to withdraw your investment earnings without paying taxes on them. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. This gives you more control over your savings in. Web early withdrawal from a roth ira. Unlike traditional iras, roth iras don't require you to withdraw a certain amount each year once you reach a certain age. Money is contributed to a. 1, 2024, your countdown begins jan. But you can only withdraw the account’s earnings according. You can withdraw your contributions at any time and owe no taxes or penalties. For example, if your roth 401(k) balance is 90% contributions and 10% earnings and you withdraw $10,000, $1,000 of. But if you own a traditional ira, you must take your first required minimum distribution (rmd) by april 1 of the year following the year you reach. Web in 2024, you can contribute up to $7,000 to an ira or, if you're age 50 or older, up to $8,000. You can withdraw your contributions at any time and owe no taxes or penalties. Money is contributed to a. The account or annuity must be designated as a roth ira when it is set up. Traditional, rollover, or. Web once you contribute money to a roth ira, you can withdraw your original contributions at any time without paying any sort of tax or penalty. Early withdrawal from a simple ira. For instance, you may opt to put 60% of your contributions into one or more bond index funds and the remaining 40% into equity index. So if you. Web basically, anyone can recharacterize a roth ira contribution to a traditional ira contribution. Web for example, you can park up to $7,000 or $8,000 in an ira, you can add some or all of that $25,000 to your regular, taxable brokerage account, you can send some or all of it to one or more mutual. But you can only. When you set up your roth ira account you will be asked to select investments you want to buy with your contributions. You have to be age 59½ or older, and you must have owned the account for at least five years. This choice is typically made in the form of a percentage. Withdrawals from a roth ira you've had. For instance, you may opt to put 60% of your contributions into one or more bond index funds and the remaining 40% into equity index. Traditional ira · private equity · forex trading · resources Early withdrawal from a simple ira. Web you'd only have to wait until jan. The account or annuity must be designated as a roth ira when it is set up. You have to be age 59½ or older, and you must have owned the account for at least five years. Web if you’re withdrawing roth ira earnings, to avoid triggering a 10% early withdrawal penalty, you must be at least 59 ½ years old, and your account must be open for a minimum of five years. Web you can make contributions to your roth ira after you reach age 70 ½. Web you need have had the account open for at least five years, and be at least age 59 ½, to withdraw your investment earnings without paying taxes on them. Web once you contribute money to a roth ira, you can withdraw your original contributions at any time without paying any sort of tax or penalty. But if you own a traditional ira, you must take your first required minimum distribution (rmd) by april 1 of the year following the year you reach rmd age. This choice is typically made in the form of a percentage. 1 of the tax year when the first contribution was made. Unlike traditional iras, roth iras don't require you to withdraw a certain amount each year once you reach a certain age. Web when can you withdraw from a roth ira? This gives you more control over your savings in retirement.

How Does A Roth IRA Work? Roth IRA Explained. YouTube

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Rollover 401(k) to Roth IRA Rules, Pros, Cons, Signs, & How to Rollover

:max_bytes(150000):strip_icc()/rothira_final-9ddd537c67fd44ecb14dbdeba58a6ace.jpg)

Roth IRA What It Is and How to Open One

Roth IRA Withdrawal Rules and Penalties First Finance News

Roth IRA Withdrawal Rules and Penalties First Finance News

How to Start a Roth IRA in 2020 Roth IRA Guide to Save for Retirement

Roth IRAs 8 Essential Rules and Strategies to Know

Roth vs Traditional IRAs A Complete Reference Guide Gone on FIRE

Now Is The Best Time In History To Do A Roth IRA Conversion The

Roth IRA Explained A simple explanation of the Roth IRA. YouTube

Traditional, Rollover, Or Sep Ira.

Money Is Contributed To A.

Withdrawals From A Roth Ira You've Had Less Than Five Years.

Web Not Understanding Roth Ira Rules.

Related Post: