When Can You Draw On An Ira

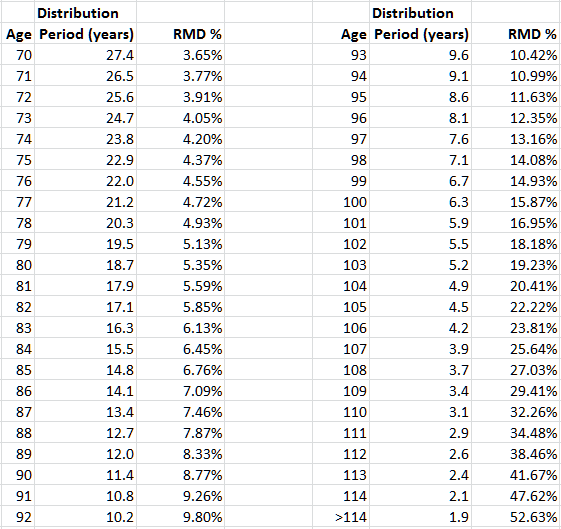

When Can You Draw On An Ira - But here’s why maybe they should. Withdrawing that money earlier can trigger taxes and a 10% early. This choice is typically made in the form of a percentage. Any early ira withdrawal is subject to a 10% penalty. Complimentary reviewservices for any goalteam of expertscustom financial plans Web age 59 ½ and under. Web you generally must start taking withdrawals from your traditional ira, sep ira, simple ira, and retirement plan accounts when you reach age 72 (73 if you reach age 72 after dec. But after that, you can wait until december 31 of each year to receive the money. For instance, you may opt to put 60% of your contributions into one or more bond index funds and the remaining 40% into equity index. It will also be taxed as income at your current income tax rate. Web but you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at least five years. You can choose to take the payments monthly, quarterly, or annually. It will also be taxed as income at your current income tax rate. While tapping your ira might get you into a. Web choosing your investments. Web july 21, 2023, at 9:21 a.m. Fund comparison toolretirement calculatormarket insightslow cost funds While tapping your ira might get you into a home sooner, it could leave. You can choose to take the payments monthly, quarterly, or annually. Early withdrawals from an ira. They can't hold investments in collectibles, life. You can contribute to a roth ira (a type of individual retirement plan) and a 401 (k) (a workplace retirement plan) at the same time. Save on taxeslow or no feeswide array of investments Web if you're 59 ½ or older: Web once you reach age 59½, you can withdraw funds from your traditional ira without restrictions or penalties. See the rules and how missing an rmd can bring stiff penalties. For instance, you may opt to put 60% of your contributions into one or more bond index funds and the remaining 40% into equity index. Web you must take your. Fund comparison toolretirement calculatormarket insightslow cost funds However, you may have to pay taxes and penalties on earnings in your roth ira. However, your distribution will be includible in your taxable income and it may be subject to a 10% additional tax if you're under age 59 1/2. You can withdraw roth individual retirement account (ira) contributions at any time.. The converted amount is included in your gross income for the year, though it still is in an ira. Since both accounts have annual contribution limits and potentially different tax benefits. For instance, you may opt to put 60% of your contributions into one or more bond index funds and the remaining 40% into equity index. April 18, 2024 at. In addition, with a roth ira, you'll pay no taxes on withdrawals, provided your account has been open for at least 5 years.** Web choosing your investments. Once you turn age 59 1/2, you can withdraw any amount from your ira without having to pay the 10% penalty. Fund comparison toolretirement calculatormarket insightslow cost funds The rmd rules require individuals. Roth iras do not have the same rules. But you'll still owe the income tax if it's a traditional ira. However, you may have to pay taxes and penalties on earnings in your roth ira. Owners of roth iras are not required to take withdrawals during their lifetime. Web once you reach age 59½, you can withdraw funds from your. Since both accounts have annual contribution limits and potentially different tax benefits. It will also be taxed as income at your current income tax rate. Save on taxeslow or no feeswide array of investments This can significantly cut into what you actually receive from the withdrawal. Roth iras do not have the same rules. It will also be taxed as income at your current income tax rate. This can significantly cut into what you actually receive from the withdrawal. Web choosing your investments. Roth iras do not have the same rules. Low cost online brokersplan for your retirementcompare ira options Save on taxeslow or no feeswide array of investments If you withdraw roth ira earnings before age 59½, a 10% penalty usually applies. The converted amount is included in your gross income for the year, though it still is in an ira. You can do it, but you'll pay a fairly high penalty. Web ira withdrawals taken before age 59 1/2 typically incur a 10% penalty. Web but you can only pull the earnings out of a roth ira after age 59 1/2 and after owning the account for at least five years. Any early ira withdrawal is subject to a 10% penalty. So, what if you start pulling cash out before then? You must report any funds you take out early from your traditional ira on your 1040 tax form, and you'll pay income taxes on the money as well. Web ira beneficiaries don’t have to take an rmd this year. This can significantly cut into what you actually receive from the withdrawal. That means, once you hit age 59 1/2, you can take money out of your account without penalty. Web if you're 59 ½ or older: But you'll still owe the income tax if it's a traditional ira. Fund comparison toolretirement calculatormarket insightslow cost funds Withdrawing that money earlier can trigger taxes and a 10% early._into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Rollover 401(k) to Roth IRA Rules, Pros, Cons, Signs, & How to Rollover

3 Types of IRAs Due

Roth IRA Withdrawal Rules and Penalties First Finance News

What Is The Best Way To Draw Funds From My IRA? YouTube

What is an IRA? Roth or Traditional Which is Better

What is an IRA and Why Should You Care? Slightly Educational

Individual Retirement Account (IRA) What It Is, Types, Pros & Cons

Drawing Down Your IRA What You Can Expect Seeking Alpha

What is an IRA? Practical Credit

COMO DIBUJAR A IRA DE INSIDE OUT PASO A PASO Dibujos kawaii faciles

Fund Comparison Toolretirement Calculatormarket Insightslow Cost Funds

There Are Exceptions To The 10 Percent Penalty, Such As Using Ira Funds To Pay Your Medical Insurance Premium After A Job Loss.

Since Both Accounts Have Annual Contribution Limits And Potentially Different Tax Benefits.

This Choice Is Typically Made In The Form Of A Percentage.

Related Post: